Record-Low Crypto VC Funding in June: Infrastructure Emerges as Favored Investment Destination

In Brief

VC funding into the crypto space hit a record low in June with $520.1 million raised.

Infrastructure has emerged as the leading investment destination for VCs with over $210 million raised in June.

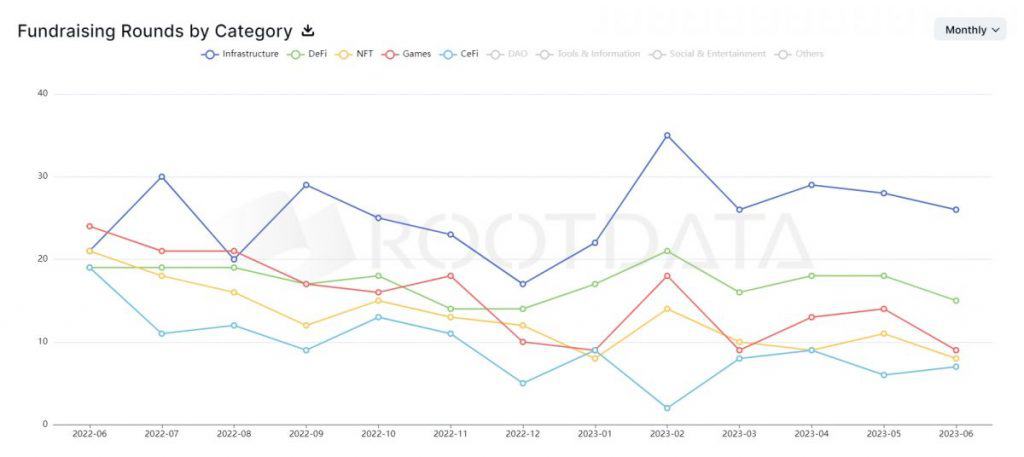

Amidst the crypto market’s struggle to sustain bullish momentum, venture capital funding in the crypto space reached an all-time low in June, raising $520.1 million across 84 funding rounds, according to RootData. This is a decrease of 23.11% compared to the month of May.

In February, the crypto fundraising landscape reached its peak this year, with a total of $947 million raised through 123 funding rounds. However, since then, there has been a consistent decline in fundraising activities within the crypto industry.

While funding amount has declined across all categories in the crypto space, RootData shows that infrastructure has emerged as the leading investment destination for VCs with over $210 million raised across 26 rounds in June.

In the last 30 days, decentralised machine learning compute protocol Gensyn, Mythical Games, One Trading, and Galaxy Finance are amongst the top 10 companies that have raised the most funds in Series A, B, and C1 rounds. Gensyn led with $43 million raised in Series A as VCs seek to capitalize on machine learning and cloud infrastructure amidst the AI frenzy. Notably, Thai cryptocurrency exchange Bitkub raised $17.8 million at a valuation of $193 million.

Investment in CeFi projects saw the largest decline over the past six months, going from $369 million in December to $101 million in June. The gaming and DeFi sectors also saw a steady decline in funds raised.

Unsurprisingly, the NFT space has been seeing the lowest amount of funding since Oct 2022 with $12.3 million across 8 rounds in June. This reflects a wider cooldown in the NFT market as the floor price of blue-chip projects such as Bored Ape Yacht Club plummeted to a 20-month low of under 30 ETH on Sunday. Last week, Azuki parent company Chiru Labs, saw the floor price of its new collection, Elementals, dip below issue price within 24 hours after launching.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via cindy@mpost.io with press pitches, announcements and interview opportunities.

More articles

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via cindy@mpost.io with press pitches, announcements and interview opportunities.