Why ApeCoin dropped 40% during a disastrous land sale

On April 30th, Yuga Labs released “Otherdeeds” which gave Ape fans access to the Otherside Metaverse.

But, during the mint, ApeCoin‘s value dropped by 40%. By all rights, the token should have gained value since the users could only mint using ApeCoin. What happened?

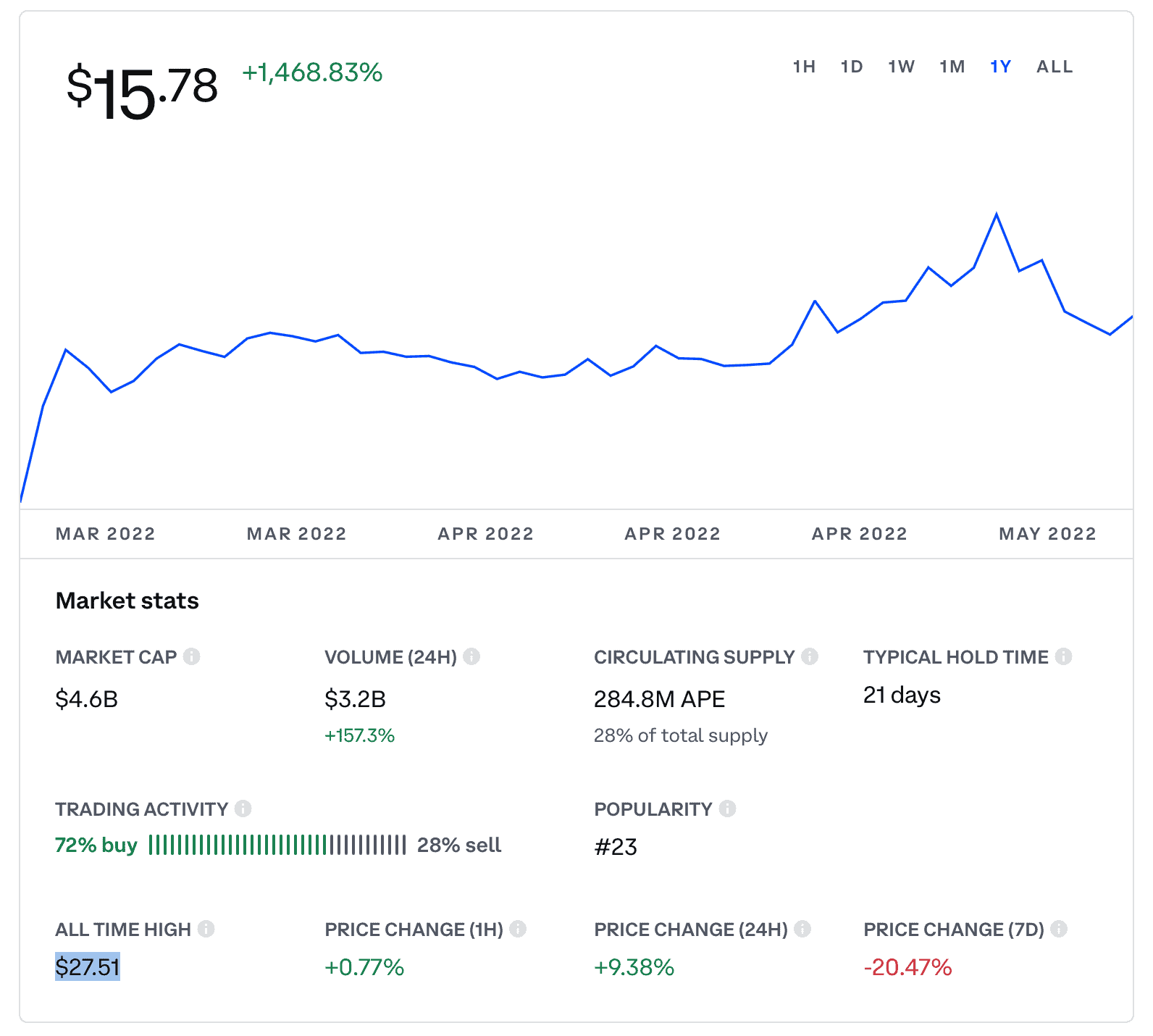

On April 27th, Bored Ape Yacht Club creators announced the minting would be a Dutch auction. Right after, on April 28th, the price of ApeCoin reached its all-time high, $27.57.

Yuga Labs then decided to cancel the Dutch auction and introduce a fixed price for land in their Metaverse. Each deed cost 305 $APE, approximately $5,500, at the moment of minting. Within three days after the announcement, ApeCoin’s price dropped to $17.

Then on April 30th, OpenSea announced it would accept $APE for payments on its platform.

This is when the worst price dump occurred. During the minting of Otherside Lands, users burned 55,225 $ETH on gas fees. The contract was not optimised, so the users and Yuga Labs lost $154 million dollars. Moreover, many users that minted two lands claimed that they did not receive one of them. In short, the entire ape-speriment kind of fell over.

As soon as it happened, BAYC creators tweeted that Ethereum is the problem and that they are planning to fork the Ape Chain. The founder of Ethereum Vitalik Buterin replied that the optimisation of the contract would not help. In short, the market was doing what it was supposed to do, resulting in upset ape lovers and lots of burnt Ethereum.

The current price of $APE is $15.78, down significantly from its all-time high of $27.51. Apsey come, apsey go.

Read related posts:

- $154M Burned in Gas Fees During Otherside Lands Minting

- Otherside Metaverse Lands Minting Starts Tomorrow

- Bored Ape ‘Otherside’ Metaverse Drops Next Week, ApeCoin Soars to Record High

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Valeria is a reporter for Metaverse Post. She focuses on fundraises, AI, metaverse, digital fashion, NFTs, and everything web3-related. Valeria has a Master’s degree in Public Communications and is getting her second Major in International Business Management. She dedicates her free time to photography and fashion styling. At the age of 13, Valeria created her first fashion-focused blog, which developed her passion for journalism and style. She is based in northern Italy and often works remotely from different European cities. You can contact her at valerygoncharenko@mpost.io

More articles

Valeria is a reporter for Metaverse Post. She focuses on fundraises, AI, metaverse, digital fashion, NFTs, and everything web3-related. Valeria has a Master’s degree in Public Communications and is getting her second Major in International Business Management. She dedicates her free time to photography and fashion styling. At the age of 13, Valeria created her first fashion-focused blog, which developed her passion for journalism and style. She is based in northern Italy and often works remotely from different European cities. You can contact her at valerygoncharenko@mpost.io