Fund Outflows Hamper Crypto Growth in January while Whales Bolster BTC Reserves

In Brief

Despite volatile price movements, whale activity demonstrates Bitcoin’s strong potential in the upcoming months as BTC holdings increase.

A significant outflow of funds for digital asset investment products marked the last week of January. As reported by CoinShares, cryptocurrency funds managed by BlackRock, Bitwise, Fidelity, Grayscale, ProShares and 21Shares experienced a total net outflow of $500 million. Grayscale Bitcoin Trust (GBTC) was the anti-leader in outflows for the month, with its funds losing $2.2 billion.

Bitcoin has taken center stage with outflows totaling $479 million, while short-Bitcoin positions attracted additional inflows amounting to US$10.6 million. However, CoinShare’s analysts conclude that the main reason for the outflows was that most of the BTC seed capital was formed before Bitcoin Spot ETFs were approved on January 11.

Whales Steadily Grow their BTC Holdings

Amid fund outflows and the accompanying drop in the price of Bitcoin to the $38,000 mark, many crypto whales holding over 1,000 BTC took advantage of the resulting discount to further boost their holdings, as shown by the data provided by the analytics firm IntoTheBlock.

Bitcoin whales have increased their $BTC holdings by ~$3B (76,000 BTC) sine the start of this year. pic.twitter.com/0hi3Q7WXEo

— IntoTheBlock (@intotheblock) January 27, 2024

Despite the volatile price movements, whale activity demonstrates a strong belief in Bitcoin’s potential for the upcoming months, while their Bitcoin holdings continuously increase during market downturns.

Despite the current performance, many experts, including analysts at Standard Chartered and Galaxy Digital, have previously been quite optimistic about the prospects for Bitcoin Spot ETFs. For example, according to an earlier research note from Galaxy Digital, the projected Bitcoin Spot ETF inflows could reach up to $14.4 billion. Such substantial investment inflows could significantly impact the asset’s price and push it to the $100,000 mark by the end of 2024.

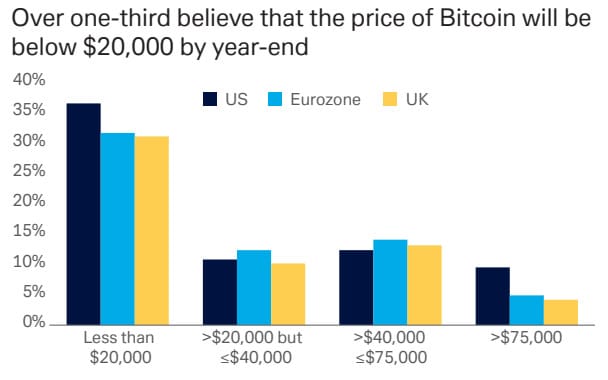

However, there are also contrary opinions about the future prospects of the leading cryptocurrency. Based on a January 2024 survey of retail investors conducted by Deutsche Bank, more than one-third of respondents anticipate Bitcoin’s value dropping below $20,000 by the following January. Only 15% of participants believe the price will range between $40,000 and $75,000 by the end of the current year.

Marion Laboure and Cassidy Ainsworth-Grace, analysts from Deutsche Bank, underscored the anticipated impact of the recently introduced spot Bitcoin ETFs on advancing the institutionalization of the well-established digital asset. However, their recent report “What’s next after the Spot Bitcoin ETF?” notes that contrary to this expectation, most inflows into these ETFs have come from retail investors.

It is still too early to draw unambiguous conclusions about the direction the BTC price will take in the coming months, but the opinion about the upcoming bull market prevails among most experts.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.About The Author

Ilya is an experienced writer specializing in the topics of blockchain technology and crypto markets. Over the years, he has worked on various articles, research publications, and full-fledged reports spanning across different fields. Ilya's passion lies in delivering up-to-date observations and insights to readers, driven by a commitment to contribute to the future landscape of the tech industry.

More articles

Ilya is an experienced writer specializing in the topics of blockchain technology and crypto markets. Over the years, he has worked on various articles, research publications, and full-fledged reports spanning across different fields. Ilya's passion lies in delivering up-to-date observations and insights to readers, driven by a commitment to contribute to the future landscape of the tech industry.