Metaverse Fundraising Report for October: Trends in Gaming, Infrastructure, Payment

In Brief

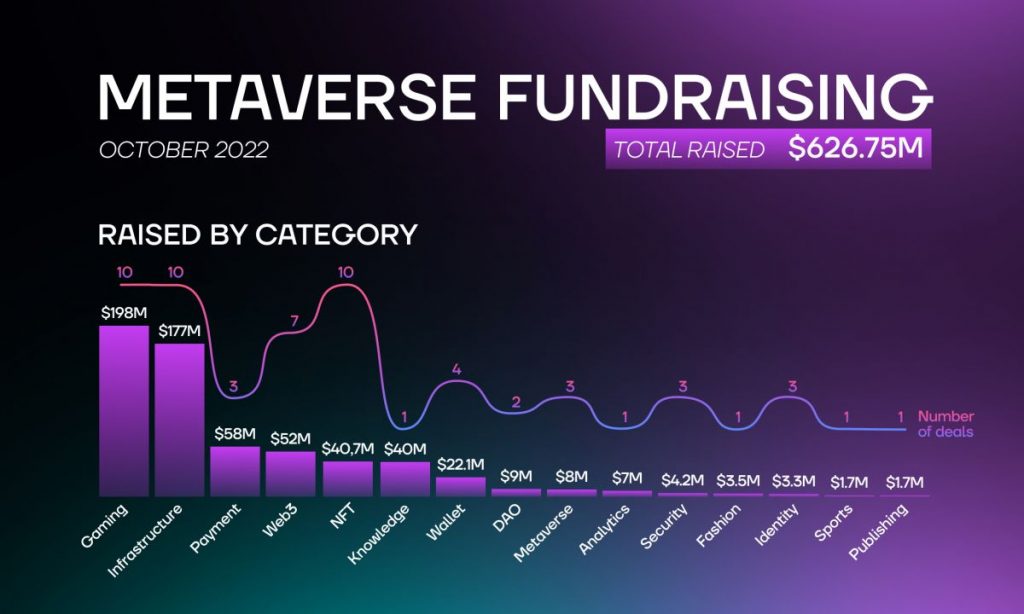

Web3 companies raised a total of $626.72 million in October

Investors paid attention to fifteen categories, among which Publishing and Knowledge

Gaming remains the leading category, having raised $198.4 million this month

Metaverse-related startups are losing drastically in volume – the category received approximately $8 million

- Gaming Industry Trends

- NFT Industry Trends

- Metaverse Industry Trends

- Fashion Industry Trends

- Sports Industry Trends

- DAO Industry Trends

- Publishing Industry Trends

- Knowledge Industry Trends

- Identity Industry Trends

- Wallet Industry Trends

- Payment Industry Trends

- Web3 Industry Trends

- Security Industry Trends

- Analytics Industry Trends

- Infrastructure Industry Trends

- Notable Investors

Metaverse Post introduces a fundraising report for October 2022 that focuses on tech companies specializing in Web3, Metaverse, gaming, and more.

In October, Web3 companies raised a total of $626.72 million. This result is below September’s total when startups received nearly twice as much—$1.3 billion. The drastic decrease might be caused by the overall global economic situation, with the inflation rate remaining at 8.2% in the past two months. It’s worth noting that the average financing sums also decreased compared to September’s investment rounds.

October saw 15 investment categories. Two of these are new: Publishing, which raised $1.7 million, and Knowledge, which received $40 million. The fashion category returned to investors’ radars, having raised $3.5 million.

Ten NFT startups have raised a total of $40.7 million, while Metaverse companies received approximately $8 million. The results of this category continue decreasing – in September, Metaverse-related startups received $39 million, and in August, $22.3 million. Although sports-related projects are still of interest, they haven’t received as much attention as before. The category raised $1.7 million, which is $7.3 million less than in the previous month.

Gaming remains one of the most trending categories among investors, having raised $198.4 million. In September, GameFi received $129 million, which was below August’s result of $466 million. In October, investors focused on free-to-play games and gaming developer tools, which empower users and builders.

It might be observed that the overall trends suggest the increasing adoption of Web3. Several wallet and banking startups are working on the facilitation of digital payments globally. For instance, the mobile money application Wave aims to make Africa the first cashless continent.

In addition, entrepreneurs started offering their Web3 versions of much-used Web2 apps and services. In particular, Decentralized Engineering Corporation is developing a blockchain-based Uber competitor, while Blackbird’s Ben Leventhal is creating a restaurant-focused hospitality platform.

The adaption of these Web3 applications is just a matter of time, and so is the transition from the current form of the internet to the decentralized one.

Gaming Industry Trends

Playable AAA Blockchain Game Delysium raised $10 million in a strategic round, with support from Anthos Capital, Immutable, GSR, Blockchain Coinvestors, Leon’s Capital, Antalpha, Perion, and Formless Capital.

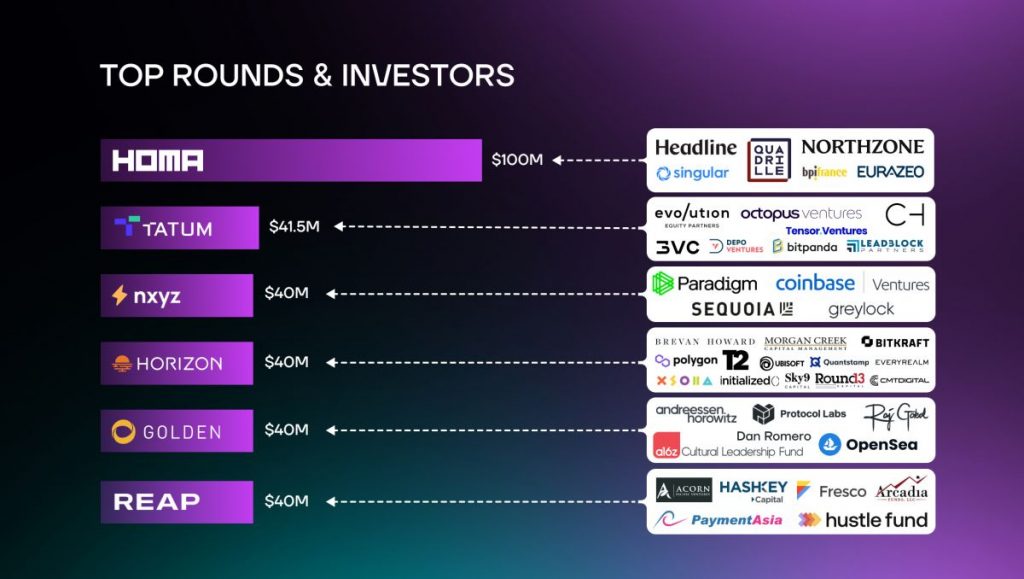

Homa, a creator-focused startup that develops tools, data insights, and revenue generation, raised $100 million in a Series B round led by Headline and Quadrille Capital. The round also saw participation from Northzone, Bpifrance, Eurazeo, and Singular.

Fashion-themed digital studio Muus Collective raised $5 million from LA-based Griffin Gaming Partners. The startup is set to launch its first Web3 mobile game.

“Consumer demand exceeds supply at the intersection of gaming, fashion, and Web3. The Muus team has a track record of building innovative experiences across all three spaces, and we’re excited to revolutionize the consumer experience and define the future of this intersection together,”

said the managing director at LionTree and Griffin Gaming Partners, Emily Wang.

Mobile-first Web3 game studio Tribo raised €1.2 million in a pre-seed round. Play Ventures, Sisu Games Ventures, and Joakim Achrén participated in the round. The founders have previously developed such noted games as Angry Birds and Candy Crush and now aim to redefine the industry by producing Web3 games.

Flowstate Games raised $2 million in a pre-seed round. Among the investors are Play Ventures, Equilibrium, and Joakim Achrén. The startup is building a Web3 arcade game, Smash Stars, and plans to develop more free-to-play games.

Gaming multiverse Elyzio raised $2 million in a pre-seed round led by Vgames. The round also saw participation from Shima Capital, Paribu Ventures, and Solana Ventures. The startup aims to develop next-generation blockchain-based, free-to-play games.

Horizon Blockchain Games raised $40 million in a Series A round led by Brevan Howard Digital and Morgan Creek Digital, with participation from Take-Two Interactive Software Inc., Polygon, Ubisoft, Initialized Capital, Xsolla, BITKRAFT, Quantstamp, Everyrealm, Sky9 Capital, Round13 Capital, CMT Digital, Xchange, Translink, J17, Sentiment Capital, Unicorn Partners, and Perpetual Value Partners. The studio aims to make Web3 fun and accessible and empower both users and builders.

Video gaming platform Stardust raised $30 million in a Series A round led by Framework Ventures and backed by Acrew Capital, Distributed Global, and Blockchain Capital. The Palo Alto-based startup aims to facilitate the development of accessible virtual games.

Solana-based gaming platform Arcade2Earn raised $3.2 million in a Seed round led by crypto.com Capital. The round was backed by Solana Ventures, KuCoin Labs, Shima Capital, LD Capital, Merit Circle, GSR, BigBrain, Tenzor Capital, and others. The startup will use the funds to continue transforming GameFi into an accessible space.

Auto-chess battler Project Eluune raised $5 million in a Seed round led by C² Ventures. Among other participants are Polygon, 6MV, Lightspeed, Everyrealm, Ancient8, Avalaunch, Morningstar Ventures, and Big Brain Holdings.

NFT Industry Trends

NFT startup Otterspace raised $3.7 million in a pre-seed round led by Cherry Crypto and Inflection. Coinbase Ventures, Bessemer Venture Partners, Btov Partners, and Paua Ventures are among the other participants. The company focuses on NFTs earned for customers’ participation in DAOs.

Sports-themed NFT platform FANtium raised $2 million in a pre-seed round. Among the participants are angel investors Sebastien Borget, Dominic Thiem, Brian O’Hagan, and others.

Lasso Labs raised $4.2 million in a round led by Electric Capital. The round also saw participation from OpenSea, Ethereal Ventures, Village Global, Page One Ventures, and several angel investors. The company has already launched its Ethereum-based Beta version.

NFT trading protocol Waterfall raised $4 million in a seed round led by electric Capital and Pantera Capital.

Music-themed NFT platform Stems raised $4 million in a pre-seed round. Among the investors are IDEO Colab Ventures, Merit Circle, Yield Guild Games, FireEyes, Jump Crypto, and Akatsuki.

NFT security startup TrustCheck, developed by Web3 Builders, raised $7 million in a seed round. Among the participants are OpenSea, Road Capital, G20, Sparkle Ventures, ACME, Picus Capital, TTV, Haven Ventures, and Global Founders Capital. The browser extension analyzes the risks of crypto transactions.

College sports NFT startup Mercury raised $7.5 million in a Seed round led by Multicoin Capital. The round also saw participation from North Island Ventures, Brevan Howard Digital, Crosslink Capital, and others. Mercury uses NFTs to promote IRL experiences for college fan bases.

NFT trading tooling platform Mintify raised $1.6 million in a seed round led by Arca. Among other investors are Alchemy Ventures, GSR, Psalion, and Fasanara.

Luxury-focused NFT startup Exclusible raised $5M in a round led by FC Basel owner Dan Holzmann and Tioga Capital. The company provides high-end brands with digital asset development support.

Spice Finance, an aggregator and liquidity routing protocol for NFT lending marketplaces, raised $1.7 million in a pre-seed round led by Shima Capital. Among other participants are ProtoFund, Delta Blockchain Fund, Big Brain Holdings, Nxgen, Side Door Ventures, Hypotenuse Labs, Crest Group, Origin Protocol, and Orrick. The startup aims to become a liquidity scaling protocol for the global digital economy at large, starting as a high-yielding lending application that will bridge DeFi’s capital to NFT lending’s yields.

Metaverse Industry Trends

AlterVerse, which is developing a Metaverse game experience, received funding from Binance Labs, Polygon Ventures, Baselayer Capital, Ankr, and EnjinStarter. The company is working on “SkyCity,” which consists of four gaming phases.

METAV.RS, a metaverse platform aimed at brands and agencies, raised €3 million in a seed round led by Jsquare. The round also saw participation from Sia Partners, 50 Partners, David Balland, Sebastien Borget, and others.

Zebra Labs raised $5 million from NetDragon and Sumitomo Mitsui Trust Bank. The startup helps Chinese celebrities enter the metaverse and plans to launch its NFT project.

Fashion Industry Trends

Web3 fashion and lifestyle platform YoloYolo raised $3.5 million in a seed round. The round saw the participation of Avatar Ventures, ParaFi Capital, C² Ventures, Mirana Ventures, Morningstar Ventures, Yolo Investment, Signum Capital, Genblock Capital, and UOB Venture Management.

Sports Industry Trends

Web3 fitness app Gritti raised $1.7 million in a seed round led by Lingfeng Capital. Youbi Capital, Stratified Capital, Bixin Ventures, Orderly Network, and CDI participated in the round. The platform is aimed at professional runners and athleticwear manufacturers.

DAO Industry Trends

Origami, a DAO framework provider, raised $6.2 million in a round led by Bloomberg Beta. Among other participants are Betaworks, Orange DAO, VC3 DAO, and Protocol Labs. The funds will be used for the expansion of the global DAO community.

EmpireDAO, a multi-chain Web3 cultural center for builders and artists, raised $2.8 million in a seed round. Among the investors are NEAR, IA Capital Partners, Eberg Capital, Reciprocal Ventures, Stack Accelerator, Big Brain Holdings, Collab+Currency, Orca Capital, Wicklow Capital, and a41 Ventures.

Publishing Industry Trends

Web3 publishing platform Paragraph raised $1.7 million in a pre-seed round led by Lemniscap. Among other investors are FTX Ventures, Global Coin Research, Binance Labs, Seed Club Ventures, and Sfermion. The startup offers Web3 tools for content creation, allowing writers to manage their audiences through NFT-backed memberships. The startup aims to bridge fashion brands and the Web3 space.

Knowledge Industry Trends

Golden, which develops canonical knowledge graph, raised $40 million in a Series B round led by a16z. Among other investors are Protocol Labs, Raj Goal of Solana, OpenSea Ventures, Dan Romero, and a16z Cultural Leadership Fund.

Identity Industry Trends

Identity-oracle protocol Clique closed a seed round with an undisclosed amount. Among the investors are GGV Capital, Alliance DAO, Qiming Venture Partners, Infinity Ventures, Sevenx Ventures, Mirana, Sky9, SNZ, DWeb3, Mask Network, Tess Ventures, Formless Capital, SMRTI Lab, Redline DAO, and Artichoke Capital.

Notebook Labs, a privacy-focused identity protocol, raised $3.3 million in a Seed round led by Bain Capital Crypto. Among other participants are Y Combinator, Abstract Ventures, Soma Capital, NFX, and Pioneer Fund. The startup plans to expand the development team.

Sealance, a blockchain-based Trust Platform for cryptocurrencies, raised an undisclosed amount from Galaxy, Ribbit Capital, Coinbase Ventures, Gemini Frontier Fund, Luno Expeditions, and Jump Capital.

Wallet Industry Trends

Enterprise wallet software Pine Street Labs raised $6 million in a seed round led by Polychain Capital. Among other investors are Blockchain Capital, Coinbase Ventures, Genesis, CoinList, Figment Capital, and BECO Capital.

Aptos-based wallet Martian raised $3 million in a pre-seed round led by Race Capital. Among other investors are FTX Ventures, Jump Capital, Superscrypt, and Aptos Labs. Martian will use the funds to develop new wallet features and expand the team.

Ottr Finance raised $3.1 million in a pre-seed round led by Race Capital. Among other participants are Slow Ventures, Circle Ventures, and Kamal Ravikant. The startup will use the funds to expand to more than a hundred countries.

Smart contract-based wallet Braavos raised $10 million in a round led by Pantera Capital. Among other investors are Road Capital, DCVC, BH Digital, Crypto.com, Starkware, and Matrixport.

Payment Industry Trends

African mobile money app Wave raised $5 million in a round led by Stellar Development Foundation Enterprise Fund. The startup aims to make Africa the first cashless continent with its technology.

Hong Kong-based digital payment company Reap raised $40 million in a Series A round. The round was led by Acorn Pacific Ventures, HashKey Capital, and Arcadia Funds, with participation from Payment Asia, Fresco Capital, and Hustle Fund. The startup will use the funds to set up hubs in North America, Europe, and Asia.

Web3 banking platform Arf raised $13 million in a seed round. The round saw participation from FTX, Coinbase, Kabbage, Stellar Development Foundation, Circle Ventures, United Overseas Bank Venture Management, Solana, Hard Yaka, Signum Capital. The startup will use the funds to develop the tech.

“Arf’s technology sits right at the center of cross-border payments evolution. This funding round will help us scale Arf to free up trillion dollars worth of locked working capital in the industry. We’ll keep leveraging digital assets and Web3 technologies to fuel the transformation in global finance in a fully compliant way,”

said the CEO of Arf, Ali Erhat Nalbant.

Web3 Industry Trends

Rye, a Web3 API for eCommerce, raised $14 million in a seed round led by a16z. Among other investors are Solana Ventures, Cultural Leadership Fund, GOAT Capital, L Catterton, Electric Feel Ventures, Electric Ant, Andre Iguodala, James Beshara, and Javale McGee. The startup will use the funds to expand the engineering teams and invest in the product.

Valory AG, a service that powers next-generation apps for crypto users and DAOs, raised $4 million in a seed round led by True Ventures. Signature Ventures, Semantic Ventures, and others participated in the round.

Web3 restaurant-focused hospitality platform Blackbird raised $11 million in a seed round led by Union Square Ventures, Multicoin Capital, and Shine Capital. Among other participants are Circle Ventures, Variant, and IAC.

Collectible platform MynaSwap raised $6 million from Blizzard, Wave Financial, Spartan Capital, and NFL superstars Kyler Murray and Odell Beckham Jr.

Fly-to-Earn aerial imagery platform Spexi Geospatial raised $5.5 million in a seed round led by Blockchange Ventures. Among other participants are Protocol Labs, Dapper Labs, InDro Robotics, Alliance DAO, FJ Labs, Adam Jackson, Vinny Lingham, Fort Capital, and CyLon Ventures.

Decentralized Engineering Corporation, the developer of The Rideshare Protocol, raised $9 million in a seed round led by Foundation Capital and Road Capital. Among other participants are Thursday Ventures, Common Metal, 6th Man Ventures, 305 Ventures, and several angel investors. The company is building a decentralized Uber competitor and will use the funds to accelerate the rollout of the app.

Airstack, a Web3 API platform, raised $3 million in a pre-seed round. Among the investors are Animal Ventures, Polygon, and Resolute Ventures.

Security Industry Trends

Web3 security startup Ancilla received an undisclosed amount in a pre-seed round led by Binance Labs. The company will use the funds to expand the team and broaden the range of its use cases across Web3.

“We are still in the early years of the Web3 industry. To facilitate wider adoption of Web3 technology, prioritizing security and user protection are paramount,”

said the Co-Founder of Binance and Head of Binance Labs, Yi He.

Сybersecurity boutique Hexens raised $4.2 million in a Seed round led by IOSG Ventures. Among other investors are Hash Capital, Delta Blockchain Fund, ChapterOne VC, Tenzor Capital, ImToken Ventures, and several angels.

Analytics Industry Trends

Spindl, a Web3 analytics company, raised $7 million in a seed round led by Dragonfly and Chapter One. Among other participants are Multicoin Capital, Solana Ventures, Polygon Ventures, Tribe Capital, FJ Labs, and several angel investors. The company will use the funds to expand the team.

Infrastructure Industry Trends

Solana-based infrastructure startup Helius, formed from former Amazon and Coinbase engineers, raised $3.1 million in a Seed round co-led by Reciprocal Ventures and Chapter One. The round also saw participation from Solana Ventures, Alchemy Ventures, Big Brain Holdings, and Propel VC. The startup aims to provide facilitation tools for Web3 developers.

Web3 infrastructure firm ChainSafe raised $18.75 million in a Series A round led by Round13. Among other participants are NGC Ventures, Sfermion, HashKey Capital, and Jsquare. The strap plans to use the funds for the expansion of its blockchain gaming utilities.

Crypto-friendly banking platform Juno raised $18 million in a Series A round led by ParaFi Capital. Among other participants are Jump Crypto, Greycroft, Antler Global, Hashed, Mithril, 6th Man Ventures, Uncorrelated Fund, and Abstract Ventures.

Low-code platform for blockchain applications, SettleMint, raised $16 million in a Series A round led by Molten Ventures. Among the investors are existing investors Medici Ventures, L.P., OTB Ventures, Fujitsu Ventures, Allusion, and Bloccelerate.

Tatum raised $41.5 million from Evolution Equity Partners, Octopus Ventures, 3VC, Leadblock Fund, Tensor Ventures, Circle Holdings, Depo Ventures, and the founders of Bitpanda.

Data startup nxyz raised $40 million in a Series A round led by Paradigm. Coinbase Ventures, Greylock Partners, Sequoia Capital, and several noted angel investors are among other participants. The company plans to expand the team and expand across chains.

Blockchain hardware maker Fabric Systems raised $13 million in a seed round led by Metaplanet Holdings. Blockchain.com and 8090 are among the investors.

Light Protocol Labs, a privacy and compliance infrastructure for Solana, raised $4.2 million in a seed round led by Polychain Capital. Among other participants are Hypersphere, Solana Ventures, Anagram, Dao5, Asymmetric, and Ecco Capital.

Layer 1 startup Sharedum raised $18.2 million in a seed round. Over 50 investors participated in the round, including Jsquare, Big Brain Holdings, Struck Crypto, The Spartan Group, Ghaf Capital, DFG, CoinGecko Ventures, Foresight Ventures, Cogitent Ventures, WeMade, MapleBlock Capital, Veris Ventures, ZebPay, and Tupix Capital.

Blockchain software developer Fun raised $3.9 million in a pre-seed round. Soma Ventures, Great Oaks Venture Capital, Nomo Ventures, and Justin Mateen’s Jam Fund participated in the round. The startup is building the Odsy network for dynamic decentralized wallets.

Notable Investors

Headline and Quadrille Capital led the Series B round of gaming tech developer Homa. Headline is a global U.S.-based tech-focused VC firm that specializes in investments up to $50 million. The fund previously invested in the sports-themed NFT marketplace Sorare, luxury digital retailer Farfetch, dating and friend-finding app Bumble, electric scooter company Bird, and other noted startups.

Quadrille is an active independent French investment firm specializing in technology and healthcare. Interestingly, the fund’s portfolio features Andreessen Horowitz, one of the largest VC firms specializing in crypto, and Nea, a VC firm focused on early-stage investments. Quadrille Capital’s portfolio also includes several food and fashion-related startups.

Evolution Equity Partners, Octopus Ventures, 3VC, Leadblock Fund, Tensor Ventures, Circle Holdings, and Depo Ventures invested $41.5 million in the blockchain development platform Tatum.

UK-based Evolution Equity Partners is active and specializes in crypto startups, while Octopus Ventures backs fintech, deep tech, B2B software, health, and consumer startups. The fund has previously invested in Amazon, Twitter, Coinbase, and other now well-known companies.

Circle is a global financial tech company based in the U.S. Venture capital group 3VC focused on Europe-based tech startups along with Czech Republic-based Tensor Ventures and Depo Ventures.

Paradigm led the Series A round of data startup nxyz. The collaborative U.S.-based fund actively invests in disruptive crypto and Web3 companies and protocols. Paradigm’s portfolio includes Coinbase, Optimism, Chainalanysis, Uniswap, FTX, Magic Eden, Moon Pay, and many other noted startups.

Brevan Howard Digital and Morgan Creek Digital led the Series A round of Horizon Blockchain Games, which raised a total of $40 million. U.K. VC firm Brevan Howard Digital specializes in global macro and digital assets, while U.S.-based Morgan Creek invests in the early stages of innovational startups.

a16z led the Series B round of canonical knowledge graph Golden, which has raised $40 million. Andreessen Horowitz, which focuses on Web3 companies, has also recently announced an upcoming crypto startup school. The investment fund invites entrepreneurs and developers of Web3 startups to participate in the competition through November 30.

Acorn Pacific Ventures, HashKey Capital, and Arcadia Funds led the Series A round of digital payment company Reap. Silicon Valley-based Acorn Pacific Ventures backs tech and healthcare firms, while Hong Kong-based HashKey Capital actively invests in blockchain technology and digital assets. U.S. lender Arcadia Funds focuses on payment platforms.

Read related posts:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Valeria is a reporter for Metaverse Post. She focuses on fundraises, AI, metaverse, digital fashion, NFTs, and everything web3-related. Valeria has a Master’s degree in Public Communications and is getting her second Major in International Business Management. She dedicates her free time to photography and fashion styling. At the age of 13, Valeria created her first fashion-focused blog, which developed her passion for journalism and style. She is based in northern Italy and often works remotely from different European cities. You can contact her at valerygoncharenko@mpost.io

More articles

Valeria is a reporter for Metaverse Post. She focuses on fundraises, AI, metaverse, digital fashion, NFTs, and everything web3-related. Valeria has a Master’s degree in Public Communications and is getting her second Major in International Business Management. She dedicates her free time to photography and fashion styling. At the age of 13, Valeria created her first fashion-focused blog, which developed her passion for journalism and style. She is based in northern Italy and often works remotely from different European cities. You can contact her at valerygoncharenko@mpost.io