Gamefi: A Gaming Paradigm Shift or Another Bubble About to Burst?

The emergence of GameFi, a hybrid of gaming and decentralised finance (DeFi), powered by NFTs and blockchain technology, has drastically changed the gaming industry in recent years.

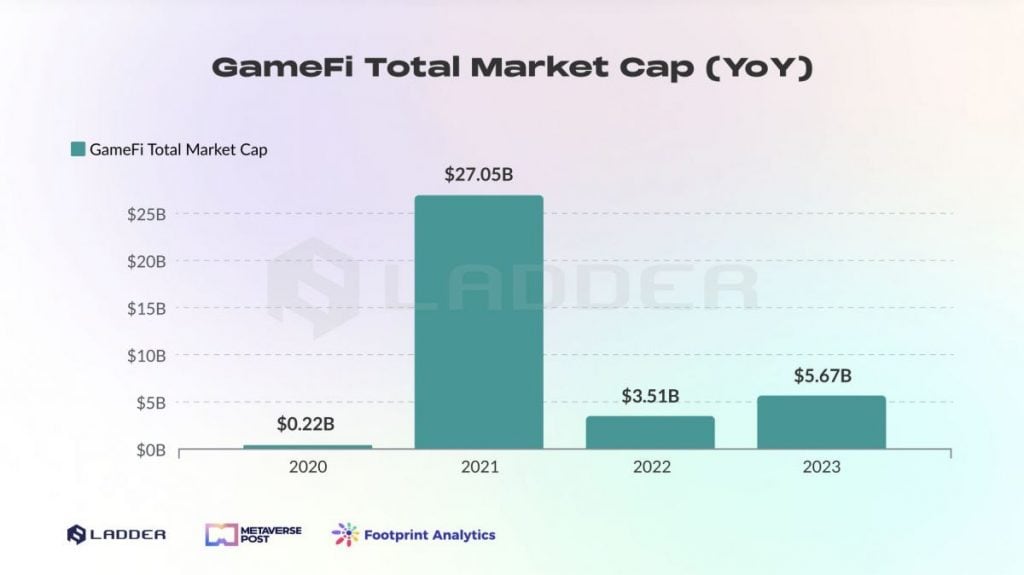

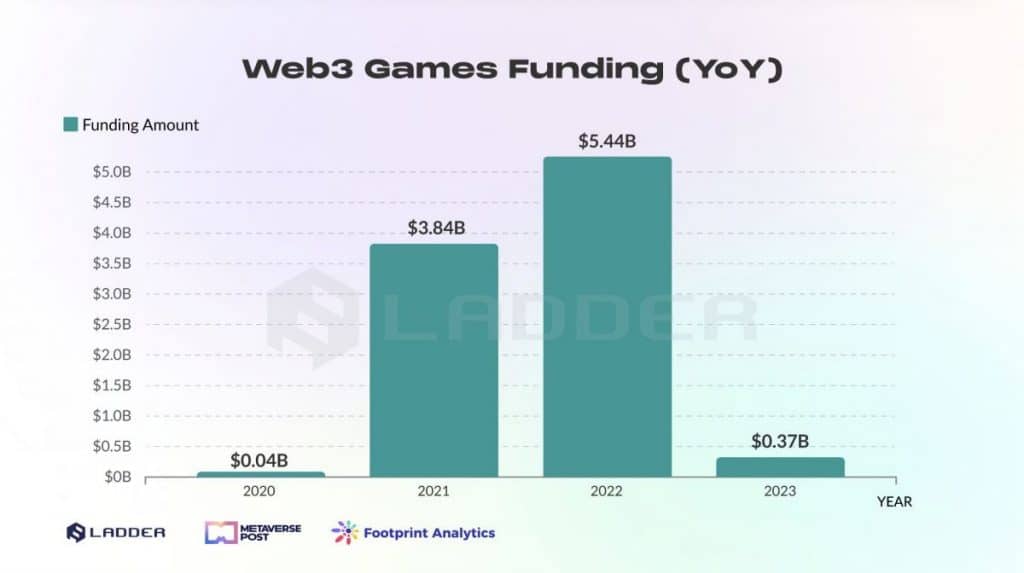

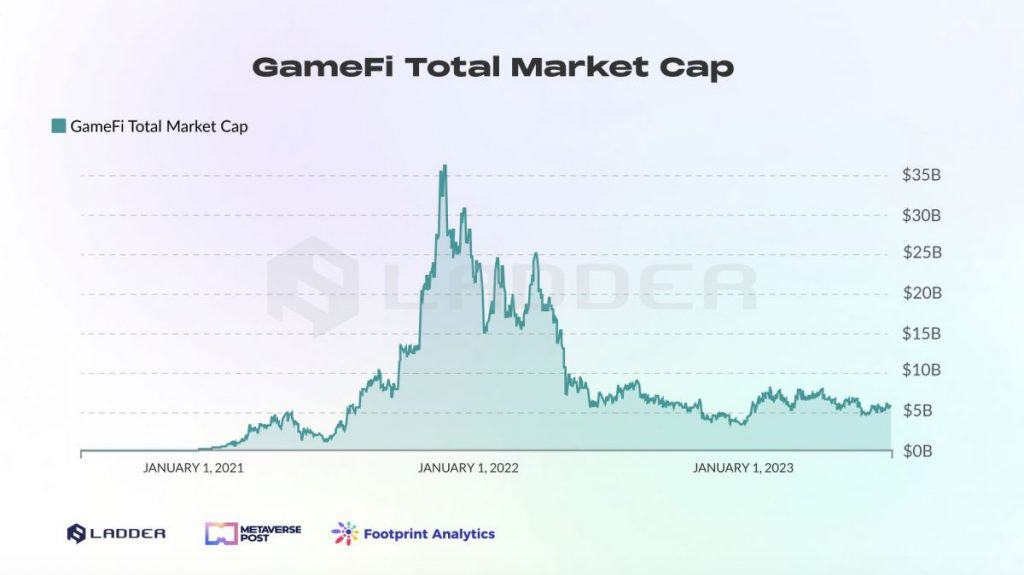

Aimed to empower players through true ownership over in-game assets, a whole new market of crypto games has taken shape, evaluated at more than $27B at the beginning of 2022 (according to Footprint Analytics). Despite a decrease of more than 85% by EOY 2022, the value proposition of blockchain gaming has not gone unnoticed by investors. From $3.8B in 2021, venture capital funding increased to a staggering $5.4B in 2022 (for the Web3 gaming niche alone), despite the macroeconomic landscape. This was accompanied by an increase in the number of funding rounds from 181 in 2021 to 295 in 2022, an increase of over 60%.

We can see a growing interest from investors in the Web3 gaming space, despite the challenging macroeconomic conditions. The increase also points to the emergence of new players in the sector, signalling a vibrant and dynamic environment ripe for innovation and entrepreneurship.

It is also important to note that AAA-quality Web3 games have not yet reached their product/market fit phase as such projects often take several years to be developed.

The rise of play-to-earn gaming

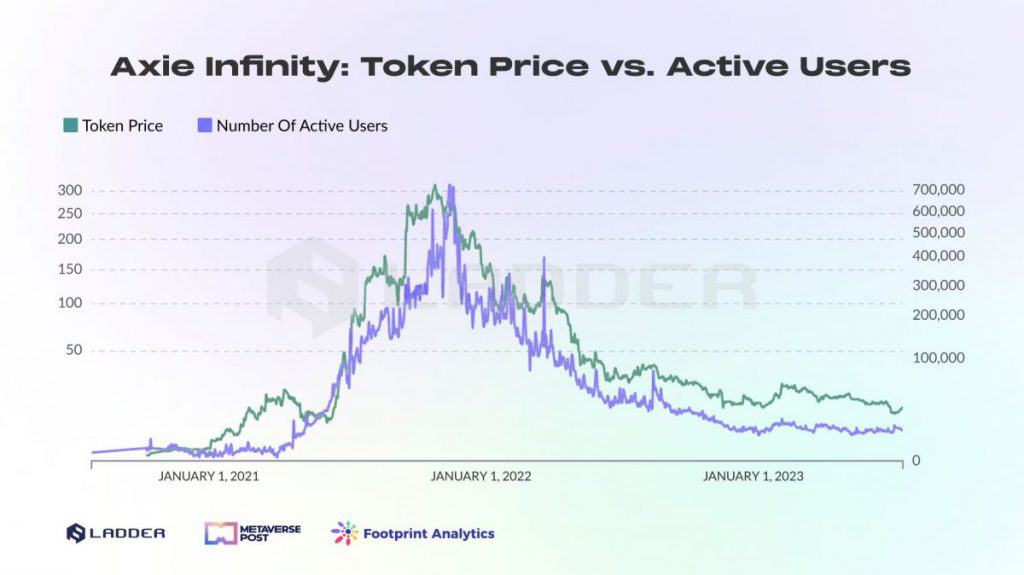

Blockchain gaming has caused a paradigm shift in the gaming industry by introducing the concept of play-to-earn (P2E). Initially popularised by Axie Infinity’s parabolic rise, the P2E model created a new avenue for individuals, especially in developing countries, to earn a living by playing games. In the wake of Axie’s 2021 bullish summer, an entirely new crypto niche was unveiled and became the hottest narrative in the market. Although the play-to-earn (P2E) model experienced a rapid rise and fall, it still marks a significant era for Web3. Firstly, it introduced a record number of users to the concept of a decentralized wallet, primarily through gaming.

Secondly, play-to-earn has extensively showcased a solution to asset ownership, an aspect traditionally controlled by centralized entities in gaming. In Web2 games, players spend countless hours grinding for virtual rewards that generally hold no real-world value. 2 prominent recent examples would be Activision-Blizzard closing World of Warcraft servers in China, leaving players without access to their hard-earned digital assets and Valve which banned accounts holding more than $2M worth of weapon skins (in-game cosmetics).

In contrast to Web2, players of crypto games can earn fungible tokens or NFTs for actively participating in the game or completing various quests. In turn, these in-game assets can be directly monetised. This new economic model has attracted a massive influx of players who now see gaming not just as a form of entertainment, but also as a means to generate income. Nonetheless, there is also a significant part of the gaming community that opposes NFTs, under the pretext that games should purely represent a hobby. However, time has proven that gaming is a culture in itself, with people often taking this ‘hobby’ to extremes (guilds, raiding, mindless item farming, etc.).

Play-to-earn economy

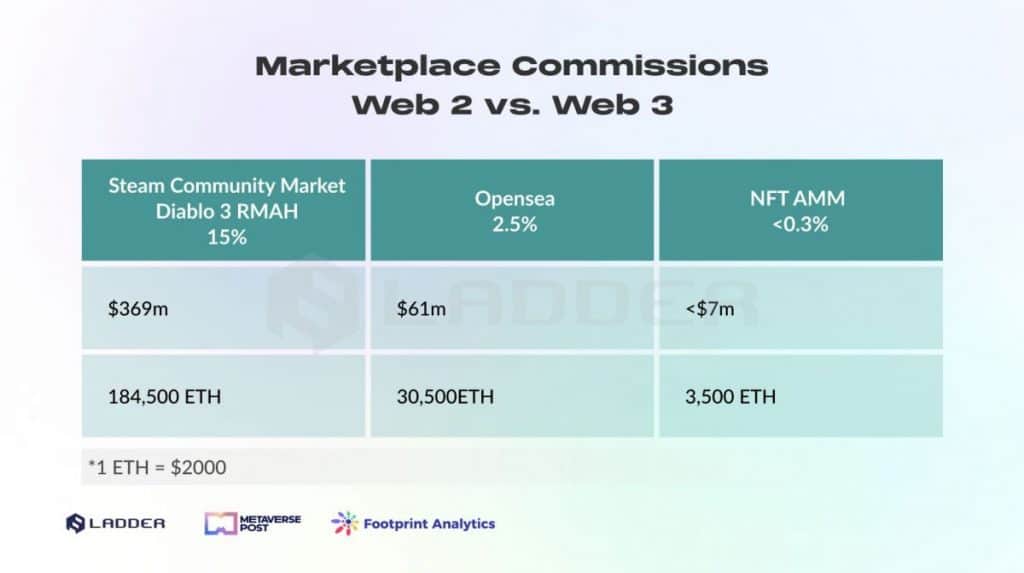

The concept of true ownership allows players to buy, sell, and trade their in-game assets freely, giving them a sense of control and autonomy. By decentralising marketplaces, players are no longer subject to exorbitant fee cuts from the monopolising distribution platform. For example, Apple Store takes a cut between 15-30%, which could be explained by their overwhelming market share in smartphone and mobile app industry.

Activision-Blizzard also made an attempt to monetize in-game assets through the Real-Money Auction House (RMAH) introduced in Diablo 3. Similar to NFTs right now, it was received with mixed feelings by the player base, most considering that it paved the way for pay-to-win (P2W). Despite the fact that Blizzard capped the maximum listing price to $250 and also gave players the option to use in-game currency instead of real money, the RMAH was removed from the game in less than 1 year, due to negative feedback. The final nail in the coffin was a hyperinflation of the in-game economy caused by item & gold dupes. More importantly, Blizzard also applied a cut of up to 15% of each sale, which is more than double that applied by Opensea, the leading NFT trading platform, (2.5%) plus the average amount of creator royalties (5%).

To better visualize the impact of platform fees, let’s consider the Bored Ape Yacht Club NFT collection as an example. Up until the time of writing this, the collection generated a total traded volume of 1,232,824 ETH, roughly equivalent to $2.5B at current rates. The chart below shows the proportion of that volume that each platform operator would receive, based on their respective fees. We compare traditional web2 marketplaces with the current leader, OpenSea, and an AMM protocol. Unlike other NFT marketplaces which operate on an order book style of exchange, Ladder Protocol utilizes Automated Market Makers and limit orders. This approach allows Ladder to offer instant swaps for NFTs, with minimal slippage and fees in a decentralized manner. Therefore, using blockchain technology could potentially save users at least 80% of transaction costs, which amounts to more than $300m USD in absolute numbers.

Diablo 3’s RMAH is a clear example that NFTs and blockchain would not only provide a marketplace alternative, but they would also help prevent exploits (i.e. dupes, stolen items, etc.) as the transparency and security offered by blockchain technology ensure that anyone could verify an asset’s history.

Secondly, the play-to-earn model has opened up new avenues of income generation, especially in regions where traditional job opportunities may be limited.

NFT utility is not limited to playable assets, as they can also represent fractional ownership over non-playable assets.

Fungible tokens, on the other hand, predominantly serve as native currency for in-game transactions. Some projects have also employed a dual-token model, in which there is a separate token for governance purposes.

Incorporating the AMM model can drastically improve in-game economies. Not only can it streamline the exchange of in-game fungible tokens, but it can also transform NFT trading by addressing their typical illiquidity. The latter use case specifically targets commonly traded NFTs, for which value resides in their overall scarcity and not necessarily in their individual rarity. In this scenario, utilising an NFT AMM reduces liquidity gaps, making NFT trading more efficient.

Ladder is developing an NFT AMM tailored specifically for seamless GameFi integration, and their mainnet launch is quickly approaching.

Community bootstrapping

Successful games have one thing in common – a loyal community. Web3 gaming enables a more efficient community bootstrapping through direct incentivization, using the token inflation period to reward active members. Apart from this, by transferring ownership over in-game assets to the players, they are more inclined to stick by a project they believe in, through thick and thin. Last but not least, Web2 board member decisions are replaced in Web3 by DAO governance, a more transparent community voting system that dictates a project’s development roadmap.

Naturally, in a volatile and growing industry, once a narrative starts heating up, there will also be speculators galore. From record-high funding valuations to expensive in-game land NFTs, only time will tell which projects manage to gain mass adoption. NFT price tags are a topic often scoffed at, but people fail to take note of equally impressive digital asset sales from the Web2 gaming industry (an outdated list can be found here, but with the announcement of Counter-Strike 2, CS:GO skin sales have started to go parabolic).

Slowly but surely, players began to despise the term ‘play-to-earn’, viewing all products under this category as Ponzi schemes, with no meaningful gameplay. As a result, other derivatives have come to life: ‘play-and-earn’, ‘play-to-own’, ‘free-to-own’, etc. GameFi is an umbrella term that encompasses various aspects of Web3 gaming, with a strong focus on in-game economy.

Nonetheless, there are numerous Web3 projects that even from early development stages have attracted high numbers of daily active users. Early adoption of emerging technologies often presents an opportunity for significant benefits, and the Web3 space is no different. Many people are attracted to projects in their early stages because of the potential for significant returns.

However, bear in mind that AAA-quality games have not yet integrated blockchain technology, so their players are off-chain, hence not directly quantifiable.

A report by DappRadar revealed that more than 50% of total blockchain transactions were gaming-related.

Metaverse

A unique sub-niche of Web3 social gaming is represented by metaverse-related projects which unlock immersive user experiences, further enhanced through asset inter-operability. Constantly frowned upon, the value proposition of the metaverse has been acknowledged by Web2 tech giants such as Facebook/Meta and, more recently, Apple, with their AR/VR headsets.

As metaverse projects aim to create virtual worlds where users can interact and engage with each other, opening up possibilities for virtual real estate, virtual commerce, etc., investing in these projects could be a long-term play as the technology and adoption continue to develop.

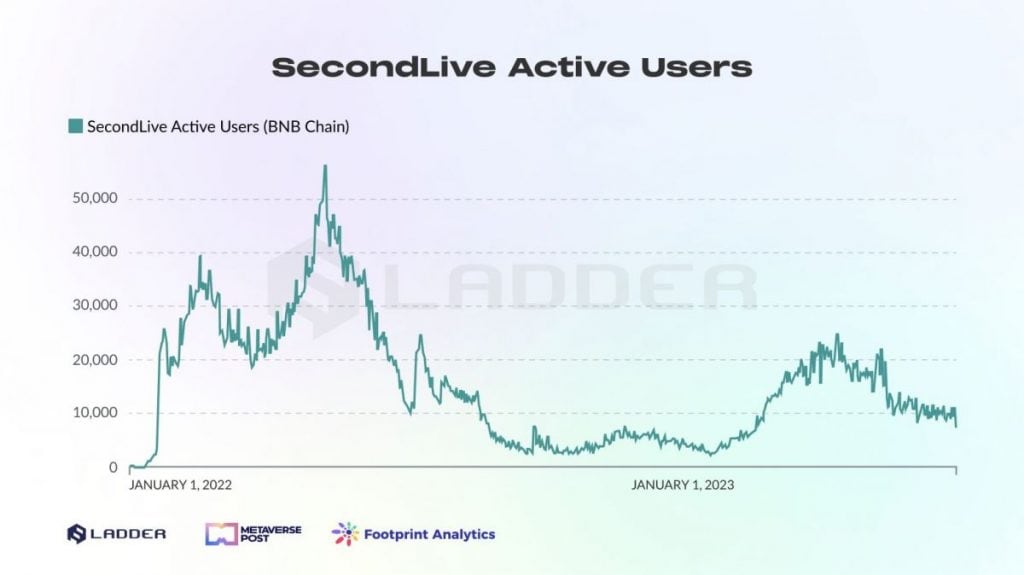

SecondLive, the pioneering metaverse game on the market, serves as a compelling case in the blockchain industry. Remarkably, after years of operation, it still has over 10,000 active users daily, according to Footprint Analytics, and this level of sustained engagement is quite rare in the blockchain world.

The metaverse concept, which allows for immersive user experiences and asset interoperability, has proven to be a strong draw for users in both Web2 and Web3 games. Especially in the Web3 games, the ability to own real assets also provides a unique value proposition that has kept users engaged over the long term.

Distribution platforms

Following in the footsteps of Epic Games, a key trend that facilitates access to Web3 games is represented by blockchain gaming platforms that offer a wide range of games and services. These platforms act as a gateway for players to access various crypto games, making it easier for them to discover and explore new gaming experiences.

Despite Steam’s reluctance to publish games that integrate any sort of blockchain technology, Epic Games is actively supporting titles such as Star Atlas, Gala Games’ Superior, Impostors, etc. This integration could potentially bridge the gap between traditional gaming and the crypto games market, bringing blockchain gaming to a wider audience.

However, even with technological advancements in the field of blockchain scalability (Layer 2 rollups, mainly zero-knowledge tech becoming considerably more efficient) in recent years, one main bottleneck remains: user experience (UX).

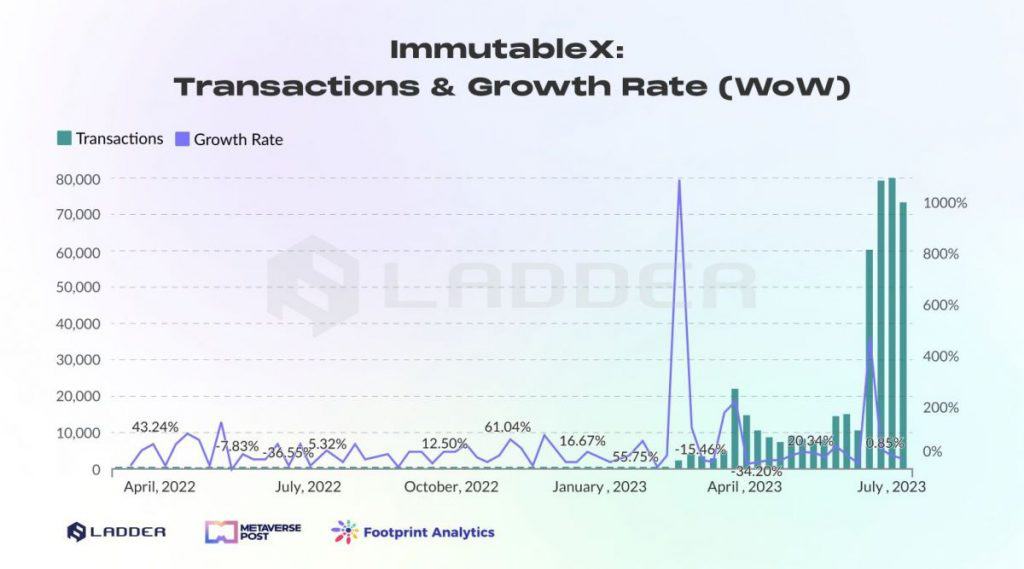

Immutable is one of the companies that has set out to fix just that, initially through their layer 2 ZK-STARK-powered marketplace that allowed players to transact in a gas-free environment (although technically there are still minimal gas fees as transaction proofs have to be posted on Ethereum, those could easily be extracted away from the user).

By partnering with Polygon, Immutable has also integrated Polygon’s zkEVM rollup in its tech stack. This perfectly complements their previously used STARK-powered products by adding a fully compatible EVM solution alongside the Cairo language.

The shift to Web3

The Web3 gaming space has not only captured the attention of big corporations but also started attracting high-ranking employees from Web2, such as Ryan Watt, the former head of gaming at YouTube, who moved to Polygon.

Out of the traditional gaming studios, Square Enix, the developers of the Final Fantasy franchise, were among the first to adopt NFTs, but they were heavily criticised by their community.

Risks associated with Web3 gaming (investing)

While the crypto gaming market presents exciting opportunities, it is not without its fair share of challenges and risks, and most importantly, asset valuation volatility. Secondly, security concerns are normal for any emerging technology, as hackers and scammers are constantly looking for vulnerabilities to exploit.

Despite recent filings for spot Bitcoin ETFs, as well as IMF & FED chair Powell declaring that cryptocurrencies are here to stay and banning them is detrimental to economic innovations, regulatory uncertainty remains a Web3-native risk, even in the gaming sector.

Last but not least, investors need to discern between teams with game development experience and cash grabbers/speculators as a successful game can take years to be fully developed.

On the bright side, with the increasing adoption of cryptocurrencies and blockchain technology, more investors are likely to enter the market, pushing for innovations. VC funding was at record highs in 2022, throughout the entirety of the crypto industry, despite the raised interest rates or a looming recession.

One of the most impressive raises in blockchain gaming was that of Gunzilla Games’, which raised over $70M (in a bear market) to bring their vision to life; the first product to be released being Off the Grid.

The (bright) future of blockchain gaming

The traditional gaming industry is valued at over $250B in 2023 and estimated to nearly double by 2030, compared to blockchain gaming which, at the moment of writing (July 2023), was sitting at a market capitalization of less than $10B.

What’s even more notable is that VCs are no longer crypto-native only, but have piqued the interest of Web2-native gaming brands as well. Razer just announced their zVentures Web3 Incubator (ZW3I) which already participated in funding some big upcoming titles in the Web3 space: Shrapnel, Gunzilla Games’ Off the Grid, Nyan Heroes, etc.

Considering the market share ratio of Web2 gaming compared to Web3, one could say that the risk-reward balance tips in favour of outlandish returns even at 8-figure valuations.

Bear in mind that market capitalization for blockchain games in 2021-2022 was mainly driven by speculation in the wake of Axie’s parabolic growth. We expect that mainstream adoption and product/market fit will lead to even higher valuations once macroeconomic conditions ameliorate.

As Web2 starts implementing blockchain technology and Web3-native gaming studios develop AAA-quality games (favoured by the increasing technical capabilities of Unreal Engine 5), players are also likely to give blockchain gaming another chance. Ultimately, as blockchain integrations become seamless, Web3 gaming will get rid of the ‘Web3’ tag.

What began with NFTs marking crypto’s consumer moment, Web3 gaming will push the widespread adoption of blockchain technology well beyond the possibilities of DeFi. Bull or Bear, gamers will always play.

Furthermore, the development of metaverse projects holds tremendous potential. As virtual reality technology continues to advance and become physically slimmer, metaverse projects could change the way we interact and engage with digital worlds. This could pave the way for new forms of entertainment, virtual commerce and social interaction.

In conclusion, the rise of GameFi and the crypto games market has ushered in a new era of gaming that combines entertainment and financial opportunities, of which we have only seen the tip of the iceberg. With the advent of blockchain technology, players can now truly own and monetize their in-game assets, while investors can capitalise on the growing popularity of this emerging market.

Read more related topics:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Vitalis is a results-driven executive with an entrepreneurial mindset, recognized for building products and teams from scratch. He currently serves as the Head of Europe at ByteTrade and as COO and co-founder of Ladder Protocol. Having entered the crypto scene in 2017, he rapidly ascended from the role of Global Development Manager to COO of Cointelegraph in less than a year. He is deeply passionate about employing decentralized technologies to solve real-world problems.

More articles

Vitalis is a results-driven executive with an entrepreneurial mindset, recognized for building products and teams from scratch. He currently serves as the Head of Europe at ByteTrade and as COO and co-founder of Ladder Protocol. Having entered the crypto scene in 2017, he rapidly ascended from the role of Global Development Manager to COO of Cointelegraph in less than a year. He is deeply passionate about employing decentralized technologies to solve real-world problems.