Crypto Trading Volume Soared to $37 Trillion in 2023, Fueled by Bullish Q4 Surge: CoinGecko Report

In Brief

The crypto market saw a 55% increase in total market capitalization, rising from $1.1 trillion to $1.6 trillion during Q4 2023.

The crypto market experienced a 55% increase in total market capitalization, rising from $1.1 trillion to $1.6 trillion during Q4 2023, according to CoinGecko’s 2023 Annual Crypto Industry Report.

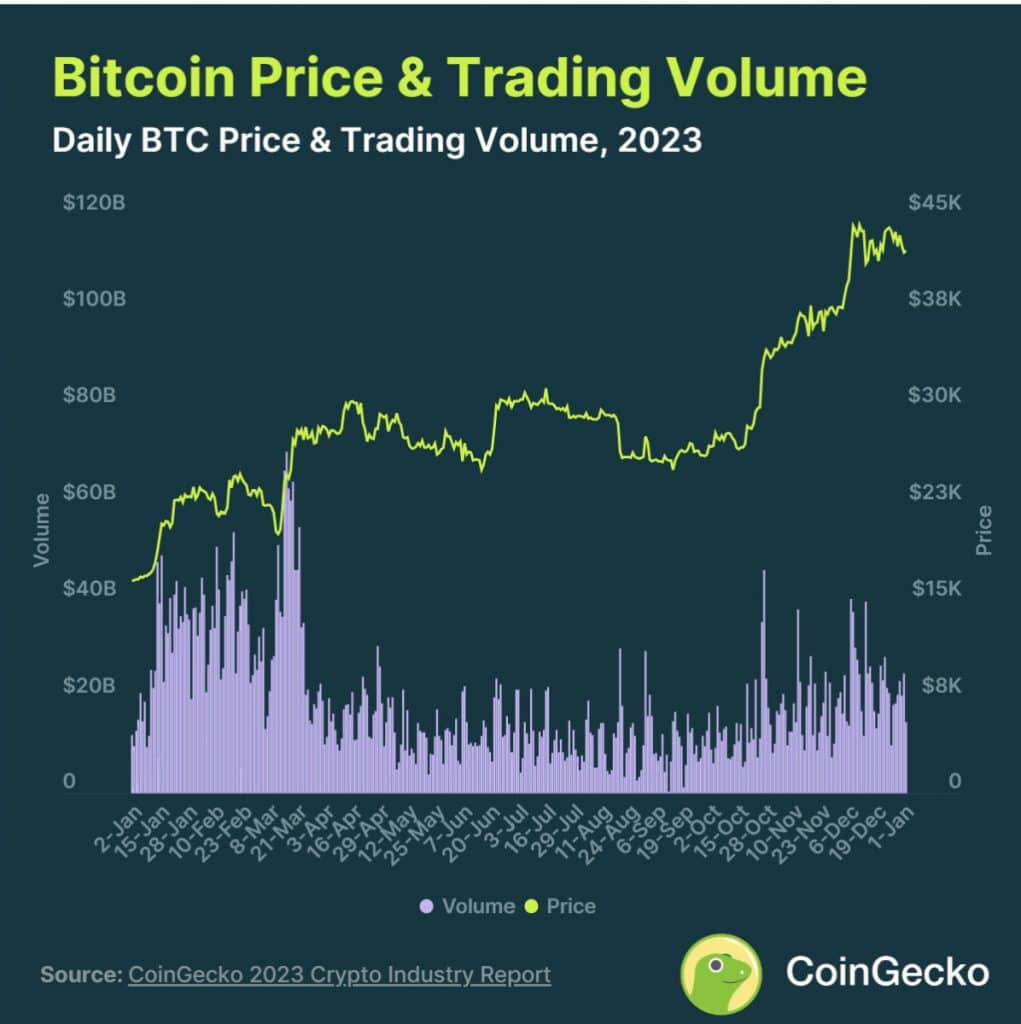

This surge was underpinned by the bullish sentiment driven by the prospects of Bitcoin ETFs gaining regulatory approval. Notably, the price of Bitcoin, the flagship cryptocurrency, witnessed a substantial ascent from $27,000 to $42,000 in the same quarter.

It is important to note that recently the U.S. Securities and Exchange Commission (SEC) approved the issuance of Spot Bitcoin Exchange-Traded Funds (ETFs), concluding months of anticipation within the digital asset sector.

According to the CoinGecko report, zooming out to the entire year of 2023, the crypto market exhibited extraordinary growth, more than doubling its total market cap from $832 billion at the year’s outset. This was primarily attributed to the resurgence of Bitcoin, which recorded a remarkable 2.6x increase.

The report further delves into the intricate details of the market landscape, analyzing the performance of key players such as Bitcoin and Ethereum, and provides an exploration of the decentralized finance (DeFi) and non-fungible token (NFT) ecosystems.

In terms of market statistics, the total crypto market cap witnessed a +108.1% increase in 2023, reaching $869.0 billion. Trading volume also displayed a notable trajectory, with the 2023 Q4 average daily trading volume surging to $75.1 billion – a +91.9% quarter-on-quarter increase.

However, despite the overall growth, the annual daily trading volume still lingered at -31.6% below the figures recorded in 2022.

Analyzing Bitcoin, Ethereum, Solana and NFTs

Bitcoin, the pioneer of cryptocurrencies, stole the spotlight with a good performance in 2023. The cryptocurrency widely touted as ‘digital gold’ climbed by +155.2% throughout the year, with Q4 alone witnessing a surge of +64.3%, catapulting its price from $26,918 to $42,220. Bitcoin hit a yearly high of $44,004 in December, reaching levels not seen since April 2022.

Ethereum, the second-largest cryptocurrency by market capitalization, closed 2023 at $2,294, marking a gain of +90.5% for the year. Ethereum’s highest returns were recorded in Q1, with a +49.8% increase from $1,196 to $1,792. After a consolidation period in Q2 and Q3, Ethereum rallied with a +36.4% increase in Q4, reaching a yearly high of $2,376 in December.

Solana (SOL) climbed +917.3% from $10.0 to $101.3. While Q2 and Q3 saw muted price action due to the FTX bankruptcy estate selling its holdings, Solana experienced an aggressive rally in Q4, reaching a high of $121.5.

In the realm of non-fungible tokens (NFTs), trading volumes across the top 10 chains amounted to $11.8 billion in 2023. However, this figure marked a decline, standing at less than half of the NFT trading volume in 2022, which reached $26.3 billion.

Moreover, the report highlights that despite the regulatory challenges faced by centralized exchanges (CEXs), they continued to dominate trading volume in 2023. The CEX: DEX spot ratio stood at 91.4%, emphasizing the enduring prominence of centralized platforms. Similarly, the CEX: DEX derivatives ratio was 98.1%, highlighting the market’s preference for centralized exchange offerings despite hurdles faced by major players like FTX and Binance.

“2023 turned out to be a strong year of recovery for the crypto industry, with regulatory concerns addressed and last cycle’s excesses purged. Going into 2024, the projects that have been building during the bear market have strengthened crypto’s tech stack and launched new apps, and we’re excited to see what the next developments will be,” said Bobby Ong, COO and co-founder of CoinGecko.

As the industry continues to evolve, the report sets the stage for further exploration and analysis of the dynamic crypto landscape.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.About The Author

Kumar is an experienced Tech Journalist with a specialization in the dynamic intersections of AI/ML, marketing technology, and emerging fields such as crypto, blockchain, and NFTs. With over 3 years of experience in the industry, Kumar has established a proven track record in crafting compelling narratives, conducting insightful interviews, and delivering comprehensive insights. Kumar's expertise lies in producing high-impact content, including articles, reports, and research publications for prominent industry platforms. With a unique skill set that combines technical knowledge and storytelling, Kumar excels at communicating complex technological concepts to diverse audiences in a clear and engaging manner.

More articles

Kumar is an experienced Tech Journalist with a specialization in the dynamic intersections of AI/ML, marketing technology, and emerging fields such as crypto, blockchain, and NFTs. With over 3 years of experience in the industry, Kumar has established a proven track record in crafting compelling narratives, conducting insightful interviews, and delivering comprehensive insights. Kumar's expertise lies in producing high-impact content, including articles, reports, and research publications for prominent industry platforms. With a unique skill set that combines technical knowledge and storytelling, Kumar excels at communicating complex technological concepts to diverse audiences in a clear and engaging manner.