Metaverse Fundraising Report for January: Trends in Security, Gaming, Wallet

In Brief

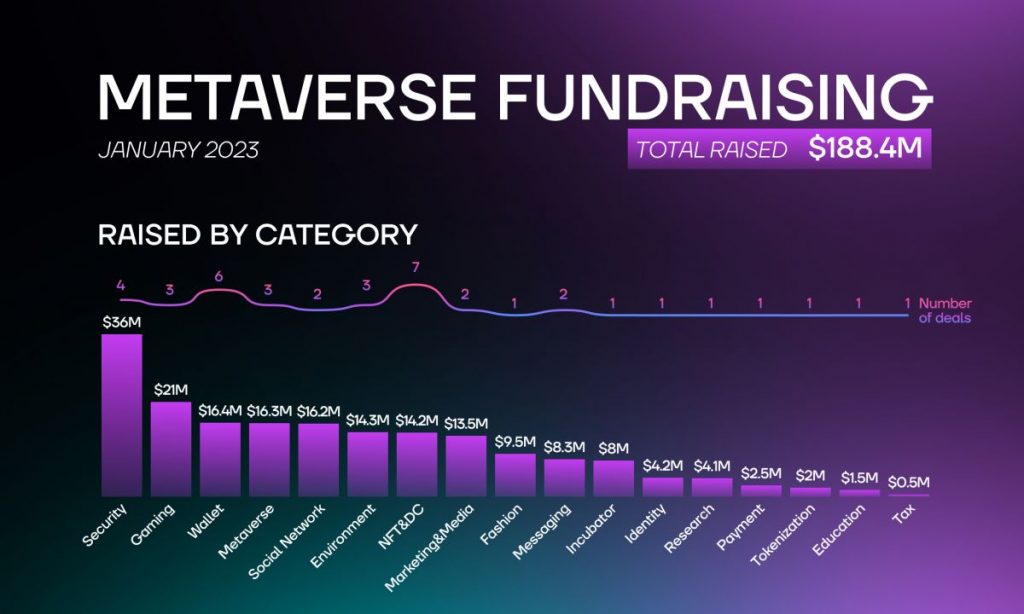

Web3 companies raised a total of $188.4 million in January 2023

Investors paid attention to 17 categories, among which messaging, wallet, and environment

Security is the leading category, which raised $36 million in January.

- Metaverse Industry Trends

- Gaming Industry Trends

- NFT and Digital Collectibles Industry Trends

- Fashion Industry Trends

- Marketing and Media Industry Trends

- Social Network Industry Trends

- Messaging Industry Trends

- Identity Industry Trends

- Research Industry Trends

- Education Industry Trends

- Wallet Industry Trends

- Incubator Industry Trends

- Environment Industry Trends

- Payment Industry Trends

- Tax Industry Trends

- Tokenization Industry Trends

- Security Industry Trends

- Notable Investors

The fourth quarter of 2022 has not been easy for web3 entrepreneurs, and January 2023 did not mark a positive changr. The overall sum of web3-related investments decreased from $378.55 million in November 2022 to $188.4 million in January. However, investors were still active and participated in 40 web3 fundraising rounds despite the ongoing crypto winter and the holiday season.

Security companies received the most of VCs’ attention in January, having raised a total of $36 million. Gaming and metaverse industries, which were most trending in the second half of 2022, raised only $20.95 million and $16.3 million, respectively. NFT and digital collectibles startups only received $14.2 million from investors. The trend declined in the second half of last year and currently receives little attention and interest. For instance, in November 2022, NFT companies raised a total of $31.8 million, while in September, VCs invested approximately $111 million in NFT-related startups.

January also saw the rise of new industry trends. Environment and ecology are of much interest right now, and crypto investors are not an exception. In January, three new environmental startups attracted $14.3 million.

Metaverse Industry Trends

Brave Group received $2.3 million from entertainment giant Animoca Brands’ Japanese division. The startup, which focuses on entertainment businesses in the metaverse, will use the funds to accelerate global development.

Web3 pet game Neopets Metaverse received $4 million from Polygon Ventures, Hashkey Capital, IDG Capital, Blizzard Avalanche Ecosystem Fund, and NetDragon Websoft. The company will use the funds to furtherly develop the game and attract new users.

User-generated content metaverse platform Createra raised $10 million in a Series A round led by Andreessen Horowitz. The startup aims to build the largest Generation Z-focused metaverse platform, which will let users create, distribute, and monetize content.

Gaming Industry Trends

YGG Japan, a subDAO of Yield Guild Games, completed a private fundraising round with $2.95 million. Square Enix, Shinsegae, FREE, Marblex, Gate.io, Infinity Ventures Crypto, and Coincheck Labs are among the investors.

Web3 gaming studio Oh Baby Games raised $6 million in a seed round led by eGirl Capital and Synergis Capital. Several angel investors, including the co-founder of Twitch, Kevin Lin, backed the round. The startup will soon introduce a new game featuring cross-game collectibles.

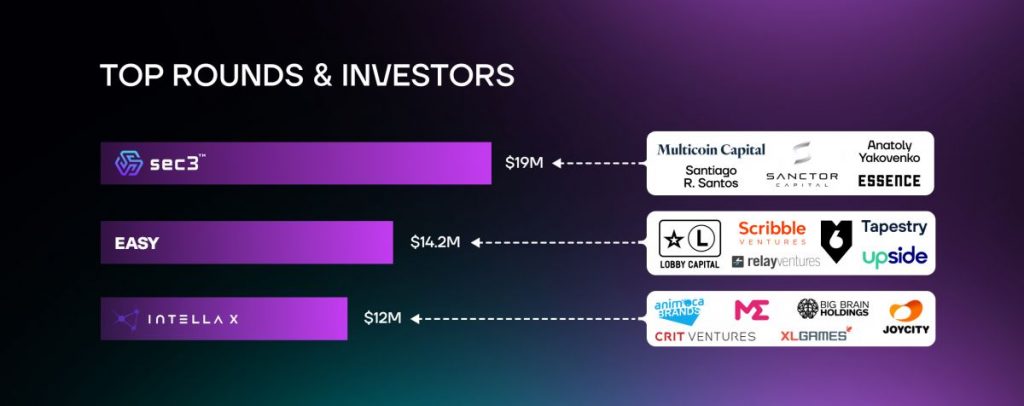

Polygon-based next-generation gaming platform Intella X received $12 million from Animoca Brands, Magic Eden, Big Brain Holdings, JoyCity, Crit Ventures, XL Games, and other investors. The platform, developed by the South Korean company Neowiz, will go live in Q1 2023.

NFT and Digital Collectibles Industry Trends

NFT-backed customer engagement platform Cohort raised €3.2 million in a seed round led by Axle Capital and IRIS. Among other participants are Kima Ventures, 3founders, and several angel investors. The startup will use the funds to expand the team and boost its sales effort.

Opinion web3 platform Polemix raised $2 million in a seed round led by Globant and Newtopia VC.

Gaming NFT marketplace Fractal received an undisclosed amount from Polygon and expanded its platform to the Polygon blockchain. The companies also plan to launch joint campaigns for gaming tournaments and participate in the Game Developers Conference in March.

Gifto, a web3 gifting protocol, raised $2.5 million in a strategic round led by Poolz Ventures. The startup will use the funds to support its roadmap for 2023. In addition to the investment, the partnership includes plans for joint marketing, which would increase the adoption of both Gifto and Poolz.

Marketplace for metaverse land sales, Metahood, received $3 million from 1confirmation. Volt Capital, Neon DAO, Flamingo DAO, and several angel investors backed the round. The startup plans to add more virtual worlds to its platform and develop a hub for web3 users.

Gary Vaynerchuk’s digital collectible platform Candy Digital received an undisclosed amount in a Series A round led by Consensus Mesh and Galaxy. Among the other participants are Consensus and 10T Holdings. The company plans to shape the future of web3-enabled collectibles, events, and experiences.

Digital collectibles startup Sleepagotchi raised $3.5 million in a seed round. Among the participants are 6th Man Ventures, Collab+Currency, Shima Capital, DeFi Alliance, 1kx, Sfermion, LCA Game Guild, and Emoote. The gamified experience gives users digital collectibles rewards for meeting consistent sleep goals.

Fashion Industry Trends

Fashion startup SYKY, launched by the former Ralph Lauren executive, received $9.5 million in a Series A round led by Alex Ohanian’s VC firm Seven Seven Six. Brown Howard, First Light Capital Group, Polygon, and Leadout Capital backed the round. The platform will reportedly function as an incubator for fashion designers.

Marketing and Media Industry Trends

Addressable raised $7.5 million in a seed round led by Fabric Ventures and Viola Ventures. Among other participants are North Island Ventures and Mensch Capital Partners. The web3 platform enables marketers to build accurate audience profiles based on their social media data accounts and wallets.

StoryCo, a platform that enables individuals to co-own story franchise IP, raised $6 million in a seed round led by Collab+Currency and Patron. Blockchange Ventures, Floodgate Ventures, Sfermion, Flamingo DAO, and several angels backed the round. The startup also announced the release of its collaborative storytelling platform and the launch of its first story universe.

Social Network Industry Trends

Web3 social wallet The Easy Company raised $14.2 million in a seed round. Among the investors are Lobby Capital, Scribble Ventures, 6th Man Ventures, Tapestry VC, Relay Ventures, Upside, and several angels from web3 and web2 companies. The startup has recently launched its social wallet, which is now publicly available in beta.

Web3 social platform DeBox raised $2 million in a seed round led by ABCDE Capital. The startup plans to build the web3 substack and a full-stack DAO platform.

Messaging Industry Trends

Web3 social wallet and group chats application Tribes raised $3.3 million in a pre-seed round led by South Park Commons, Kindred Ventures, and Script Capital. In addition, the startup announced the launch of its social wallets, which enable users to manage and co-own digital assets.

Encrypted messaging application Mask Network raised $5 million in a round led by DMW Labs. The latter invested by purchasing $5 million worth of $MASK tokens as part of the deal. The companies will furtherly collaborate to make web3 more accessible.

Identity Industry Trends

Web3 credential protocol Gateway raised $4.2 million in a seed round led by Reciprocal Ventures. Among other participants are 6th Man Ventures, Figment, Spartan Group, and several noted angel investors, including Sandeep Nailwal and Ryan Selkis. The startup aims to decentralize credentials maintenance and issuance.

Research Industry Trends

VitaDAO, a community-owned collective that funds longevity research, received $4.1 million from Pfizer Ventures. Shine Capital, L1 Digital, and angel investor Balaji Srinivasan also participated in the private token sale. The DAO will furtherly use the funds to finance research projects and biotech startups.

Education Industry Trends

Crypto content business platform Collective Shift received $1.5 million from RNR Capital.

Wallet Industry Trends

Sui blockchain-based wallet Ethos Wallet raised $4.2 million in a seed round led by Boldstart Ventures and Gumi Cryptos Capital. Among other participants are Mysten Labs, Tribe Capital, South Park Commons, and Matrixport. The startup will use the funds to continue developing the wallet, infrastructure, and applications.

Crypto wallet Tholos raised $1.5 million in a pre-seed round led by North Island Ventures, Lattice, Chainforest, and Dispersion Capital. Numerous noted angel investors backed the round. The company aims to develop the next generation of digital asset custody and treasury management.

Multichain wallet Cypher received $4.3 million in a round led by Y Combinator. OrangeDAO, Samsung Next, and Balaji Srinivasan backed the round. The startup will use the capital to develop the product, conduct further research, and pursue partnerships with banking institutions.

Multi-signature, non-custodial digital assets management solution MSafe raised $5 million in a seed round led by Jump Crypto. Among other participants are Circle Ventures, Coinbase Ventures, Redpoint Ventures, SV Angel, Superscrypt, Spartan Group, and Shima Capital. The Silicon Valley-based startup will use the funds to grow the team, develop its portfolio, and scale product adoption.

Decentralized digital asset aggregator Assure Wallet raised $1.4 million in a pre-Series A round. The startup plans to furtherly optimize the product and improve its user experience.

Decentralized wallet developer Odsy Network received an undisclosed amount in a strategic round led by Tykhe Block Ventures. The company aims to make web3 more secure by using cutting-edge cryptography.

Incubator Industry Trends

Tané, an incubator focused on web3 startups from Dubai, New York City, and Tokyo, received $8 million. X Tech Ventures, DEEPCORE, DeNA, B Dash Ventures, and several angel investors backed the round.

Environment Industry Trends

Climate finance trading platform Sunken received $7.5 million from Obvious Ventures. Offline Ventures, Kraken Ventures, Climate Capital, and Inflection are among the other participants. The startup plans to launch the first-ever public sale of tokenized Carbon Forwards. The funding will be used to power the liquid marketplace for the carbon credits.

ValuesCo, formerly Socialstack, raised $2.7 million in a seed round. Flori Ventures, Metaweb Ventures, OWN Fund, Rene Reinsberg, and Richard Spanton Jr. are among the participants. The community-driven startup enables a collaborative future for non-profit organizations, companies, and creators.

On-chain verification platform for forests, Open Forest Protocol, raised $4.1 million in a pre-seed round. Among the participants are Shima Capital, Not Boring Capital, Big Brain Holdings, Valor Capital, Übermorgen Ventures, Mercy Corps Ventures, Byzantine Marine, and several angel investors. The Swiss startup will use the funds to continue building the core infrastructure.

Payment Industry Trends

Fiat-to-crypto payment provider C14 raised $2.5 million in a seed round. General Catalyst, Fin Capital, Istari Ventures, and Cipholio Ventures backed the round.

Tax Industry Trends

Polish crypto tax automation platform Cryptoiny raised $500,000 in a pre-seed round led by ff Venture Capital and Pointer. Capital. Marcin Wenus backed the round. The startup plans to expand into the United Kingdom market, introduce new features, and enlarge its team.

Tokenization Industry Trends

Web3 platform Quantum Temple raised $2 million in a pre-seed round led by Borderless Capital. Algorand Foundation, Outliers Fund, New Moon Ventures, NxGen, and Shima Capital are among the other participants. The startup aims to preserve cultural heritage via blockchain technology.

Security Industry Trends

Security research firm Sec3 raised $19 million in a seed round led by Multicoin Capital. Sanctor Capital, Essence Venture, Anatoly Yakovenko, and Santiago R. Santos backed the round.

Hypernative, a web3-focused risk prevention platform, raised $9 million in a seed round led by Boldstart ventures and the IBI tech fund. Blockdaemon, Borderless, Alchemy, CMT Digital, Nexo, and several angels are among the other participants. The startup’s founders aim to prevent cyber attacks and believe there is a lot of opportunity to improve the space.

AI-driven security startup Trusts Labs raised $3 million in a seed round led by SevenX Ventures and Vision Plus Capital. Among the other participants are HashKey Capital, GGV Capital, Redpoint China Ventures, and SNZ Holding. The company will use the funds to build services aimed at web3 projects.

Asset Reality, an asset recovery solution for law enforcement, raised $4.9 million in a seed round led by Framework Ventures, SGH Capital, TechStars, and Chris Adelsbach. The company will use the funds to hire engineers and expand the operations team.

Notable Investors

Crypto and blockchain-focused investment firm Multicoin Capital led the seed round of Security research firm Sec3, which has raised a total of $19 million. The venture capital firm has previously invested in Ethereum, Flow, Algorand, and other noted companies.

The Easy Company received the second largest investment of January 2023. Its seed round was backed by VC firm Lobby Capital, which has previously invested in Docyt; tech-focused Sribble Ventures, which is operated by investors from a16z, Twitter, and Instagram; web3 investment collective 6th Man Ventures, which has previously backed Etherscan, Magic Eden, and Stepn; Tapestry VC, which invested in Zapp and Hopin; tech-focused Relay Ventures, and VC firm Upside.

Intella X received $12 million from entertainment giant Animoca Brands, NFT marketplace Magic Eden, crypto-focused VC firm Big Brain Holdings, which has previously invested in Near and Solana, and other venture funds.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Valeria is a reporter for Metaverse Post. She focuses on fundraises, AI, metaverse, digital fashion, NFTs, and everything web3-related. Valeria has a Master’s degree in Public Communications and is getting her second Major in International Business Management. She dedicates her free time to photography and fashion styling. At the age of 13, Valeria created her first fashion-focused blog, which developed her passion for journalism and style. She is based in northern Italy and often works remotely from different European cities. You can contact her at valerygoncharenko@mpost.io

More articles

Valeria is a reporter for Metaverse Post. She focuses on fundraises, AI, metaverse, digital fashion, NFTs, and everything web3-related. Valeria has a Master’s degree in Public Communications and is getting her second Major in International Business Management. She dedicates her free time to photography and fashion styling. At the age of 13, Valeria created her first fashion-focused blog, which developed her passion for journalism and style. She is based in northern Italy and often works remotely from different European cities. You can contact her at valerygoncharenko@mpost.io