Friend.tech’s Surge in Trading Volume: A Sign of Its Revival in Web3?

In Brief

Friend tech saw a rising $18.51 million in trading volume and $1.9 million in capture fees on September 13, both record highs.

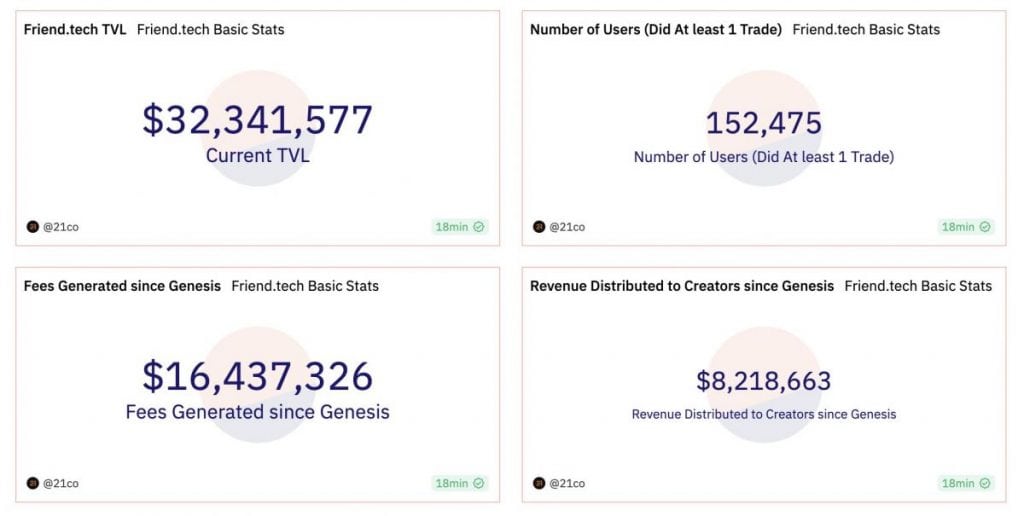

Friend.tech, a social platform operating on the BASE blockchain, recently reported staggering figures. On September 13, the platform recorded an all-time high in trading volume, reaching $18.51 million, and in capture fees, accumulating $1.9 million.

Friend.tech was responsible for 35.1% of the total gas cost on the Base chain for that day. Furthermore, data showed a daily active user count contributing to this volume was 15,902, according to Dune Analytics. The platform allows users to link their profiles from X (Former Twitter) and to establish a wallet address on Friend.tech.

The company also aims to change the way creator platforms operate by enabling more direct interaction between users and creators. Users can buy membership “keys” for specific creators and even resell these keys, thereby introducing an investment dimension to social interaction.

While the platform showed potential with high trading volumes and capture fees, it has not been immune to challenges. In less than three weeks from its launch, Friend.tech experienced a sharp decline in daily new users—from 20,360 on August 21 to a mere 1,811 on August 27. This drastic drop led critics and users to question the platform’s future viability.

Friend Tech daily volume just set a new ATH!

— TylerD 🧙♂️ (@Tyler_Did_It) September 14, 2023

Today closed with $18.5M in total volume, besting the prior ATH of $16.9M by ~10%.

We also saw a local high in users at 15,900, and Racer keys hit a new ATH at 8.5 ETH.

What a day… pic.twitter.com/TeB9N5HrIZ

Influential Names Linked to Friend.tech

The platform has attracted a spectrum of users, including non-crypto native celebrities. However, it’s worth noting that celebrity involvement can be a volatile factor: it can draw attention to the platform but also sets high expectations that may not be sustainable in the long term.

Friend.tech has managed to produce some impressive metrics, albeit inconsistently. The September 13 data indicates there is a demand for what the platform offers, but the significant drop in late August serves as a cautionary data point. The oscillation in metrics suggests that while Friend.tech has found a niche, it has not yet found stability.

The platform’s fluctuating metrics provide both reasons for optimism and caution. While the concept shows promise in altering how audiences interact with creators, questions regarding its long-term stability remain. As it stands, Friend.tech serves as an intriguing case study in the emerging field of SocialFi, illustrating both the potential and the risks involved in such ventures.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.

More articles

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.