Fidelity’s Ethereum Investment Thesis Points to Network Demand Driving ETH Price

In Brief

The research highlights that the perceived value of Ethereum is tied to network usage.

While ETH shares similarities with Bitcoin as a form of digital money, it faces significant headwinds in becoming widely accepted as a monetary asset.

Ethereum’s transition to proof-of-stake and the introduction of mechanisms like MEV have reshaped its tokenomics.

In a new research report, Fidelity examines the burning question: how does the utility of the Ethereum network translate into value for its native cryptocurrency, ETH?

While users have enjoyed the technological benefits of Ethereum’s extensive ecosystem, the investment community has sought to understand the reasons behind acquiring and holding ETH beyond its utility as a transactional token.

Fidelity’s Ethereum Investment Thesis delves into the value proposition of ETH from an investment thesis perspective, while also dissecting the technical aspects related to various investment theses.

Key observations from the report include:

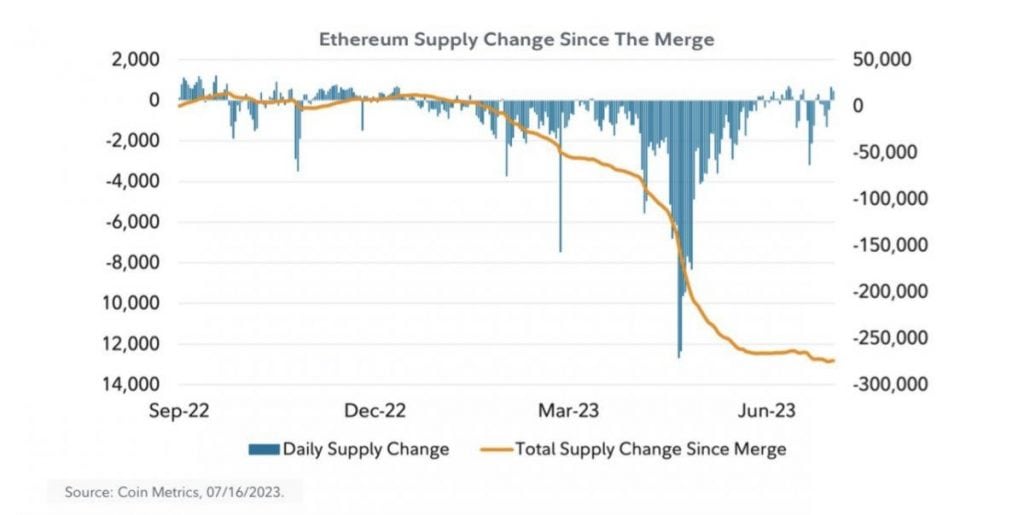

- Value Linked to Network Usage: The perceived value of Ethereum is tied to network usage and the dynamics of supply and demand, which have evolved significantly since the implementation of The Merge.

- Platform Usage and Value Accrual: Increased utilization of the Ethereum network and platform may contribute to the accumulation of value for Ether token holders.

- Ether as an Emerging Form of Money: One investment thesis posits Ether as an emerging form of digital money, akin to Bitcoin.

- Challenges in Competing with Bitcoin: The report acknowledges that while other digital assets, including Ether, may attempt to serve as forms of money, competing with Bitcoin’s characteristics and network effects could be a formidable challenge.

- Ether’s Functions as Money: The report explores Ether’s ability to fulfill two primary functions of money: a store of value and a means of payment.

Ether’s Aspiration as Money

A prevailing narrative in the cryptocurrency space often positions Bitcoin as a nascent form of digital money. This begs the question: Can ETH assume a similar role? In essence, can it be considered “money”?

The answer, as per Fidelity’s analysis, is affirmative but comes with caveats. ETH does indeed share several characteristics with traditional forms of money, including Bitcoin, such as its role as a medium of exchange. However, there are notable differences to consider.

Challenges in Becoming Widely Accepted

One of the key challenges ETH faces in becoming a widely accepted form of money is its supply dynamics. Unlike Bitcoin, which adheres to a fixed supply schedule and is seen as a secure and sound digital currency by many, ETH supply parameters are technically unlimited. These parameters can fluctuate based on factors like the number of validators and burning mechanisms.

Furthermore, ETH’s track record as a monetary asset differs from Bitcoin’s. Ethereum undergoes network upgrades approximately once a year, requiring time and developer attention to establish a stable performance history. This is important for garnering trust among stakeholders.

Competing Forms of Money

While Bitcoin holds a strong position as a monetary asset, Fidelity suggests that this does not preclude the existence of other forms of digital money, including ETH.

Ethereum’s unique attributes, such as its ability to facilitate complex transactions and execute smart contract logic, set it apart from its digital currency counterparts. These capabilities provide it with a unique utility beyond being a simple medium of exchange.

Real-World Ethereum Integrations

While widespread everyday transactions on Ethereum are yet to materialize, Fidelity provides examples of already noteworthy integrations between the Ethereum ecosystem and the physical world as well as the traditional finance sector:

- MakerDAO’s Multimillion-Dollar Purchase: MakerDAO, a project operating on the Ethereum blockchain, recently completed a substantial purchase of $500 million, highlighting Ethereum’s growing influence.

- Ethereum’s Role in Real Estate: Ethereum marked a historic milestone as the platform for the sale of the first U.S. house using a non-fungible token (NFT), showcasing its potential to disrupt the real estate market.

- Blockchain Bonds by European Investment Bank: The European Investment Bank ventured into the blockchain realm by issuing bonds directly on the blockchain, a sign of traditional finance’s growing embrace of Ethereum’s technology.

- Franklin Templeton’s Ethereum-Powered Money Market Fund: Franklin Templeton introduced a money market fund utilizing Ethereum and Polygon to streamline transaction processing and record share ownership.

Challenges on the Path to Mass Adoption

While the convergence of the Ethereum ecosystem with real-world assets is undeniably underway, the report suggests that there are tough challenges to overcome.

These include the need for continuous network improvement, regulatory clarity, education, and the passage of time to instil confidence in Ethereum and similar platforms.

It may take years before Ethereum sees widespread adoption for everyday transactions, making ETH a niche form of money for the time being.

Fidelity’s Concluding Thought

According to Fidelity, the key question on the minds of investors is whether Ethereum’s robust developer activity and the proliferation of applications translate into tangible value for ETH.

“We have shown that, in both theory and data thus far, increased activity on Ethereum’s network drives demand for block space, which, in turn, generates cash flow that can accrue to token holders,” Fidelity concludes.

“What is also evident, though, is that these various drivers are complex, nuanced, and have changed over time with various protocol upgrades and the emergence of scaling developments, like layer 2, and may change again in the future.”

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via cindy@mpost.io with press pitches, announcements and interview opportunities.

More articles

Cindy is a journalist at Metaverse Post, covering topics related to web3, NFT, metaverse and AI, with a focus on interviews with Web3 industry players. She has spoken to over 30 C-level execs and counting, bringing their valuable insights to readers. Originally from Singapore, Cindy is now based in Tbilisi, Georgia. She holds a Bachelor's degree in Communications & Media Studies from the University of South Australia and has a decade of experience in journalism and writing. Get in touch with her via cindy@mpost.io with press pitches, announcements and interview opportunities.