Growing Chinese Bitcoin Mines in the U.S. Spark National Data Security Concerns

In Brief

Chinese-linked Bitcoin mining operations have been making significant inroads in the United States, raising concerns about national security.

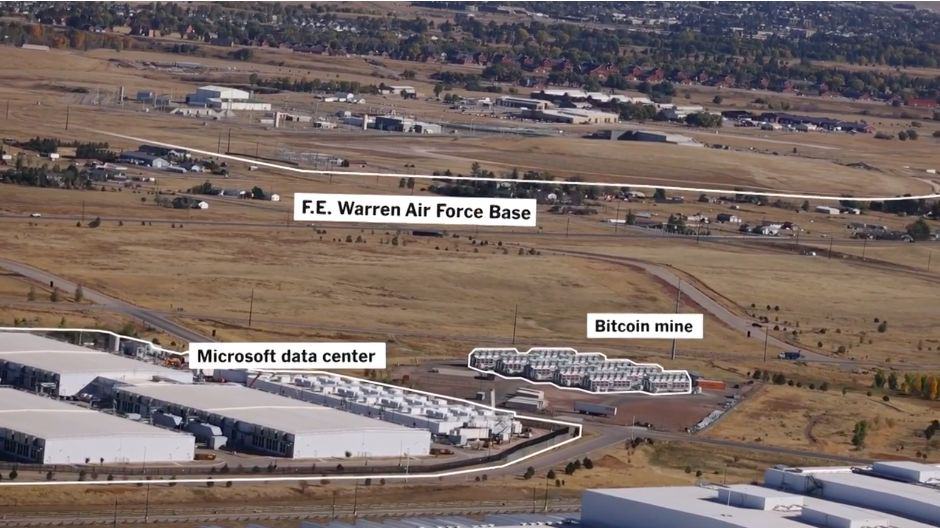

A mining operation in Cheyenne, Wyoming, is located near a Microsoft data center that supports the Pentagon and an Air Force base controlling nuclear-armed missiles.

Texas has become a hotspot for Chinese Bitcoin miners due to its favorable combination of cheap electricity and a relaxed regulatory environment.

Chinese owned/operated Bitcoin mines in the United States have raised national security alarms due to their proximity to critical infrastructure and potential grid disruptions. Reportedly, Microsoft and U.S. government officials are monitoring these operations, which pose a risk of intelligence collection and targeted blackouts and are primarily powered by Bitmain’s specialized computers.

The location of a Chinese-affiliated crypto-mining operation in Cheyenne, Wyoming, is right next to a Microsoft data center that supports the Pentagon and near an Air Force base controlling nuclear-armed missiles. Microsoft’s security team alerted the Committee on Foreign Investment in the United States about the potential threat.

While Microsoft has not found direct evidence of malicious activities, it warns of significant threat vectors, especially regarding energy-hungry operations. Microsoft’s security team raised alarms about the potential risks associated with this proximity, as it could allow for “full-spectrum intelligence collection operations” by the Chinese.

Texas is a Chinese Bitcoin Mining Hotspot

Several U.S. states, including Arkansas, Ohio, Oklahoma, Tennessee, Texas and Wyoming, reportedly host Chinese-owned or operated Bitcoin mines consuming power equivalent to 1.5 million homes.

One prominent Chinese-affiliated cryptocurrency mining company, Poolin, operates two mines in West Texas that can draw on as much as 600 megawatts of energy, enough to power nearly half a million U.S. homes. The company’s founder, Kevin Pan, is a Chinese citizen who has celebrated the warm welcome he received in Texas, showcasing the state’s appeal to cryptocurrency miners.

In 2021, BBC published an article that said Texas is appealing to Chinese miners, as it offers a combination of cheap electricity and a relaxed regulatory environment, making it an ideal location for their energy-intensive operations. Moreover, Texas has embraced blockchain and cryptocurrency through regulatory recognition, attracting Chinese bitcoin companies seeking stability and opportunity.

Governor Greg Abbott has shown support for cryptocurrency, and the state’s deregulated power grid with low energy prices makes it an attractive destination. Other state officials, including Senator Ted Cruz, have also expressed support for cryptocurrencies and want Texas to become a haven for Bitcoin and blockchain technology.

According to The New York Times, the Electric Reliability Council of Texas has reported that Bitcoin mines’ energy consumption and lack of transparency have resulted in forecasting errors, potentially magnifying grid events and impacting reliability. To mitigate risks, proposals have emerged to regulate how quickly these mines can start or stop using energy. Unlike other power generators and transmission companies, Bitcoin mining operations operate in a largely unregulated “gray area.”

Concerns Over Energy Strain and Cybersecurity

Despite the concerns raised about national security risks and potential disruptions to power grids, the Chinese-affiliated Bitcoin mining operations in the U.S. continue to expand, with their energy-intensive operations posing challenges and controversies in various states.

Moreover, the concern extends to the immense strain these operations place on power grids and their ability to participate in programs that pay them to shut down during grid strain, potentially disrupting grid stability.

Bitmain, a Chinese company responsible for much of the mining equipment, has expanded its presence in the U.S. following China’s Bitcoin mining ban in May 2021. These operations have raised fears due to their enormous energy consumption and potential cyberattacks on critical infrastructure. The complex ownership structures of these mines often involve shell companies with ties to the Chinese Communist Party and government.

The rapid growth of China-linked Bitcoin mines, particularly those affiliated with the Chinese government or entities, has prompted concerns about grid reliability and transparency, with calls for regulations on energy usage and operations. Despite national security concerns, some U.S. politicians have embraced these Bitcoin mining operations in Texas, but the industry remains largely unregulated.

Crypto and Bitcoin Mining Regulations in the U.S.

Cryptocurrency regulations in the United States are intricate and continuously evolving. Federal and state authorities are working on regulations, but overlapping agency responsibilities complicate the regulatory environment.

Each state in the U.S. can implement its own regulations and licensing procedures related to digital assets. While cryptocurrencies are generally legal in every state, businesses operating in this space may encounter differences in state-level regulations and definitions.

Cryptocurrency mining is also permitted in all U.S. states, but specific states may enforce restrictions. Recently, some states have raised concerns about the energy consumption associated with cryptocurrency mining. For instance, New York’s Environmental Committee proposed a moratorium on proof-of-work mining in March 2022.

In late November, New York became the first state to enact a two-year moratorium on specific cryptocurrency mining activities. This legislation temporarily halts the issuance and renewal of permits for fossil fuel power plants used by mining companies. Importantly, individual miners can still engage in mining activities within the state.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Agne is a journalist who covers the latest trends and developments in the metaverse, AI, and Web3 industries for the Metaverse Post. Her passion for storytelling has led her to conduct numerous interviews with experts in these fields, always seeking to uncover exciting and engaging stories. Agne holds a Bachelor’s degree in literature and has an extensive background in writing about a wide range of topics including travel, art, and culture. She has also volunteered as an editor for the animal rights organization, where she helped raise awareness about animal welfare issues. Contact her on agnec@mpost.io.

More articles

Agne is a journalist who covers the latest trends and developments in the metaverse, AI, and Web3 industries for the Metaverse Post. Her passion for storytelling has led her to conduct numerous interviews with experts in these fields, always seeking to uncover exciting and engaging stories. Agne holds a Bachelor’s degree in literature and has an extensive background in writing about a wide range of topics including travel, art, and culture. She has also volunteered as an editor for the animal rights organization, where she helped raise awareness about animal welfare issues. Contact her on agnec@mpost.io.