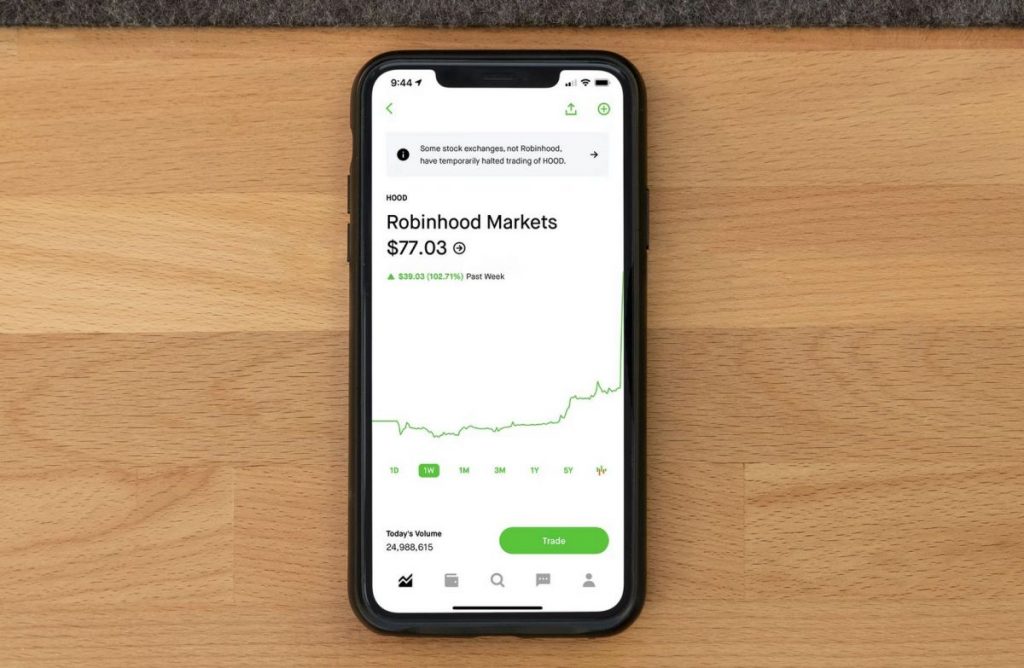

Robinhood’s crypto division reaches $30 million settlement with NYDFS over internal staffing

As August opened, the case closed on an investigation by the New York Department of Financial Services into infamous investment platform Robinhood’s crypto division. The state agency’s first-ever enforcement in the crypto space started in 2020, well before Robinhood’s IPO in 2021, spanning a supervisory examination and an enforcement investigation.

These investigations found “significant violations of the Department’s anti-money laundering and cybersecurity regulations,” Superintendent Adrienne A. Harris said in a release. Robinhood crypto (RHC) initially expected in 2021 to pay a $10 million fine, according to the Wall Street Journal, but later adjusted that estimate to the correct final sum: $30 million.

Some specifics underpinning Robinhood’s latest run-in with the law stem from scalability. Their personnel and tech infrastructure didn’t keep pace with the meteoric growth of their user base—which peaked during the pandemic. NYDFS’s release said the company “failed to timely transition from a manual transaction monitoring system that was inadequate for RHC’s size, customer profiles, and transaction volumes.”

RHC also failed to staff its requisite BSA/AML department sufficiently and ignored “critical failures” in their cybersecurity program related to operational risks. They even neglected to comply with the simple requirement to list a phone number on their site dedicated to fielding consumer complaints.

Through deceit, carelessness, or a blend of both, Robinhood still certified compliance with NYDFS’s Transaction Monitoring Regulation and Cybersecurity Regulation and ignored reporting requirements set forth by their bespoke Supervisory Agreement with NYDFS.

Thirty million dollars isn’t even half of it for Robinhood, who paid a $65 million SEC settlement in 2020 and another $70 million fine to the Financial Industry Regulatory Authority (FINRA). Each separate offense related to “misleading customers,” CNBC said.

Just one day after the NYDFS’s final sum went live for the public, Robinhood CEO Vlad Tenev announced the company would cut nearly a quarter of its employees—about 900 people—citing inflation, but not their $295 million net loss posted in Q2 2022.

“While employees from all functions will be impacted, the changes are particularly concentrated in our operations, marketing, and program management functions,” Tenev said shortly after RHC was fined for being understaffed.

The NYDFS reduced RHC’s violations down to “a failure to foster and maintain an adequate culture of compliance.” A global financial center that it is, New York’s state government has a huge role to play in setting a foundational regulatory precedent in this burgeoning space.

This year’s crypto winter has or is serving to wash away, concluding the proverbial first wave. In retrospect, what the space underwent was a once-in-a-lifetime wild ride that’ll now shake out into actually sustainable systems. Stability can bring more possibilities but requires emotional agility, exemplified by Snapshot as they acknowledged the benefits of shielded voting while pausing just a beat to remember the excitement. DeFi will need to get a bit more real to survive.

“All virtual currency companies licensed in New York State are subject to the same anti-money laundering, consumer protection, and cybersecurity regulations as traditional financial services companies,” Harris reminded readers in the release. “DFS will continue to investigate and take action when any licensee violates the law or the Department’s regulations, which are critical to protecting consumers and ensuring the safety and soundness of the institutions.”

Robinhood, meanwhile, pledged its commitment to ethical improvement.

“We have made significant progress building industry-leading legal, compliance, and cybersecurity programs and will continue to prioritize this work to best serve our customers,” Associate General Counsel of Litigation and Regulatory Enforcement Cheryl Crumpton said in a statement quoted by WSJ.

“We remain proud to offer a more accessible, lower-cost platform to buy and sell crypto and are excited to continue to grow our business in a responsible manner with new products and services that our customers want.”

As part of their $30 million settlement this week, Robinhood will also work with an independent consultant to evaluate and monitor their remediation efforts. Their user base is down right now, but energy is powerful. So maybe Robinhood can buy the dip by sinking some effort into their ethics while bearish circumstances last.

Read related posts:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Vittoria Benzine is a Brooklyn-based art writer and personal essayist covering contemporary art with a focus on human contexts, counterculture, and chaos magic. She contributes to Maxim, Hyperallergic, Brooklyn Magazine, and more.

More articles

Vittoria Benzine is a Brooklyn-based art writer and personal essayist covering contemporary art with a focus on human contexts, counterculture, and chaos magic. She contributes to Maxim, Hyperallergic, Brooklyn Magazine, and more.