Holders of Solana, Cardano, and Polkadot are investing heavily in small caps, and here’s why

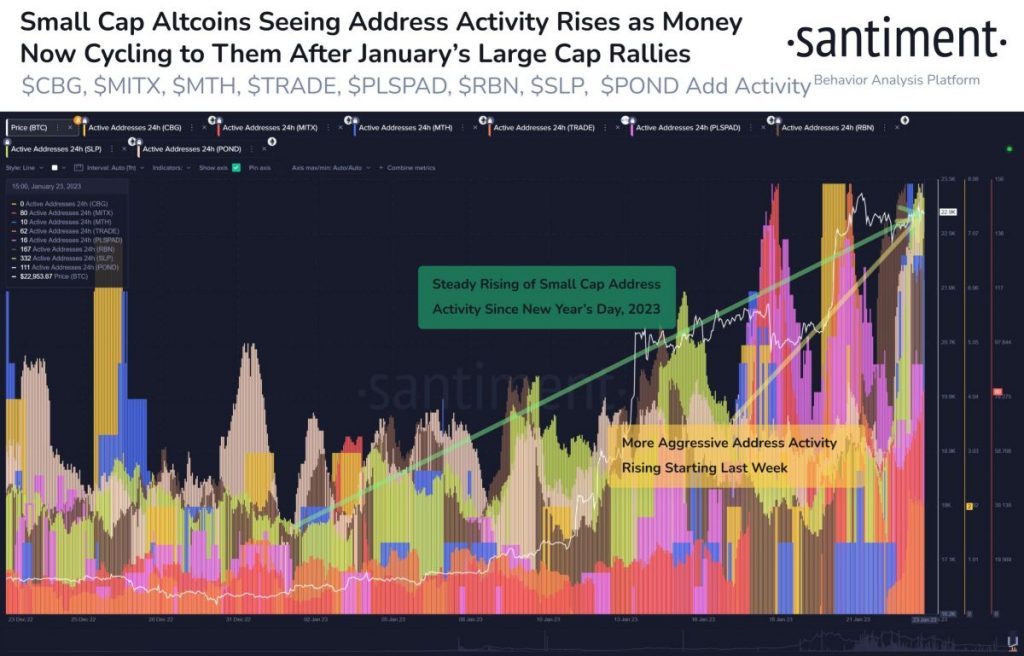

Since January 17, the active address count on small caps has skyrocketed. This means that these traders have seen potential gains to be made in CBG, MITX, MTH, TRADE, PLSPAD, RBN, SLP, and POND tokens. Some of the market’s most prominent players getting involved in these tokens could lead to significant returns.

Clearly, these traders are looking for undervalued cryptocurrencies and want to benefit from the potential of small-cap tokens. However, it is also worth noting that most of these coins haven’t seen much price appreciation over the years, making them attractive investments for those seeking higher levels of return.

As more investors look to get involved in the smaller-cap market, the value of these tokens could increase significantly. This could benefit investors who get in early and capitalize on the potential gains.

Therefore, if you are a Solana, Cardano, or Polkadot holder looking for possible returns this cycle, it is worth exploring small caps as part of your portfolio. With the proper research and strategic investments, you could benefit from some of the possible gains these tokens offer. It’s currently unclear just how much of a return these small caps will bring over the next few months, but it is an investment sector worth considering if you want to make the most out of this cycle.

Cryptocurrency markets are highly volatile, making them an excellent opportunity for savvy traders to generate substantial profits quickly. Unfortunately, there the other side of the coin is the unpredictability of these markets. It can be exploited by unscrupulous actors who look to manipulate prices and take advantage of buyers or sellers. With the resurgence of altcoin pumps in January 2023, it’s more important than ever to be aware of the risks associated with trading in these markets.

Any price manipulation aims to take advantage of uninformed buyers and sellers, driving up prices to reap enormous profits from their trades. This activity is often coordinated by “whales,” traders with large amounts of capital who can drive market movements.

Whales can use techniques like spoofing and wash trading to create artificial demand and inflate prices or employ tactics like “pump and dump” to manipulate the market. As such, like with all cryptocurrencies, it is essential to know the risks associated with trading small caps and do your due diligence before investing.

Although the potential rewards of small-cap trading tokens can be enticing, remember that these markets are incredibly volatile and susceptible to manipulation. Therefore, it is essential to understand how whales operate to protect yourself from being taken advantage of. With the proper research and knowledge, you can make informed decisions and get the most out of your investments.

Conclusion

Small-cap tokens can potentially provide investors with high returns in a short period. Therefore, Solana, Cardano, and Polkadot holders should consider exploring these markets as part of their portfolios. However, it is essential to be aware of the risks associated with trading small caps, including manipulation by whales. With the proper research and understanding, you can make informed decisions and get the most out of your investments.

Related articles:

- Bitcoin markets: Nearly 100% of public bitcoin miners have been sold out

- In 2023, let’s unpack the dissimilarities between on-chain volume and trading volume

- For the first time ever, BTC’s Hash Ribbon model failed; What does this mean for Bitcoin’s future?

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Moses is an experienced freelance writer and analyst with a keen interest in how technology is disrupting the financial sector. He has written extensively on the subject of cryptocurrencies from an investment perspective, as well as from a technical standpoint. He has also been involved in trading cryptocurrencies for over two years.

More articlesMoses is an experienced freelance writer and analyst with a keen interest in how technology is disrupting the financial sector. He has written extensively on the subject of cryptocurrencies from an investment perspective, as well as from a technical standpoint. He has also been involved in trading cryptocurrencies for over two years.