Top 5 NFT Staking Projects for 2022: Pros and Cons

The non-fungible token market is booming, and creators and developers are looking for new ways to use them. One of the latest trends is staking these tokens to generate passive income.

There are a few different ways to stake NFTs, but the most common is through a smart contract. This type of staking allows you to lock up your tokens for a set period of time and receive rewards based on the amount you stake.

With so many different NFT staking projects out there, it can be difficult to know which one is right for you. That’s why we’ve compared the top NFT staking projects and their rewards to help you make the best decision for your needs.

A Detailed Look at the Best Staking NFTs

Staking NFTs on a DeFi platform in order to collect rewards is a process that has been around for a while now, though it may be new to those who are not as familiar with cryptocurrencies. Fundamentally, staking only requires an investor have a cryptocurrency wallet that contains NFTs.

In fact, many NFT projects come equipped with their own internal DeFi tools which makes the entire process much more streamlined and straightforward. The tricky part comes about because not every NFT can actually be used for staking purposes– there are only a select few out of the numerous types of existing NTFs.

Lucky Block

Launched in 2022, the Lucky Block is an NFT staking project that allows users to lock up their NFTs for a set period of time and receive rewards based on the amount they stake.

The Lucky Block team has created a detailed guide on how to stake your NFTs, which can be found here.

To get started, you’ll need to have a Lucky Block NFT. These can be purchased on the Lucky Block website or through select exchanges. Once you have your NFT, you’ll need to deposit it into the Lucky Block smart contract.

Once your NFT is deposited, you’ll be able to choose how long you want to stake it for. The minimum stake period is 1 week, and the maximum is 12 weeks.

You’ll also need to choose how much GAS you’re willing to pay for each transaction. The more GAS you’re willing to pay, the faster your transactions will be processed.

Pros:

- Easy to use platform

- Detailed guide on how to stake NFTs

- Minimum stake period is 1 week

Cons:

- You’ll need to purchase a Lucky Block NFT before you can begin staking

Quint

Quint is one of the coolest new NFT projects to launch in recent years. The ecosystem comprises a few notable features, including an NFT marketplace and the Quint shop. However, what sets this project apart from others is its super staking pool.

Quint staking pool’s rewards not only come in the form of digital tokens but also include unique real-world collectibles such as complimentary stays at luxurious 5* resorts, supercar experiences, and discounts on hotel bookings, restaurants, and properties.

Quint also offers luxury raffle pools with exclusive prizes to participants. To get started, investors can purchase tailor-made NFTs via the platform’s marketplace. Quint focuses on offering luxury NFT services, which means that investors can also receive newly minted NFTs framed and have them delivered right to their homes.

Pros:

- Offers a unique staking pool that includes real-world collectibles as rewards

- Also offers luxury raffle pools with exclusive prizes

- NFTs can be purchased through the marketplace and delivered right to your doorstep

Cons:

- Not much information available about the project

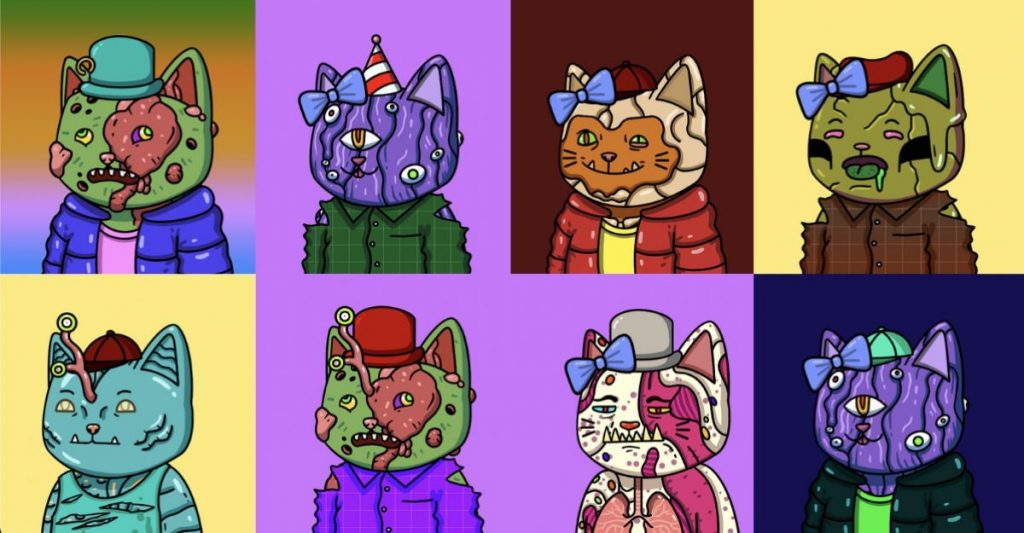

Mutant Cats

Mutant Cats is perhaps the first cryptocurrency project that purchases and fractionalizes other blue-chip NFTs. In other words, it allows users to buy a tiny portion of an NFT that they could never afford outright. For example, the recent purchase of a Beeple art piece for $69 million would have cost each Mutant Cats user approximately $0.30.

Since its launch in early 2021, the project has acquired and fractionalized a handful of high-profile NFTs, including those created by well-known artists like Beeple and Mike Winklemann (aka Beeple).

Mutant Cats is an NFT staking project that allows users to lock up their NFTs for a set period of time and receive rewards based on the amount they stake.

Pros:

- Allows users to buy a tiny portion of an NFT that they could never afford outright

- Has acquired and fractionalized a handful of high-profile NFTs

- Is an NFT staking project that allows users to lock up their NFTs and receive rewards

Doge Capital

Doge Capital has launched an exclusive collection of 5,000 art NFTs, every 24×24 pixels. Furthermore, like the Mutant DAO project, Doge Capital also invests in other well-known NFT projects.

The Doge Capital team has created a detailed guide on how to stake your NFTs, which can be found here.

To get started, you’ll need to have a Doge Capital NFT. These can be purchased on the Doge Capital website or through select exchanges. Once you have your NFT, you’ll need to deposit it into the Doge Capital smart contract.

Pros:

- Offers an exclusive collection of 5,000 art NFTs

- Also invests in other well-known NFT projects

- Has created a detailed guide on how to stake your NFTs

Cons:

- You’ll need to purchase a Doge Capital NFT before you can begin staking

Wolf Game

The Online Project of the Wolf Game is a metaverse project that has implemented NFT staking into its gameplay. In this world, NFTs are known as Wolves and Sheep. To protect their sheep from wolves, players will need to stake their NFTs.

Players will receive rewards for staking their NFTs, which can be used to purchase in-game items or exchanged for other cryptocurrencies.

Pros:

- Implemented NFT staking into its gameplay

- Players will receive rewards for staking their NFTs

- Rewards can be used to purchase in-game items or exchanged for other cryptocurrencies

FAQs

One of the best NFT Staking initiatives is The Sandbox. It is the first blockchain game platform to offer non-fungible tokens (NFTs), which reflect in-game assets owned by players. These NFTs can be used to generate in-game content such as game objects, avatars, and land.

Staking NFTs is similar to staking cryptocurrencies because NFTs are tokenized assets. Furthermore, not every nonfungible token, like every token, can be staked using NFTs. Because NFTs are tokenized assets, they may be deployed on NFT staking platforms and kept secure.

Through staking, where the NFT is locked or deposited for a predetermined amount of time in exchange for dividends that are paid in tokens or other digital assets, NFTs can provide passive income.

To earn rewards without selling the NFTs, they can be staked on a staking platform. It functions similarly to a time deposit bank account in that you deposit a set sum of money and receive interest on it.

Staking is the process of locking up cryptocurrency assets for a predetermined amount of time to maintain a blockchain’s operation. You gain extra cryptocurrency by staking your existing cryptocurrency. A proof of stake consensus mechanism is used by numerous blockchains.

By keeping your NFTs in your wallet and not selling or transferring them for the duration of the staking lock period, you can earn rewards with your land without using any gas.

In order to reward customers with tokens from our token contract, we employ our staking contract to keep their NFTs from our NFT Drop contract. The user will receive more tokens the longer they stake their NFT.

Conclusion

As you can see, there are a variety of different NFT staking projects currently available. Each project offers its own unique rewards and benefits. When choosing a project to invest in, be sure to carefully consider the pros and cons of each one.

Related articles:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Damir is the team leader, product manager, and editor at Metaverse Post, covering topics such as AI/ML, AGI, LLMs, Metaverse, and Web3-related fields. His articles attract a massive audience of over a million users every month. He appears to be an expert with 10 years of experience in SEO and digital marketing. Damir has been mentioned in Mashable, Wired, Cointelegraph, The New Yorker, Inside.com, Entrepreneur, BeInCrypto, and other publications. He travels between the UAE, Turkey, Russia, and the CIS as a digital nomad. Damir earned a bachelor's degree in physics, which he believes has given him the critical thinking skills needed to be successful in the ever-changing landscape of the internet.

More articles

Damir is the team leader, product manager, and editor at Metaverse Post, covering topics such as AI/ML, AGI, LLMs, Metaverse, and Web3-related fields. His articles attract a massive audience of over a million users every month. He appears to be an expert with 10 years of experience in SEO and digital marketing. Damir has been mentioned in Mashable, Wired, Cointelegraph, The New Yorker, Inside.com, Entrepreneur, BeInCrypto, and other publications. He travels between the UAE, Turkey, Russia, and the CIS as a digital nomad. Damir earned a bachelor's degree in physics, which he believes has given him the critical thinking skills needed to be successful in the ever-changing landscape of the internet.