Web3 Fundraising Report Q3 2023: A Overview of Evolving Trends and Strategies

In Brief

In this report, we explore all the trends in the AI, crypto and web3 sectors and identify the Q3 2023’s most notable industries and key players.

As the crypto landscape grapples with the ongoing bear market, its challenges are becoming visibly evident in the fundraising landscape. The trend of decline, apparent since the outset of 2022, persisted in Q3 2023.

The quarter witnessed record lows in both total funding and deal volume, a phenomenon not observed since Q4 2020. In specific figures, the quarterly aggregate amounted to slightly under $2.1 billion, spread across 297 transactions. This represented a substantial 36% decrease in both funding and deal volume compared to the preceding quarter.

Metaverse Post presents its Web3 Fundraising Report for the third quarter of 2023. In this report, we delve into the latest trends within the AI, crypto, and web3 sectors and identify the standout industries and key players for the quarter.

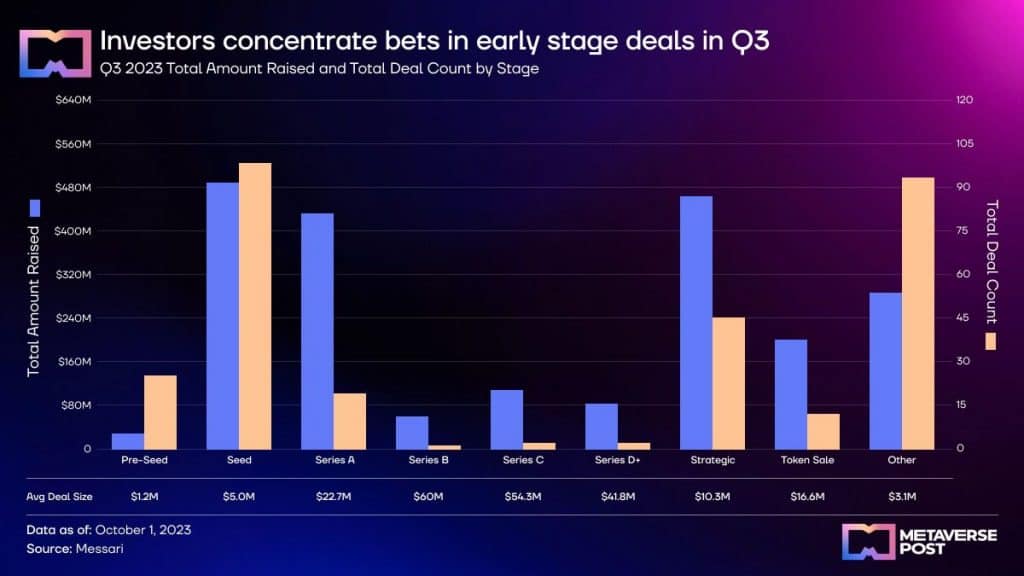

Analyzing Q3’s Fundraising & Investment Stages

Examining Q3 fundraising activities based on their respective stages reveals a discernible emphasis on early-stage investment rounds. Seed funding, in particular, emerged as the predominant category, amassing a total of $488 million across 98 rounds.

This notable shift towards earlier-stage initiatives has steadily gained prominence over the past three years, accompanied by a noticeable decline in later-stage ventures.

The category of early-stage deals, encompassing Pre-Seed, Seed, and Series A rounds, has progressively expanded its market share from 37% in Q4 2020 to a commanding 48% in Q3 2023. In contrast, later-stage deals, typified by Series B or subsequent rounds, have markedly receded from an 8% market share in Q4 2020 to a mere 1.4% in Q3 2023.

This strategic realignment mirrors the dynamics of the bear market, as investors seek projects offering the potential for significant asymmetric returns, poised to deliver substantial profits when market sentiment eventually shifts towards a more favorable direction.

Market Category: Web3

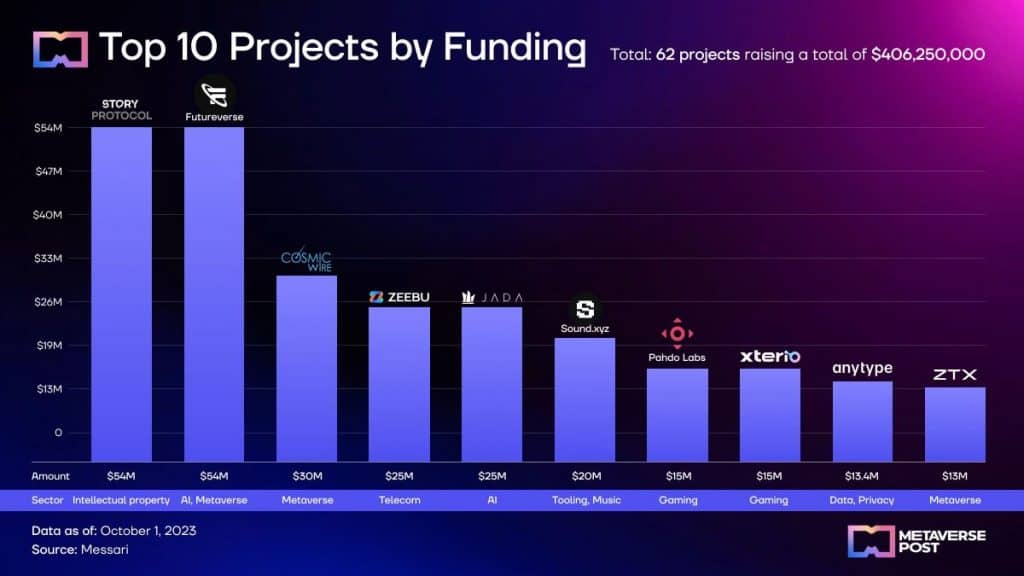

Total: 62 projects raising a total of $406,250,000

Top 10 Projects by Funding

| Project | Round | Date | Amount | Sector | Website |

| Story Protocol | Unknown | 9/6/2023 | $54,000,000 | Intellectual property | https://www.storyprotocol.xyz/ |

| Futureverse | Series A | 7/18/2023 | $54,000,000 | AI, Metaverse | https://www.futureverse.com/ |

| Cosmic Wire | Seed | 7/19/2023 | $30,000,000 | Metaverse | https://www.cosmicwire.com/ |

| Zeebu | Private Token Sale | 9/7/2023 | $25,000,000 | Telecom | https://www.zeebu.com/ |

| Jada Ai | Unknown | 8/17/2023 | $25,000,000 | AI | https://jada-ai.com/ |

| Sound.xyz | Series A | 7/12/2023 | $20,000,000 | Tooling, Music | https://www.sound.xyz/ |

| Pahdo Labs | Series A | 9/11/2023 | $15,000,000 | Gaming | https://www.pahdolabs.com/ |

| Xterio | Strategic | 7/12/2023 | $15,000,000 | Gaming | https://xter.io/ |

| Anytype | Unknown | 8/23/2023 | $13,400,000 | Data, Privacy | https://anytype.io/ |

| ZTX | Seed | 8/15/2023 | $13,000,000 | Metaverse | https://ztx.io/ |

A Breakdown of Web3 Project Ecosystem

1. Total Projects and Funding:

- Total Projects: 62

- Total Funding: $406,250,000

2. Top 10 Projects by Funding:

- Highest Funded Projects: “Story Protocol” and “Futureverse” lead with $54,000,000 each. Interestingly, they represent different niches within Web3, with the former focusing on intellectual property and the latter on AI and the metaverse.

- Diverse Focus Areas: The top 10 projects span a variety of focus areas, including Intellectual Property, AI, Metaverse, Telecom, Tooling, Music, Gaming, Data, and Privacy.

- Total Funding of Top 10 Projects: When we sum up the funds received by the top 10 projects, it amounts to: $264,400,000

3. Implications and Observations:

- In Q3 2023, the top 10 projects independently contributed 65.08% ($264,400,000 out of $406,250,000) to the total funds raised within the Web3 category. This showcases a funding concentration within these prominent projects.

- The Metaverse emerges as a prevalent theme, with multiple top 10 projects showcasing robust investor enthusiasm for this domain.

- Substantial investments were directed towards AI and gaming, underscoring the ever-evolving dynamics of the Web3 ecosystem.

In Q3 2023, the Web3 ecosystem secured a substantial investment of $406,250,000, distributed among 62 projects. Although the top 10 projects command the majority of funding, indicating a notable capital concentration, there is clear and diverse interest.

This interest extends across multiple Web3 sub-domains, including AI, Metaverse, Gaming, and Intellectual Property.

The robust financial support for these leading projects underscores investors’ confidence in the future potential of Web3 technologies and their transformative impact in the years ahead.

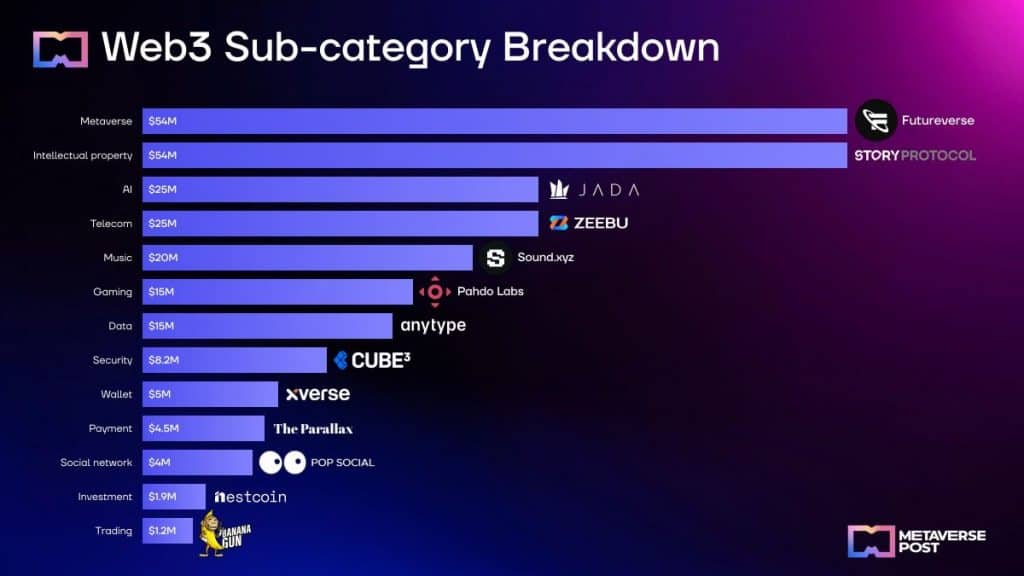

Web3 Sub-category Breakdown

| Sub-Category | Number of Projects | Total Funding | Top Project | Its Funding | % of Total Investment |

| Gaming | 9 | $56,900,000 | Pahdo Labs | $15,000,000 | 14% |

| Trading | 1 | $1,200,000 | Banana Gun | $1,200,000 | 0% |

| Wallet | 2 | $9,000,000 | Xverse | $5,000,000 | 2% |

| Investment | 1 | $1,900,000 | Nestcoin | $1,900,000 | 0% |

| Payment | 1 | $4,500,000 | Parallax | $4,500,000 | 1% |

| Metaverse | 7 | $103,000,000 | Futureverse | $54,000,000 | 25% |

| Music | 1 | $20,000,000 | Sound.xyz | $20,000,000 | 5% |

| AI | 6 | $36,100,000 | Jada Ai | $25,000,000 | 9% |

| Intellectual property | 1 | $54,000,000 | Story Protocol | $54,000,000 | 13% |

| Data | 8 | $32,000,000 | Anytype | $13,400,000 | 8% |

| Telecom | 1 | $25,000,000 | Zeebu | $25,000,000 | 6% |

| Security | 3 | $23,400,000 | Cube3 | $8,200,000 | 6% |

| Social network | 2 | $5,400,000 | Pop Social | $4,000,000 | 1% |

Intellectual Property

In the domain of Intellectual Property, Story Protocol secured an impressive $54,000,000 in funding during Q3 2023. While the exact details of the funding round remain unknown, Story Protocol’s focus on intellectual property is evident. Its substantial investment hints at the intriguing potential it holds in this domain.

AI

Futureverse, a forward-thinking project bridging the realms of AI and the Metaverse, made waves with a Series A funding round on July 18, 2023, accumulating $54,000,000 in investment. Futureverse’s substantial funding showcases the growing interest in these transformative technologies.

Jada Ai, a prominent player in the AI sector, also secured a substantial of $25,000,000 in funding during Q3 2023, with exact details about the funding round remaining unknown.

Metaverse

In the Metaverse sector, Cosmic Wire embarked on its journey with a Seed round on July 19, 2023, securing $30,000,000 in funding. Cosmic Wire’s substantial investment highlights the allure of this emerging domain.

Likewise, ZTX also raised $13,000,000 in a Seed round on August 15, 2023.

Telecom

Zeebu, a B2B crypto firm operating in the Telecom sector, conducted a Private Token Sale on September 7, 2023, raising a noteworthy $25,000,000. The company’s focus on Telecom and its significant investment highlight its potential in this field.

Music

Sound.xyz, a project encompassing Web3 Tools and Music, successfully raised $20,000,000 in a Series A round on July 12, 2023. The infusion of tools and music within the Web3 realm is evident in the substantial funding secured by Sound.xyz.

Gaming

Pahdo Labs, a key player in the Gaming sector, secured $15,000,000 in a Series A funding round on September 11, 2023. Gaming’s growing influence in the Web3 ecosystem is exemplified by Pahdo Labs’ notable investment.

Xterio, another contender in the Gaming domain, garnered $15,000,000 in strategic funding on July 12, 2023. Xterio aims to amplify its focus on Web3 gaming through the substantial investment in this sector.

Data and Privacy

Data and Privacy Web3 company Anytype, secured $13,400,000 in funding during Q3 2023, with the exact details of the funding round remaining undisclosed.

Web3’s financial landscape is as diverse as it’s revolutionary. While the metaverse and intellectual property are grabbing the headlines, other areas such as gaming, AI and data are not far behind. The figures reveal a clear narrative: Web3 is vast, varied and here to stay.

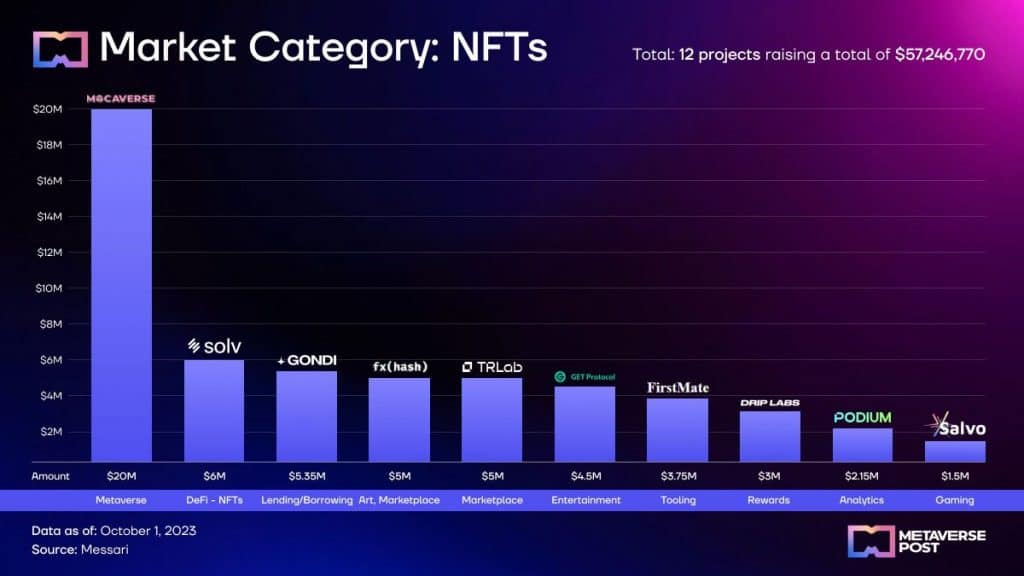

Market Category: NFTs

Total: 12 projects raised a total of $57,246,770

| Project | Amount | Sub-Category | % of Total Investment |

| Mocaverse | $20,000,000 | Metaverse | 35% |

| Solv Protocol | $6,000,000 | DeFi – NFTs | 10% |

| Gondi | $5,350,000 | Lending/Borrowing | 9% |

| fxhash | $5,000,000 | Art, Marketplace | 9% |

| TRLAB | $5,000,000 | Marketplace | 9% |

| Get Protocol | $4,500,000 | Entertainment, Ticketing | 8% |

| FirstMate | $3,750,000 | Marketplace, Tooling | 7% |

| Drip Labs, Inc. | $3,000,000 | Rewards | 5% |

| Podium | $2,146,770 | Analytics | 4% |

| Salvo | $1,500,000 | Gaming | 3% |

| Moonbox | $1,000,000 | AI, Intellectual property | 2% |

Amid the widespread excitement surrounding Non-Fungible Tokens (NFTs), it’s imperative to discern the trajectory of investment within this domain. Notably, this category has witnessed a substantial influx of funds, reaching $57,246,770, distributed among 12 promising projects.

Leading Projects in NFTs:

- Mocaverse ($20 Million, 35%): Operating in the metaverse sub-category, Mocaverse captures a significant chunk of the NFT investments.

- Solv Protocol ($6 Million, 10%): Venturing into the fusion of DeFi and NFTs, Solv Protocol grabbed a noteworthy slice.

- Gondi ($5.35 Million, 9%): Focusing on lending/borrowing, Gondi represents a wider aspect of the NFT ecosystem.

- Marketplaces: Projects like fxhash ($5 Million, Art and Marketplace) and TRLAB ($5 Million) emphasize the growth of platforms facilitating NFT trading.

The NFT sector encompasses a wide array of applications, spanning metaverses, marketplaces, analytics and entertainment. With an overall investment approaching $60 million, the NFT landscape is only beginning to unveil its full potential.

The wide array of projects and their funding emphasize that the NFT ecosystem extends beyond digital art. It represents a swiftly expanding realm of digital ownership and innovation.

Notable Investors of Q3 2023

Several notable investors showed significant interest by actively participating in various fundraising rounds. Here are some of the prominent investors and their contributions to the Web3 ecosystem during Q3 2023:

- Cogitent Ventures and Polygon: Cogitent Ventures and Polygon both emerged as active investors in Web3 projects, with each participating in four different fundraising rounds. Their diverse portfolios reflect their commitment to fostering innovation in the Web3 space.

- AllianceDAO, Andreessen Horowitz, Base Ecosystem Fund, Binance Labs, Collab+Currency, Foresight Ventures, Hashed, Hashkey Capital, NGC Ventures, Robot Ventures, and Shima Capital: These investors have each engaged in three Web3 fundraising rounds during Q3 2023. Their collective support underscores the dynamism and growth potential of the Web3 sector.

Prominent NFT Projects Investors

In the thriving realm of Non-Fungible Tokens (NFTs), several investors made a significant impact by backing promising NFT projects. Here are some notable NFT investors and their contributions in Q3 2023:

- 6th Man Ventures and Dragonfly Capital: Both 6th Man Ventures and Dragonfly Capital have actively invested in two NFT projects, demonstrating their belief in the transformative power of NFTs.

- Fabric Ventures, OKX Ventures, and Tezos Foundation: These investors have also played a crucial role by participating in two NFT fundraising rounds each, further highlighting the diversification and potential of the NFT ecosystem.

These investors have not only provided crucial financial support but have also contributed to the continued development and innovation within the Web3 and NFT sectors. Their portfolios encompass a wide range of projects, reflecting the multifaceted nature of the Web3 and NFT landscapes.

Decoding the Persistent Challenges of Q3 2023

In the third quarter of 2023, the crypto community experienced a comparatively quieter phase in contrast to the earlier tumultuous first quarter. Nevertheless, it faced challenges primarily arising from a surge in scams and fraudulent activities.

OpenSea’s “Deals” Feature Fails to Make an Impact

OpenSea, one of the leading NFT marketplaces, introduced a new feature called “Deals.” The feature aimed to enable users to trade NFTs by offering their own NFTs as barter, rather than relying solely on cryptocurrencies.

While the concept of “Deals” sought to enhance security and serve as an intermediary in transactions, it received mixed reviews. Many users expressed disappointment, citing that it arrived late. It also coincided with a period when the NFT market was not performing well.

Rise in QR Code-Linked Phishing Scams

The surge in the popularity of QR codes has brought along an unfortunate rise in QR-linked phishing scams. Threat actors have embraced QR codes in a trend known as ‘Qishing,’ using them to conceal malicious URLs.

These attackers mimic multi-factor authentication processes. They trick victims into scanning QR codes with their mobile devices, unknowingly granting access to malicious links. This emerging trend poses new challenges in cybersecurity and highlights the importance of user vigilance.

Google Ads Scheme Exposes Cryptocurrency Users to Scam Vulnerability

Cryptocurrency users faced a concerning vulnerability through a fraudulent Google Ads scheme. Scammers have been purchasing ads on Google that redirect clicks to fraudulent cryptocurrency domains. Despite multiple reports to Google, the tech giant has yet to take decisive action against these malicious actors.

Conclusion

In summary, analyzing Web3 projects in Q3 2023 reveals several key findings:

- The quarter showed a total of 62 projects collectively raising $406,250,000 in funding.

- The top 10 projects cover diverse areas within Web3, securing substantial funding and showcasing varied interests within the ecosystem.

- Top 10 projects accounted for a significant 65.08% ($264,400,000) of the total Web3 funding. This indicates a concentration of capital in leading endeavors.

- Notable trends included a strong focus on the Metaverse and substantial investments in AI and gaming.

In summary, Q3 2023 showcased substantial investment activity within the Web3 sector, attracting a variety of projects.

While prominent initiatives secure the majority of funding, the sector’s expansive scope highlights its promise. Investors maintain their belief in the transformative capabilities of Web3 technologies, laying the groundwork for future expansion and innovation.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.

More articles

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.