Metaverse Fundraising Report for February: Trends in Gaming, Environment, Messaging

In Brief

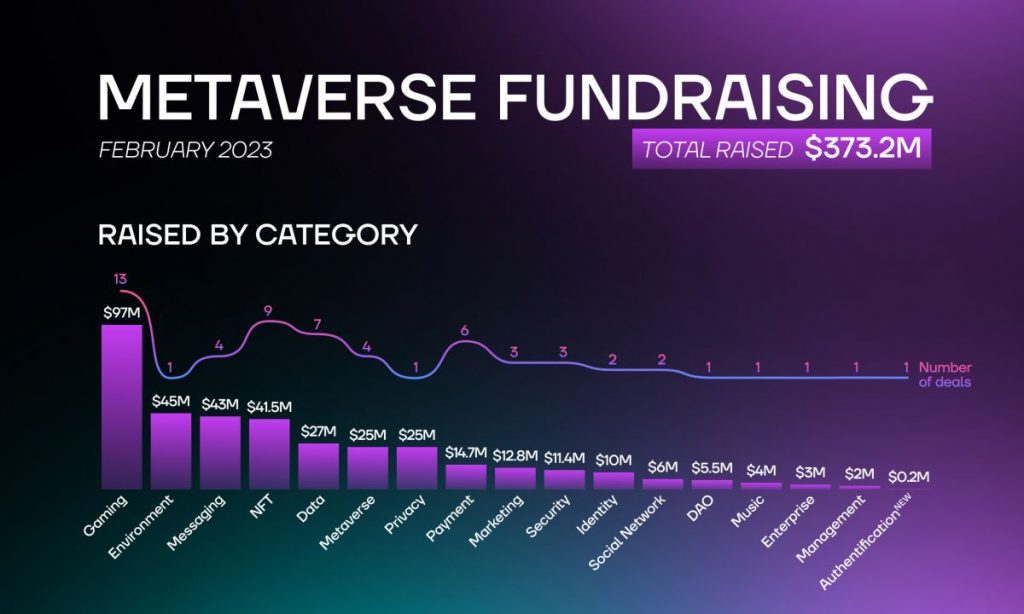

In February 2023, sixty startups received $373.2 million in funding.

Investors paid attention to 17 categories, among which authentication, management, and enterprise.

Gaming, Environment, and Messaging are the leading categories of this month.

In February 2023, angel investors, VC funds, and banks showed us their interest in web3, having invested $373.2 million in 60 startups.

This month, the leading industries are gaming, environment, and messaging. Thirteen gaming startups received $97 million in funding, with the list actually featuring several massively multiplayer games. In January, gaming companies raised $21 million, and in November of 2022, $53 million. We can note that the peak of the gaming industry happened in August when nineteen startups received $466 million.

- Gaming Industry Trends

- Metaverse Industry Trends

- NFT Industry Trends

- Music Industry Trends

- Social Network Industry Trends

- DAO Industry Trends

- Environment Industry Trends

- Privacy Industry Trends

- Identity Industry Trends

- Enterprise Industry Trends

- Payment Industry Trends

- Investment Industry Trends

- Authentification Industry Trends

- Marketing Industry Trends

- Management Industry Trends

- Data Industry Trends

- Messaging Industry Trends

- Security Industry Trends

- Notable Investors

An environment startup called Carbonplace received $45 million. The industry was also present in the previous month when three environment companies raised $14.3 million.

Four messaging startups got $43 million from VC funds and angels. In January, the industry saw two startups receive a total of $8.3 million. In November, one messaging company raised $10 million. The industry is evolving, and we might see greater consumer interest as web3 becomes less niche.

Nine NFT-related startups come next, with the result of $41.5 million raised altogether. Of course, the number is not as impressive as it was in August when NFT companies received $186.4 million. However, the rounds mean that the industry is still growing despite the fact that the NFT bubble burst by the end of 2022.

Gaming Industry Trends

Massive multiplayer online roleplaying NFT-based game Worldwide Webb raised $10 million in a Series A round led by Pantera Capital. The startup will use the funds to expand the team, integrate more NFTs into the game, and form partnerships with brands. In addition, the studio plans to launch a browser-based game called “Blockbusterz” in the upcoming weeks.

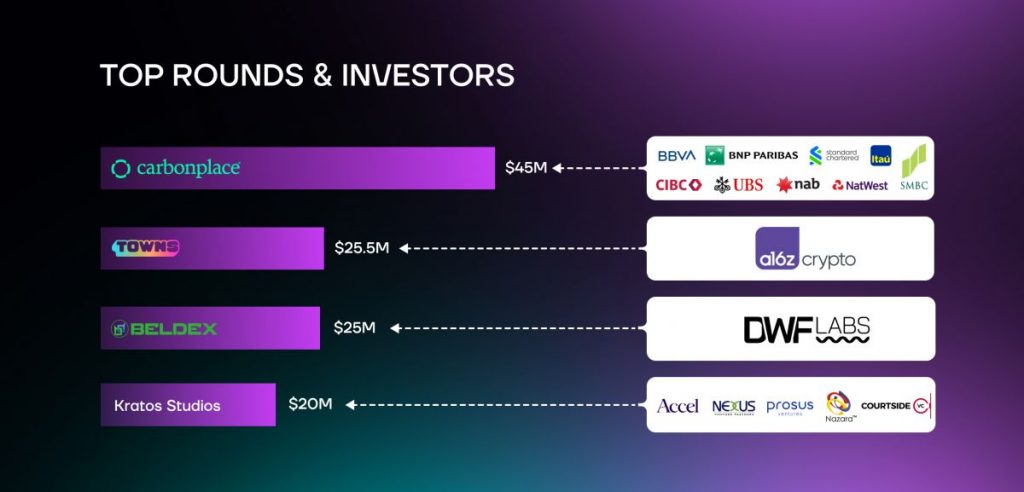

India-based Kratos Studio raised $20 million in a seed round led by Accel. Among the other participants are Prosus Ventures, Nexus Venture Partners, Courtside Ventures, and Nazara Technologies. Notably, the startup also acquired a sub-DAO of Yield Guild Games DAO, IndiGG.

Massive multiplayer online game Chainmonsters raised $1.5 million. The game will soon be launched on the Epic Games Store.

Curio raised $2.9 million in a seed round led by Bain Capital Crypto. TCG Crypto, Robot Ventures, Smrti Lab, Formless Capital, and angel investors backed the round. The company will continue developing its blockchain-based games.

“Despite the tremendous growth and innovation we have seen in the on-chain gaming space, we haven’t seen that many innovations that would truly differentiate the on-chain gameplay experience from that of traditional games,”

noted the co-founder of Curio, Yija Chen.

Azra Games raised $10 million in an extended seed round. Andreessen Horowitz, NFX, Coinbase Ventures, Play Ventures, and Franklin Templeton Investments participated in the round. The company will use the funds to develop the NFT-themed Legions & Legends.

Yield Guild Games raised $13.8 million in a private token sale led by DWF Labs. Among the other participants are a16z Crypto, Sangha Capital Fund, Galaxy Interactive, Sanctor Capital, and former corporate attorney at Google David Lee. The company will use the funds to continue developing its initiatives.

“The token purchase signals the confidence of our partners in YGG’s mission of empowering gamers through web3 gaming,”

said the co-founder of YGG, Gabby Dizon.

Gaming-focused infrastructure startup Nefta raised $5 million in a seed round led by Play Ventures. Polygon Ventures, Sfermion, SevenX Ventures, and Picus Capital are among the other participants. The company plans to expand its team and scale its offering according to the demand for the product.

Empires Not Vampires raised $1 million in a seed round led by Shima Capital. Zee Prime Capital, Firex Capital, FOMOCraft Ventures, Firex Capital, Starter Capital, and Devmons participated in the round. The startup will use the funds to develop its blockchain-based multiplayer game, Paradise Tycoon.

The NFT Gaming Company, Inc. announced the pricing of its $7 million initial public offering. The startup allows users to mint unique cross-game avatars.

The decentralized gaming platform in the Polkadot ecosystem, Ajuna, raised $5 million in a private financing round led by CMCC Global.

Tower Pop, the game studio behind Omega Royale, raised $2.1 million from Play Ventures, Agnitio Capital, and Santiago R. Santos. The studio will use the funds to develop its web3 Battle Royale game.

“We’re creating something completely new, something that has never been done before in the

said the founders of Tower Pop.

gaming world: a Battle Royale Tower Defense game utilizing the blockchain,”

Web3 mobile gaming development studio and publisher Mino Games raised $15 million in a round led by Standard Crypto. Among the other participants are Collab + Currency, Boost VC, Konvoy Ventures, and Earl Grey Capital. The studio uses web3 to build a direct relationship between the community and the developer.

Bibliotheca DAO, the community behind the massively multiplayer on-chain game Loot Realms, received $3,970,473 in a public token sale. According to the Decentralized Autonomous Organization, the participants will be refunded 84.25% of their investments.

Metaverse Industry Trends

Avalon Corp., a gaming studio that develops an interoperable metaverse, raised $13 million in a round led by Bitkraft Ventures, Hashed, Delphi Digital, and Mechanism Capital. The other investors include Coinbase Ventures, Yield Guild Games, Avocado Guild, Merit Circle, and Morningstar Ventures.

Phi, an on-chain immersive social gaming world, raised $2 million in a seed round led by Chapter One and Delphi Digital. Polygon Ventures, Stani Kulechov, and other noted angel investors backed the round. The startup plans to accelerate the development of UI and UX and add new social and gaming features.

Play-to-own Martian metaverse game Million in Mars received $3.5 million in a round led by Widus Partners and Great South Gate. Solana Foundation also participated in the round. The game studio will use the funds to add more systems and environments to its virtual version of Mars.

Marwari received $6.5 million from Blockchange Ventures, Decasonic, Abies Ventures, Prima Capital, Anfield, Outlier Ventures, and Accord Ventures. The company develops solutions that enable fast 3D content delivery for metaverse-ready assets.

NFT Industry Trends

Lifeform, a 3D virtual human avatars editor, raised $5 million in a Series A round led by Geek Cartel. KuCoin Labs, Foresight Ventures, DHVC, K24 Ventures, and Another Worlds backed the round.

AI-powered NFT trading startup NeoSwap AI raised $2 million in a pre-seed round led by Digital Asset Capital Management and AngelHub. Among the other investors are Gossamer Capital, Cavalry Asset Management, Dhuna Ventures, Stacks Ventures, and several angels.

NFT lending protocol PaprMeme received $3 million from Coinbase Ventures.

Web3 fantasy sports game platform Unagi raised $5 million in an equity-based seed round led by Sisu Game Ventures. Sfermion, 2B Ventures, UOB Ventures, Signum Capital, and Machame are among the investors.

Art gallery platform Botto received funding in a strategic round led by Variant.

Creator of designer toys, apparel, and NFTs Superplastic received $20 million in an extended Series A round led by Amazon Alexa Fund. Among the investors are Google Ventures, Galaxy Digital, Kering, Sony Japan, and Animoca Brands. The company will use the funds to develop “The Janky & Guggimon Show” series and films for Amazon.

“As we expand the Alexa Fund to address a wider range of consumer technologies that include ambient computing, smart devices, and the future of entertainment, we’re very excited to add Superplastic to our portfolio,”

said the director of the Alexa Fund, Paul Bernard, in a press release.

Finiliar Studios raised $500,000 in a pre-seed round backed by IDEO CoLab Ventures, Wave Financial, and angel investors. The startup aims to develop software and creative IP for its ecosystem. So, Finiliar will use the funds to create a suite of applications, integrations, and other products.

Non-custodial NFT index and algorithmic lending protocol Fungify raised $6 million in a round led by Citizen X. Among the other participants are Distributed Global, Anagram, Taureon Capital, Infinity Ventures Crypto, Flow Ventures, and several angel investors. The startup will reportedly launch when it concludes security audits this spring or summer.

NFT platform Collector Crypt raised an undisclosed amount in a seed round backed by GSR, Big Brain Holdings, Genesis Block Ventures, StarLaunch, Master Ventures Investment Management, FunFair Ventures, and Telos. The startup integrates physical ownership into web3 digital marketplaces.

Music Industry Trends

Web3 music platform Vault raised $4 million in a Series A round led by Placeholder VC. Among the other investors are Alleycorp, Bullpen Capital, and Everblue Management. The platform allows artists to turn their music into limited-edition NFTs and offer experiences to their fans.

Social Network Industry Trends

Zion, a social network built on “Web5” standards with the Bitcoin Lightning Network, received $6 million in a round led by XBTO Humla Ventures. Among the other participants are Kingsway Capital, UTXO Management, Bitcoiner Ventures, and Tony Robbins.

Indian short video-sharing platform Chingari received an undisclosed amount from Aptos Labs.

DAO Industry Trends

Stider raised $5.5 million in an extended seed round led by Makers Fund and Fabric Ventures. The startup aims to revolutionize the way intellectual properties are developed and owned. Among the other participants are Shima Capital, Sfermion, and Magic Eden. It’s worth noting that Stider was founded by former EA Games and Jam City executives, Andreessen Horowitz partners, and other industry experts.

Environment Industry Trends

Carbonplace, the London-based global carbon credit transaction network, raised $45 million in a strategic round. Nine banks participated, including BBVA, BNP Paribas, Standard Chartered, CIBC, Itaú Unibanco, NatWest, National Australia Bank, SMBC, and UBS. The company will use the funds to scale the platform and expand the team.

Privacy Industry Trends

Beldex received $25 million from web3 investment firm DWF Labs. The funds will be used for research and development.

Identity Industry Trends

EthSign, a decentralized electronic agreement signing platform, received an undisclosed amount from Animoca Brands.

Name service network SPACE ID raised $10 million in a strategic round led by Polychain Capital and dao5. The startup plans to use the funds to accelerate the development of its name service and other products.

Enterprise Industry Trends

3RM raised $3 million in a round led by Distributed Global. Among the other investors are Shima Capital, Big Brain Holdings, and Metareal. The startup will use the funds to build customer relationship management tools.

Payment Industry Trends

Web3 wallet infrastructure startup Portal received $5.3 million. The round saw participation from Slow Ventures, Haun Ventures, Screw Capital, Chapter One, and numerous angel investors.

Payment gateway provider FLUUS received $600,000 in pre-seed funding. FHS Capital, Encryptus.io, and several angel investors backed the round.

Open-source crypto wallet OneKey raised an undisclosed amount in an extended Series A round led by IOSG Ventures.

Self-custodial, multi-signature wallet Den raised $2.8 million in a seed round. Among the participants are IDEO Colab Ventures, Gnosis, Portal Ventures, Not Boring Capital, Balaji Srinivasan, Seed Club Ventures, Lemniscap, Spice Capital, 3SE Holdings, Eberg Capital, Human Capital, and Volt Capital.

TipLink, a lightweight wallet enabling simple digital asset transfer, raised $6 million in a seed round led by Sequoia Capital and Multicoin Capital. Big Brain Ventures, Circle Ventures, Asymmetric, Karatage, Solana Ventures, Monke Ventures, Paxos, and well-known angel investors backed the round.

Blocto raised an undisclosed amount in a Series A round led by Mark Cuban and 500 Global.

Investment Industry Trends

Bit.Store, a social cryptocurrency investment platform, received equity funding from Alchemy Pay, which acquired a 15% stake in the startup. The funds will be used to enhance Bit.Store’s technical team, as well as for research and development and product optimization.

Authentification Industry Trends

TheRollNumber raised $165,000 in a pre-seed round led by Inflection Point Ventures. The startup develops a marketplace that provides background verification. TheRollNumber will use the funds to reinforce its technology stack and improve the platform.

Marketing Industry Trends

Customer loyalty platform Cub3 received $6.5 million in a Series A round led by Bitkraft and Fabric Ventures. Among the other participants are CMT Digital, Geometry Labs, and Red Beard Ventures. The startup provides infrastructure for brands to reward users in tokens.

ManesLab, a brand group focused on web3 culture and the creator economy, raised $1.8 million in a seed round led by YZB Investment. The startup plans to incubate new web3 native IP and blockchain applications.

Sesame Labs, which provides decentralized solutions to web3 marketing, raised $4.5 million in a seed round led by Venture Capital and Patron. The startup aims to enable individuals and decentralized applications to engage with the “decentralized world” in trust.

Management Industry Trends

Decentralized account management protocol Intu raised $2 million in a pre-seed round led by CoinFund. Metaweb Ventures, Fantom Foundation, Kitefin, Orrick, and several angel investors participated in the round. The startup released its beta version at ETHDenver Buidl week on February 24.

Data Industry Trends

Gosleep, an Arbitrum-based HealthFi-focused web3 lifestyle app, raised an undisclosed amount in a round led by Foresight Ventures. Amber Group, SevenX Ventures, KuCoin Ventures, and Gate.io backed the round.

Privacy-preserving decentralized database Polybase raised $2 million in a pre-seed round led by 6th Man Ventures. Among the other participants are Protocol Labs, Alumni Ventures, Orange DAO, NGC Ventures, and CMT Digital. The startup plans to launch in the upcoming weeks.

Web3 observability platform Sentio received $6.4 million in a seed round led by Lightspeed Venture Partners. Hashkey Capital, Essence VC, Canonical Crypto, and GSR Ventures are among the backers. The funds will be used for team expansion and for the running of the existing infrastructure.

Superchain Network raised $4 million in a combined seed and pre-seed. The seed round was led by Blockchain Capital, while pre-seed funding saw participation from Maven 11, KR1, Tokonomy, and Fansara.

Data analytics startup Blockfenders received $1.5 million in a pre-seed round. Among the participants are Blume Ventures, Together Fund, Veda VC, Behind Genius Ventures, Global Devc, Better Capital, Eximius Ventures, Arka Venture Labs, FortyTwo, GSF Fund, Pointone, and Upsparks. The company will use the funds to increase its presence in various industries and expand its team.

Universal blockchain search engine developer Elementus raised $10 million in an extended series A round led by ParaFi Capital.

Port3 Network, which provides social data for web3 use cases, raised $3 million in a seed round led by KuCoin Ventures. Among the other investors are Block Infinity, Jump Crypto, Cogitent, SNZ, and Momentum6.

“The company’s in-house algorithm refines and standardizes user data, segmenting user profiles according to preference, value & authenticity,”

explains the company in a press release.

Messaging Industry Trends

Towns, a group chat protocol and app built by Here Not There Labs, raised $25.5 million in a Series A round led by Andreessen Horowitz. The startup enables users to build digital town squares.

Decentralized instant messenger Sending Labs raised $12.5 million in a seed round led by Insignia Venture Partners, Signum Capital, and MindWorks Capital. The other participants are K3 Ventures, UpHonest Capital, LingFeng Innovation Fund, and Aipollo Investment. The startup plans to use the funds to accelerate its integration with other Layer 1s and Layer 2s.

Web3 communication platform Salsa raised $2 million in a pre-seed round. Among the investors are IDEO Colab Ventures, Inflection, Superscrypt, and noted angel investors.

Sumi Network, a web3 platform that provides wallet-to-wallet communication, raised $3 million in a seed round led by Scythe. Fuse, D1 Ventures, DFG, and TRGC also participated in the round. The startup plans to use the funds to develop decentralized communication and storage solutions.

Security Industry Trends

Kekkai, a web3 wallet security provider, raised $371,350 in a pre-seed round led by Skyland Ventures.

Blockchain cybersecurity platform Ironblocks raised $7 million in a seed round led by Disruptive AI and Collider Ventures. Among the other participants are ParaFi, Samsung Next, Quantstamp, and noted angel investors. The company will use the funds to expand the team and accelerate development.

Software and hardware wallets security solution provider Webacy raised $4 million in a seed round led by VC firm gmjp. Gary Vaynerchuk, AJ Vaynerchuk, Mozilla Ventures, Soma Capital, CEAS Investments, DG Daiwa Ventures, Dreamers, Quantstamp, and Miraise backed the round.

“To welcome the next billion users to Web3, we’ll need a safe environment that allows everyone to transact and own assets with the power to protect themselves,”

said the company in a statement.

Notable Investors

Argentinian bank Banco Bilbao Vizcaya Argentaria, French BNP Paribas, British Standard Chartered, Canadian Imperial Bank of Commerce, Brazilian Itaú Unibanco, British National Westminster Bank, National Australia Bank, Sumitomo Mitsui Banking Corporation, and Swiss UBS invested $45 million in Carbonplace.

Silicon Valley-based venture capital firm Andreessen Horowitz led the Series A round of Here Not There Labs’ group chat protocol Towns. The startup received $25.5 million from the noted venture fund. In February, a16z also led the extended seed round of Azra Games, which received $10 million, and the seed round of Stelo Labs, which raised $6 million. In addition, Andreessen Horowitz participated in the $13.8 million token purchase of Yield Guild Games, which was led by DWF Labs.

DWF Labs also invested $25 million in the web3 ecosystem Bedlex. DWF Labs is a market maker and a multi-stage web3 investment firm with offices in Switzerland, UAE, Singapore, Hong Kong, South Korea, and the British Virgin Islands. The fund has previously invested in Blockchain Football, Kingdomverse, NFTY Finance, and other web3 startups. On a side note, DWF Labs makes part of the financial services company Digital Wave Finance.

Amazon Alexa Fund led the extended Series A round of digital collectibles and vinyl toys creator Superplastic. Overall, the company received $20 million from Alexa Fund, Google Ventures, Galaxy Digital, Kering, Sony Japan, and Animoca Brands.

Amazon Alexa Fund focuses on such areas as Artificial Intelligence and machine learning, education, enterprise collaboration, fintech and commerce, gaming, entertainment and social, hardware, health and wellness, mobility, property tech, robotics and frontier tech, smart home, and voice development tools.

Palo Alto-based Accel led the seed round of the India-based Kratos Studio, which raised a total of $20 million. Prosus Ventures, Nexus Venture Partners, Courtside Ventures, and Nazara Technologies backed the round. The venture capital firm has previously invested in Spotify, Facebook, Etsy, DropBox, and other noted companies.

Read more related topics:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Valeria is a reporter for Metaverse Post. She focuses on fundraises, AI, metaverse, digital fashion, NFTs, and everything web3-related. Valeria has a Master’s degree in Public Communications and is getting her second Major in International Business Management. She dedicates her free time to photography and fashion styling. At the age of 13, Valeria created her first fashion-focused blog, which developed her passion for journalism and style. She is based in northern Italy and often works remotely from different European cities. You can contact her at valerygoncharenko@mpost.io

More articles

Valeria is a reporter for Metaverse Post. She focuses on fundraises, AI, metaverse, digital fashion, NFTs, and everything web3-related. Valeria has a Master’s degree in Public Communications and is getting her second Major in International Business Management. She dedicates her free time to photography and fashion styling. At the age of 13, Valeria created her first fashion-focused blog, which developed her passion for journalism and style. She is based in northern Italy and often works remotely from different European cities. You can contact her at valerygoncharenko@mpost.io