Best 7 AI Financial Advisors & Stock Analysts in 2023

Check these 7 AI financial advisors that are expected to lead the market in 2023. These platforms utilize advanced algorithms and machine learning techniques to provide personalized investment advice and portfolio management services.

| Pro Tips |

|---|

| 1. Check these new 10+ AI-powered Data Analysts & Data Scientists tools that will help you streamline your data analysis process and make more informed decisions. |

| 2. Check these 30 + AI business ideas to stay ahead of the game in 2023. From AI-powered customer service to predictive maintenance solutions, these ideas offer a glimpse into the future of business innovation. |

| 3. Check these 9 Best ChatGPT Lifehacks to make your life easier and more efficient. From organizing your schedule to simplifying household chores, these tips will help you save time and reduce stress. |

- WallyGPT: AI-Powered Personal Finance Assistant

- Michael AI: GPT-Powered Investment Analyst

- FinChat.io: AI Stock Investing Analyst

- Jarvis Invest: Let AI Maximize Your Stock Market Returns

- FP Alpha: Transforming Financial Planning with AI Technology

- Zumma: Personal Finance Assistant with AI

- Pefin: AI-Powered Financial Planning Partner

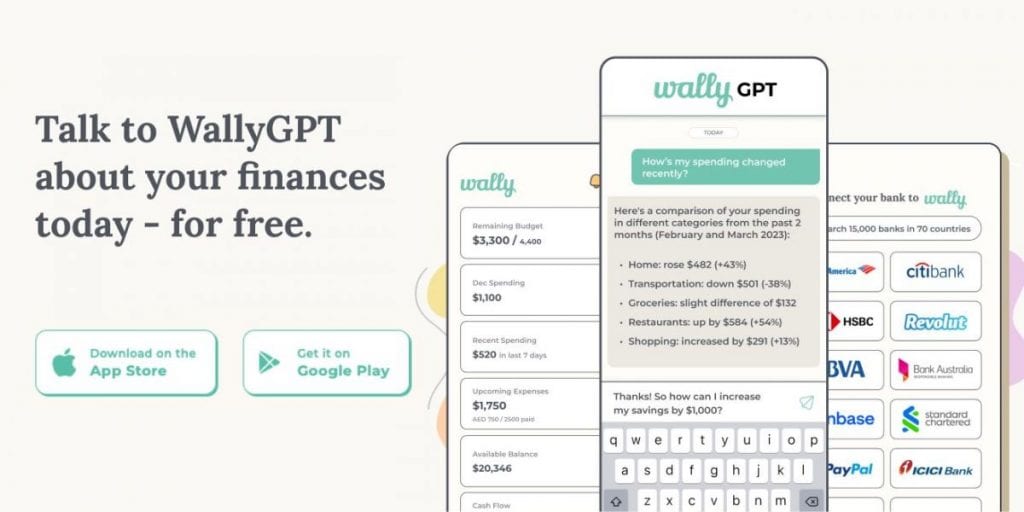

WallyGPT: AI-Powered Personal Finance Assistant

WallyGPT is the world’s first generative AI-powered personal finance app! Wally combines the power of AI with the intricacies of personal finance, offering a tailored experience that goes beyond traditional charts and graphs. It provides contextual insights, personalized guidance, and promotes financial literacy.

Over the years, we have come to understand that personal finance is more than just tracking expenses or setting budgets. It’s about comprehensively understanding your financial life. Wally offers a comprehensive view of your financial situation, automatically tracking everything from spending, budgets, and balances to net worth and cash flow, all in one place.

Enter WallyGPT, your personal finance assistant. WallyGPT elevates your financial literacy by providing expert context and tailored suggestions. Ask WallyGPT questions like “How have my grocery expenses changed in the last 4 months?” or “How much do I need to save each month for a wedding in Greece?” and receive an instant action plan. It’s like having a financial expert in your pocket, ready to assist you at any moment.

It also serves as your investment coach, answering your questions and helping you enhance your financial literacy. Whether you’re researching the right ETFs or need guidance on investing during a recession, WallyGPT is there to support you. Wally simplifies your finances, automates mundane tasks, and provides contextual insights and personalized guidance that empower you to make better financial decisions.

At Wally, we prioritize safety, security, and privacy. We have built Wally from the ground up with these principles in mind. Your conversations with WallyGPT are private and confidential. We use your data to provide relevant responses, and within 30 days, it is completely deleted. We do not use your data for training purposes, nor do we collect any sensitive banking or account information.

With the ability to connect to over 15,000 banks in 70 countries, WallyGPT is now available for free on the Apple App Store and Google Play Store. Download the app today and start your journey towards mastering your finances with the help of WallyGPT.

Michael AI: GPT-Powered Investment Analyst

Michael is your very own AI-powered Investment Analyst. With Michael, you gain access to thousands of company documents and current financial metrics, transforming your investment analysis experience and boosting your productivity.

Michael is an advanced Artificial Intelligence search tool designed specifically for the investment community. Using cutting-edge AI technology, Michael allows you to explore and discover information on publicly-traded companies simply by using natural language. With Michael, you can simply ask your questions and get the answers you need.

Michael provides access to Earnings Call and Conference Transcripts, as well as Quarterly (Qs) and Annual (Ks) Reports for a wide range of companies, including AAPL, ABNB, AMZN, BX, CAT, CMG, COST, CRM, CRWD, DDOG, DIS, DKNG, GOOGL, HD, JPM, MAR, MSFT, NFLX, NVDA, PANW, PLTR, RIVN, SNOW, SQ, TGT, TSLA, UBER, UNH, V, and WMT.

To maximize the benefits of using Michael, try asking questions in a conversational manner, as if you were speaking to a person. While Michael can handle keyword searches, it excels when you use natural language statements or questions.

In the Chat feature, Michael uses a system similar to Auto-GPT, an open-sourced AI Assistant based on ChatGPT. It evaluates your question and available actions to determine the best approach. After a few iterations, Michael provides you with an answer along with the set of documents it used to arrive at that answer.

In the Search feature, Michael takes your search statement or question, performs a semantic search against the available information, and returns the most relevant results.

FinChat.io: AI Stock Investing Analyst

FinChat.io is your AI-powered stock investing analyst designed specifically for the finance world. Imagine having access to a virtual assistant that can provide you with valuable insights and information on over 750 companies, 100+ super-investors, and a vast array of financial metrics and investing materials.

As fellow investors, the creators of FinChat.io recognized the challenges faced by the industry. Hours were spent sifting through filings, transcripts, and traditional financial data terminals, making it difficult to aggregate comprehensive data on individual companies.

With FinChat, they have combined up-to-date financial data with powerful large language models to create a simple and user-friendly tool. And here’s the best part: the basic version of the product is currently available for free, allowing users to enjoy up to 10 prompts per day. As the platform scales and improves, users can expect even more insightful answers and features.

But that’s not all. The team behind FinChat.io is also dedicated to fostering innovation in the AI industry. They are in the process of developing an industry association called The AI Innovators Collective. This association aims to bring together AI, ML, and GPT experts to collaborate on online courses and contribute valuable content.

Jarvis Invest: Let AI Maximize Your Stock Market Returns

Jarvis Invest analyzes 12 million financial parameters, including fundamental, technical, and sentimental factors, along with 120 global parameters, to create a customized equity portfolio for you. This personalized approach ensures that your investments align with your risk profile, investment horizon, and desired amount. With over Rs. 100+ crores in trusted funds, Jarvis Invest uses AI to help your money grow in the stock market.

One of the biggest challenges in stock investing is managing risk. Jarvis Invest addresses this with its inbuilt 24X7 risk management system. With continuous monitoring, Jarvis keeps a vigilant eye on your portfolio, mitigating potential risks and striving to deliver benchmark-beating returns in the long run.

Identifying timely investment opportunities in the stock market requires expertise and constant market analysis. Jarvis Invest leverages AI to analyze market trends and your portfolio, identifying potential money-making opportunities. This proactive approach ensures that you stay ahead in the market and make informed investment decisions.

Jarvis Invest’s partnership with 25+ leading broking houses ensures seamless execution of your trade orders. With just a click of a button, you can onboard digitally and start executing your trades effortlessly.

One of the key advantages of using AI in stock advisory services is the elimination of human biases and errors. Jarvis Invest relies on AI algorithms that read and analyze vast amounts of data within minutes, making it faster and more accurate than traditional approaches. The 24X7 risk management system ensures constant vigilance even when human money managers are not actively monitoring the market.

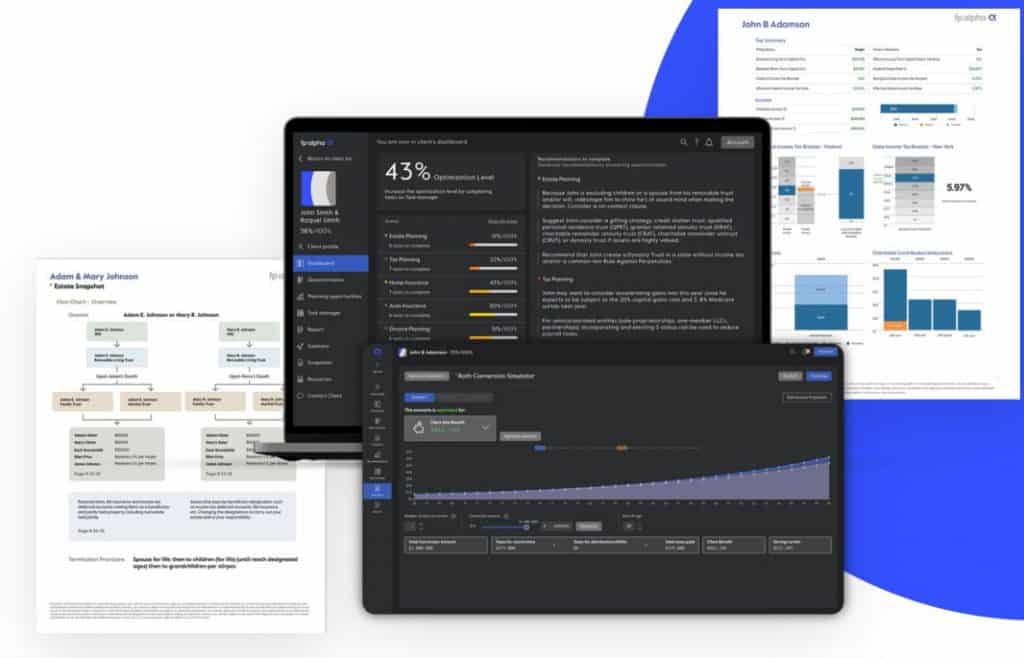

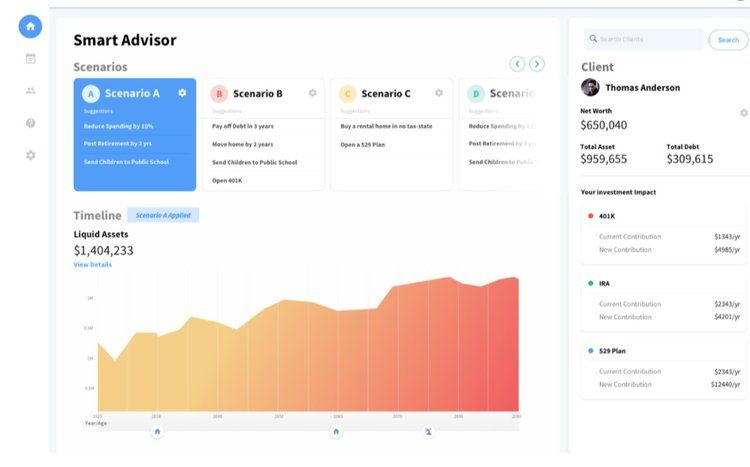

FP Alpha: Transforming Financial Planning with AI Technology

FP Alpha is the AI-driven platform for financial advisors provides comprehensive planning services to their clients. By leveraging advanced technology, FP Alpha empowers advisors to scale their planning capabilities and offer actionable advice based on clients’ tax, legal, and insurance documents.

With FP Alpha, the time-consuming task of reviewing and analyzing clients’ tax returns, wills, trusts, and insurance policies is now streamlined. The AI-driven technology “reads” these documents and instantly summarizes key data, identifying valuable planning insights and quantifying the value of advice. What used to take hours can now be done in minutes, saving both advisors and clients valuable time.

FP Alpha goes beyond traditional retirement planning software by providing a comprehensive solution that demonstrates the value of advisors’ expertise beyond investments. By analyzing clients’ complete financial picture, advisors can offer actionable plans for implementation, helping clients achieve their financial goals with confidence.

The FP Alpha platform equips advisors with visual reports that help illustrate recommendations to clients. These reports make it easier for clients to understand the value and benefits of the proposed strategies, enhancing their overall financial planning experience.

Importantly, FP Alpha is designed as an extension to traditional retirement planning software, not a replacement. The platform seamlessly integrates with the industry’s most widely used technology, enhancing the capabilities of existing planning processes. Advisors can leverage FP Alpha’s AI-driven insights while maintaining their preferred planning tools and workflows.

Zumma: Personal Finance Assistant with AI

Zumma is the personal finance platform that utilizes the power of AI to help you make better financial decisions. Designed to cater to users in Mexico and Latin America, Zumma offers a comprehensive personal finance and investment platform that provides valuable recommendations, advice, and rewards.

With Zumma, you can take control of your finances and make informed decisions. The platform harnesses the capabilities of AI to analyze vast amounts of data and provide tailored recommendations based on your financial goals and preferences. Whether you’re saving for a big purchase, planning for retirement, or looking to grow your investments, Zumma is here to guide you every step of the way.

One of the standout features of Zumma is its personalized approach. The platform takes into account your unique financial situation, risk tolerance, and investment horizon to deliver customized recommendations that align with your goals. This level of personalization ensures that you receive advice that is relevant and meaningful to your specific circumstances.

Zumma’s AI-powered algorithms continuously analyze market trends, economic indicators, and investment opportunities to provide you with up-to-date insights. With this information at your fingertips, you can make more informed decisions about where to allocate your funds and optimize your investment strategy.

But Zumma goes beyond just offering recommendations. The platform also rewards you for taking positive financial actions. By achieving financial milestones, saving consistently, or meeting your investment targets, you can earn rewards that further boost your financial well-being. This unique rewards system serves as an additional motivator to help you stay on track with your financial goals.

Pefin: AI-Powered Financial Planning Partner

Pefin is the world’s first AI financial advice platform that help you manage your finances. Pefin serves as your digital partner, offering comprehensive financial planning and advice that is accessible anytime, anywhere. With Pefin, you can access affordable fiduciary financial planning, advice, and investing right at your fingertips, 24/7. This innovative platform empowers individuals to take control of their financial future by providing personalized recommendations tailored to their specific needs and goals.

One of the key benefits of Pefin is its ability to drive financial inclusion. By leveraging AI technology, this platform enables financial institutions and digital advisors to offer financial planning, advice, and robo-investment services on a larger scale. This means that more individuals, regardless of their demographic or wealth level, can access high-quality financial guidance and services. Pefin’s AI platform is designed with humans in mind. It supports both digital-only and digital-advisor hybrid models, giving you the flexibility to choose the level of human interaction you prefer. Whether you prefer a fully digital experience or would like to connect with a human advisor, Pefin has you covered.

The platform’s advanced AI algorithms analyze vast amounts of data to provide accurate and reliable financial advice. By leveraging machine learning and data analytics, Pefin continuously learns and improves its recommendations, ensuring that you receive the most up-to-date and relevant guidance. Pefin’s user-friendly interface makes it easy to navigate and understand your financial situation. Through interactive tools and visualizations, you can track your progress, set financial goals, and make informed decisions about your money.

FAQs

An AI financial advisor is a computer-based system that utilizes artificial intelligence algorithms to provide financial advice and guidance.

AI financial advisors analyze large amounts of data, including market trends, historical performance, and user input, to generate personalized financial recommendations and strategies.

Some benefits of using AI financial advisors include 24/7 availability, data-driven insights, automated portfolio management, and the ability to cater to individual financial goals.

While AI financial advisors offer many advantages, they are not designed to completely replace human financial advisors. They can complement human expertise and provide additional tools for decision-making.

AI financial advisors can cater to a wide range of investors, from beginners to experienced investors. They can provide tailored advice based on the investor’s risk tolerance, financial goals, and investment preferences.

AI financial advisors prioritize data security and employ robust encryption protocols to protect personal and financial information. It’s essential to choose reputable providers who prioritize user privacy.

Some popular AI financial advisor platforms include:

- WallyGPT

- Michael AI

- FinChat.io

- Jarvis Invest

- FP Alpha

- Zumma

- Pefin

Yes, some AI financial advisors have features that assist with tax planning and optimization, helping investors minimize tax liabilities and maximize tax-efficient investing strategies.

Some limitations of AI financial advisors include the potential for algorithmic bias, the inability to account for unforeseen market events, and the lack of a human touch in complex financial situations. It’s important to understand these limitations and consider them when using AI financial advisors.

Fees for AI financial advisors vary depending on the platform and the services provided. Generally, AI financial advisors tend to have lower fees compared to traditional human financial advisors, making them more cost-effective for certain investors.

Read more about AI:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Damir is the team leader, product manager, and editor at Metaverse Post, covering topics such as AI/ML, AGI, LLMs, Metaverse, and Web3-related fields. His articles attract a massive audience of over a million users every month. He appears to be an expert with 10 years of experience in SEO and digital marketing. Damir has been mentioned in Mashable, Wired, Cointelegraph, The New Yorker, Inside.com, Entrepreneur, BeInCrypto, and other publications. He travels between the UAE, Turkey, Russia, and the CIS as a digital nomad. Damir earned a bachelor's degree in physics, which he believes has given him the critical thinking skills needed to be successful in the ever-changing landscape of the internet.

More articles

Damir is the team leader, product manager, and editor at Metaverse Post, covering topics such as AI/ML, AGI, LLMs, Metaverse, and Web3-related fields. His articles attract a massive audience of over a million users every month. He appears to be an expert with 10 years of experience in SEO and digital marketing. Damir has been mentioned in Mashable, Wired, Cointelegraph, The New Yorker, Inside.com, Entrepreneur, BeInCrypto, and other publications. He travels between the UAE, Turkey, Russia, and the CIS as a digital nomad. Damir earned a bachelor's degree in physics, which he believes has given him the critical thinking skills needed to be successful in the ever-changing landscape of the internet.