Abrigo Launches AI-Powered Fraud Detection Platform to Help Mitigate Financial Losses

In Brief

Abrigo launched its Abrigo Fraud Detection platform for ‘check’ image analysis and inspection to help financial institutions combat fraud.

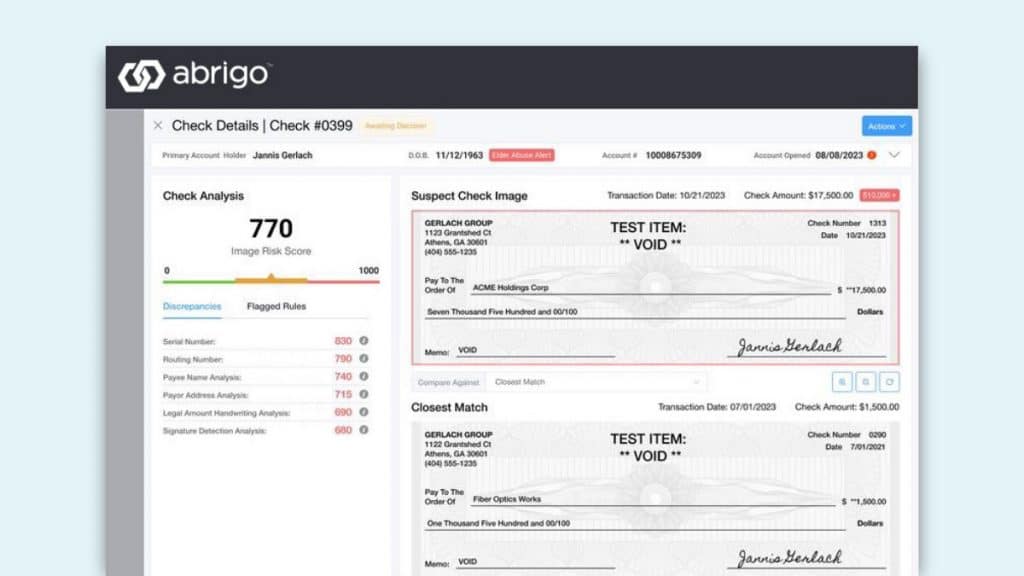

Financial crime prevention and risk management solutions provider Abrigo launched a new platform called Abrigo Fraud Detection. The platform integrates AI-powered inspection and ‘check’ image analysis with a configurable fraud decision engine to help financial institutions combat fraud.

Despite the increasing popularity of digital payment channels, checks are still the most common form of B2B payment – 81% of businesses still pay other firms with paper checks, which necessitates the firms to remain proactive.

In November 2023, Abrigo announced a partnership with mobile deposit and fraud prevention company Mitek. The Abrigo Fraud Detection platform leverages Mitek’s Check Fraud Defender and combines it with Abrigo’s configurable fraud decision engine to enhance check fraud detection.

“Abrigo Fraud Detection, powered by Mitek, utilizes advanced computational visual analysis to examine 22 key check attributes such as handwriting and font discrepancies, ensuring precise fraud detection,” Ravi Nemalikanti, CTO at Abrigo told Metaverse Post.

“Our solution assesses check images from diverse sources including ATMs, mobile apps and direct deposit at branches and compares attributes across a nationwide consortium of check fraud data to identify potential behavioral red flags and produce transparent fraud risk scores for accelerated inspection and decisions,” he added.

He added that the solution’s user-friendly interface enables analysts to evaluate suspicious checks, including immediate comparison with previous checks, and reach out to their customers or members to verify suspicious transactions.

In a pilot program with a southeastern U.S. bank, Abrigo Fraud Detection accurately identified 93% of the bank’s total fraudulent check value, amounting to over $330,000 in potential fraud loss avoidance.

Adding to this, Nemalikanti said the company’s solution pinpoints a higher rate of fraudulent checks using Mitek’s AI/ML-powered check image analysis that looks at 22 key check attributes, a nationwide consortium of check fraud data, and Abrigo’s configurable fraud decision engine.

Abrigo Enhances Fraud Prevention with Tailored Detection Tools

As technology becomes more sophisticated, fraudsters will use more complex methods for forgery and other financial crimes. Financial institutions must stay up to date with fraud trends and implement effective tools to avoid fraud losses. Abrigo’s new addition aims to reduce check fraud.

“The platform increases efficiency with automated end-to-end fraud detection workflows tailored to a financial institution’s needs, including data ingestion, inspection, decisions and reporting. This minimizes the burden of manual processing, lowering costs and proactively preventing fraud’s impact on the institution and its customers,” Abrigo’s Ravi Nemalikanti told Metaverse Post.

He added that by streamlining operations and enhancing accuracy, the platform empowers financial institutions to defend against costly attacks and safeguard customers, assets, and brand reputation.

Moreover, each financial institution has a unique risk tolerance. The Abrigo Fraud Detection platform leverages Abrigo’s experience with check fraud scenarios, allowing institutions to set custom risk tolerance levels and adapt workflows to those limits.

Nemalikanti said, “Institutions can use rules and conditions, such as transaction thresholds, to help them decide if the activity is fraudulent or not. Transparent fraud risk scores and other data attributes from the check image analysis help institutions decide which transactions to investigate.”

As of now, the solution will initially provide check fraud detection. The platform’s capabilities will expand beyond check fraud detection to include detection across additional transaction types, such as wire and FedNow, throughout 2024.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.About The Author

Kumar is an experienced Tech Journalist with a specialization in the dynamic intersections of AI/ML, marketing technology, and emerging fields such as crypto, blockchain, and NFTs. With over 3 years of experience in the industry, Kumar has established a proven track record in crafting compelling narratives, conducting insightful interviews, and delivering comprehensive insights. Kumar's expertise lies in producing high-impact content, including articles, reports, and research publications for prominent industry platforms. With a unique skill set that combines technical knowledge and storytelling, Kumar excels at communicating complex technological concepts to diverse audiences in a clear and engaging manner.

More articles

Kumar is an experienced Tech Journalist with a specialization in the dynamic intersections of AI/ML, marketing technology, and emerging fields such as crypto, blockchain, and NFTs. With over 3 years of experience in the industry, Kumar has established a proven track record in crafting compelling narratives, conducting insightful interviews, and delivering comprehensive insights. Kumar's expertise lies in producing high-impact content, including articles, reports, and research publications for prominent industry platforms. With a unique skill set that combines technical knowledge and storytelling, Kumar excels at communicating complex technological concepts to diverse audiences in a clear and engaging manner.