Ethereum’s Influence Wanes as Altcoins Thrive: Layer-1 Ecosystems Gain Momentum

In Brief

With Bitcoin rallying and altcoins poised for significant growth, the crypto market brims with optimism as it braces for potential new highs

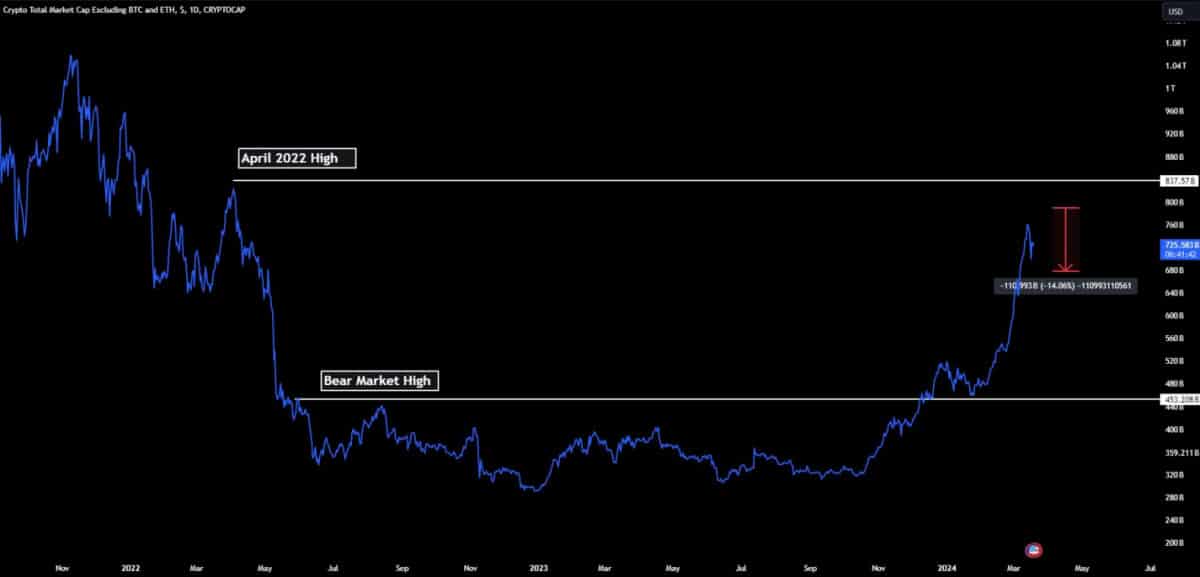

Amidst the whirlwind of Bitcoin’s recent fluctuations, altcoins have emerged as steadfast contenders, showcasing remarkable resilience and hinting at an imminent surge into what experts are dubbing a potential “mania phase.” Insights gleaned from the latest “Bitfinex Alpha” report shed light on this narrative, spotlighting the Total3 index’s meteoric rise. This index, excluding Bitcoin and Ethereum to offer a broader perspective on the cryptocurrency market, soared to unprecedented heights, breaching the $788 billion mark in market capitalisation on March 14.

This milestone signifies a staggering 74% increase from its previous peak during the bear market, indicating a robust influx of investments into altcoins. Such a trend paints a picture of a rapidly evolving landscape within the crypto realm, where altcoins are not merely gaining momentum but also attracting substantial capital inflows. Remarkably, the index now stands a mere 6.5% away from its April 2022 zenith of $837.5 billion, foreshadowing the potential catapulting of altcoins into a frenzy characterised by exuberant investor sentiment and substantial market gains.

Total3 Index variation. Image: Bitfinex

Ethereum’s influence on altcoins in 2024

While Ethereum’s Total Value Locked (TVL) continues to serve as a crucial barometer for capital influx into Ethereum Virtual Machine (EVM) compatible chains and projects, the dynamics of other Layer-1 blockchains are beginning to challenge Ethereum’s traditional hegemony as the primary indicator for altcoin movements. Nonetheless, Ethereum’s influence in predicting altcoin market trends remains palpable.

Despite the shifting landscape, Ethereum’s performance relative to Bitcoin has been lacking. The Dencun upgrade failed to provide a compelling narrative to significantly boost its price, diverging from the success stories of other altcoins in the market. The ETH/BTC ratio is now inching towards its bear market low, a threshold previously tested earlier in the year before the launch of exchange-traded funds (ETFs).

Nevertheless, amidst these challenges, Ethereum-based altcoin projects exhibit resilience, with on-chain metrics painting a bullish outlook for the ecosystem. Notably, a significant Ether netflow from exchanges, totalling 154,000 Ether, was recorded recently, signalling a potential short-term upward price trajectory. This phenomenon could be attributed to traders shifting their Ether off exchanges to partake in trading activities on ERC-20 protocols or Layer-2 platforms such as the Base mainnet, which has witnessed a doubling in its TVL over the past fortnight.

The growing adoption of major Layer-1 blockchains as the base currency for on-chain trading activities presents a bullish sign for Ethereum and its peers. This trend not only bolsters their utility and demand but also enhances their resilience during Bitcoin downturns.

Altcoin surge and Bitcoin’s rally, what’s coming next?

The weekly performance of large-cap altcoins underscores the outperformance of Layer-1 ecosystems like Tron, Solana, Avalanche, Aptos, and Binance Chain relative to the broader market.

As Bitcoin rallies, buoying the broader altcoin market, optimism pervades the space. Ethereum, Solana, Dogecoin, Cardano, Avalanche, Shiba Inu, and Chainlink are among the top 20 altcoins witnessing significant gains, while others such as Fetch.ai, Bonk, Internet Computer, Pepe, Arweave, and Near Protocol have surged by 10-15% in the last 24 hours alone.

In summary, with Bitcoin rallying and altcoins poised for significant growth, the crypto market brims with optimism as it braces for potential new highs. While past performance doesn’t guarantee future outcomes, the sustained rally in Bitcoin prices this year bodes well for both the primary cryptocurrency and its altcoin counterparts, promising a potentially lucrative period for investors and enthusiasts alike.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.About The Author

Viktoriia is a marketing researcher and copywriter with a background in international relations. Her professional portfolio includes the writing of research papers focused on the import and export of products to Europe and Asia. Proficiency in the Chinese language and the time she has spent in China have extended her capabilities to master not only European markets but also those in China and Singapore. While currently living in Italy, Viktoriia continues to deepen her knowledge and skills in marketing and copywriting. Her experience allows her to perform analytical work and create texts on a diverse range of topics, ensuring accessibility to a broad audience.

More articles

Viktoriia is a marketing researcher and copywriter with a background in international relations. Her professional portfolio includes the writing of research papers focused on the import and export of products to Europe and Asia. Proficiency in the Chinese language and the time she has spent in China have extended her capabilities to master not only European markets but also those in China and Singapore. While currently living in Italy, Viktoriia continues to deepen her knowledge and skills in marketing and copywriting. Her experience allows her to perform analytical work and create texts on a diverse range of topics, ensuring accessibility to a broad audience.