Matrixport Anticipates Bitcoin to Reach $50,000 by End of this Week

In Brief

Matrixport asserts a potential for Bitcoin to trade above $50,000 by the end of this week, due to a strong beginning-of-the-year buying flow.

Cryptocurrency financial services platform Matrixport asserts a potential for Bitcoin to trade above $50,000 by the end of this week. According to Matrixport, following the typical mid-to-end December consolidation, Bitcoin is anticipated to experience a breakout due to a strong beginning-of-the-year buying flow.

In preparation for a potential Bitcoin rally this year, institutional investors find themselves compelled to make immediate purchases as markets open for trading at the beginning of 2024. Therefore, the company expects an immediate rally that catches investors off-guard.

A potential Bitcoin Spot ETF approval could be announced any day before the expected date – January 10th. If this occurs, Matrixport expects Bitcoin prices to rise significantly.

However, the company acknowledges potential upside risks, emphasizing that $5-10 billion in fiat money may struggle to find enough Bitcoin on exchanges for exposure in Bitcoin ETFs. With Bitcoin holders increasingly favoring cold-storage options after the 2022 bankruptcies and the FTX cryptocurrency exchange implosions, approximately 70% of Bitcoins have remained ‘unmoved’ during the last twelve months.

Other Factors Fuelling Bitcoin’s Rally

Matrixport previously assessed the potential increase in Bitcoin price, drawing insights from its correlation with Tether’s market cap change. This factor has contributed to sustaining a bullish trend for Bitcoin, particularly after Federal Reserve Chair Powell exhibited a dovish stance in October 2023.

The company emphasizes that Bitcoin historically experiences robust rallies during halving cycles, coinciding with the United States election cycle. Notably, the average return for Bitcoin in the years of halving—2020, 2016, and 2012—was +192%. This historical pattern could propel Bitcoin toward a new target of $125,000, as set by Matrixport earlier last year.

Matrixport emphasizes that despite the absence of minting activities indicating increased fiat-to-crypto inflows at Tether, the ongoing rally in prices could suggest a market scenario where sellers are scarce, leading to a higher squeeze in prices.

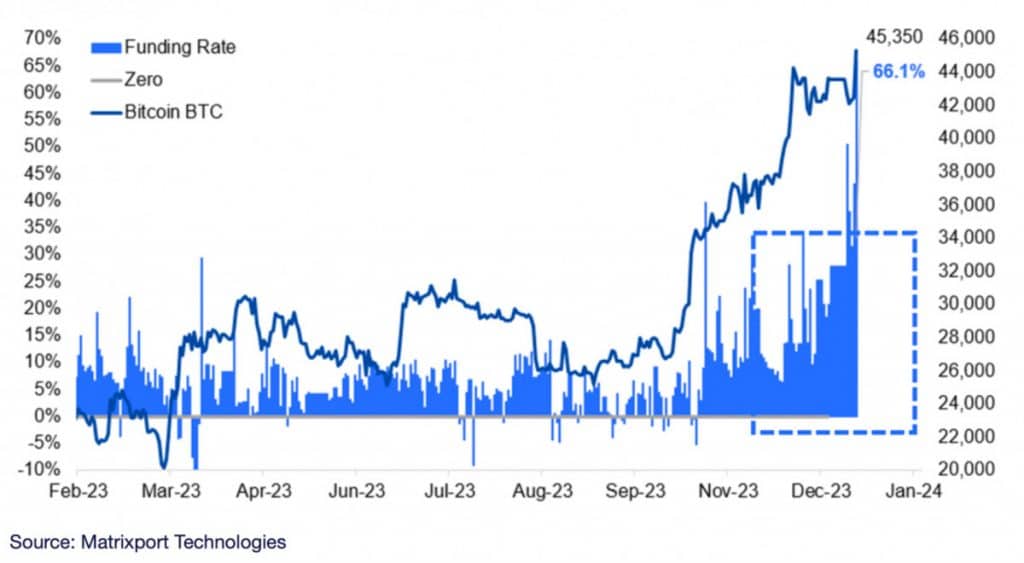

This morning, the funding rate has reached a new high at +66%. In this scenario, long positions are paying short positions 66% annually to remain in a long position. This dynamic illustrates the futures market exerting pressure on the spot market, potentially propelling Bitcoin above the $50,000 target.

Considering all the factors, with potential Bitcoin Spot ETF approval by the end of the week leading the way, Bitcoin could surge to $50,000 in January.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.About The Author

Alisa is a reporter for the Metaverse Post. She focuses on investments, AI, metaverse, and everything related to Web3. Alisa has a degree in Business of Art and expertise in Art & Tech. She has developed her passion for journalism through writing for VCs, notable crypto projects, and scientific writing. You can contact her at alisa@mpost.io

More articles

Alisa is a reporter for the Metaverse Post. She focuses on investments, AI, metaverse, and everything related to Web3. Alisa has a degree in Business of Art and expertise in Art & Tech. She has developed her passion for journalism through writing for VCs, notable crypto projects, and scientific writing. You can contact her at alisa@mpost.io