Ethereum Price Surges Past $3,800 Mark, Reigniting Investor Enthusiasm with a Rebound

In Brief

Ethereum experienced a price surge reaching a peak of $3,868, marking a recovery from the losses incurred in the preceding day.

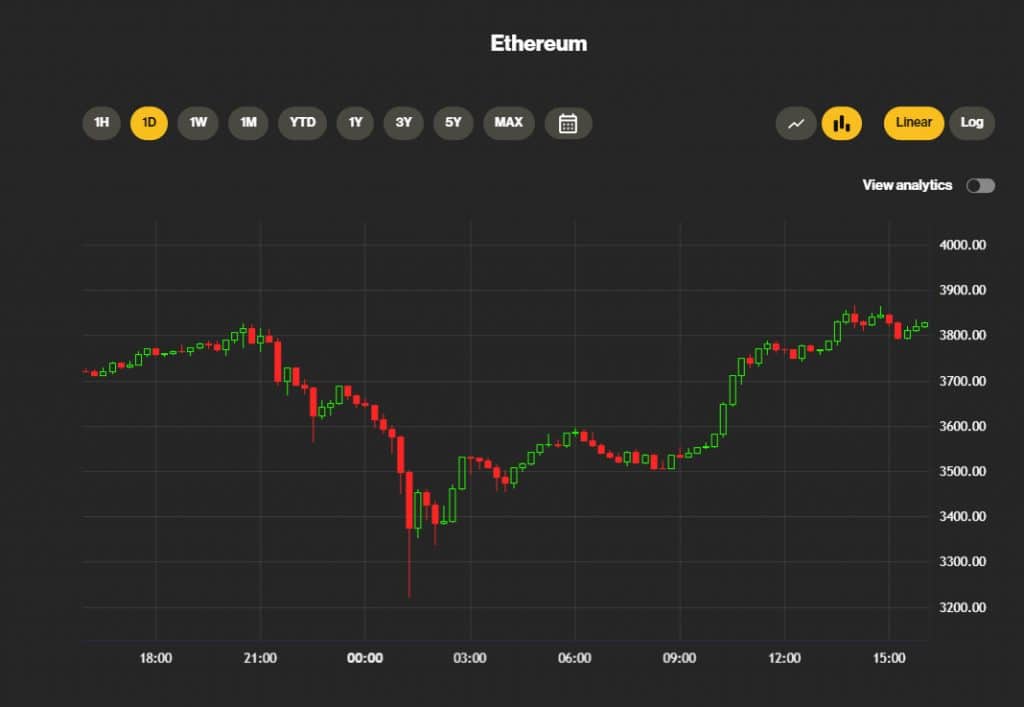

Decentralized cryptocurrency Ethereum (ETH) experienced a price surge, reaching a peak of $3,868, marking a recovery from the losses it incurred in the preceding day.

Ethereum’s price continued its upward momentum, surpassing the $3,650 level, in line with the movement of decentralized cryptocurrency Bitcoin (BTC). Bitcoin experienced a surge, reaching a new all-time high and trading above $69,000. Ethereum also surpassed the $3,800 level before encountering selling pressure.

From the peak of $3,827, a significant bearish reaction ensued, causing the price to plummet and approach the $3,200 support level. During this decline, a crucial bullish trend line with support at $3,620 was breached on the hourly chart of ETH/USD. The price reached a low point at $3,211 and is currently continuing its recovery efforts.

ETH price currently stands at $3,868 (at the time of writing), reflecting a daily increase of 4.40%, based on data sourced from CoinMarketCap.

Ethereum On Path to Sustained Growth

Analysts indicate that in the near future, Ethereum is set to sustain its upward trajectory, citing various factors that contribute to its growth.

One factor contributing to the positive outlook for ETH involves its decreasing supply on cryptocurrency exchanges. According to data from on-chain market intelligence firm Glassnode, the ETH balance on exchanges has reached a 20-month low, totalling 13.14 million ETH, following a 7.7% decrease over the past 90 days.

Another factor influencing the reduction in available ETH tokens for trading is the rising quantity of ETH being staked on the Beacon Chain. Based on data from Dune Analytics, more than $31.58 million ETH, equivalent to $119.8 billion at current rates, is currently staked on Ethereum’s proof-of-stake layer protocol. This indicates that 26.3% of the total ETH supply has been staked and is not available in the market, involving over 987,000 individual validators.

Furthermore, the rise in demand for leverage has led to an increase in Ethereum futures open interest (OI), reaching approximately $11.98 billion, approaching the peak of $13 billion in November 2021. Data from Coinglass indicates that ETH futures OI surpassed the $8 billion mark on February 12th, remaining below this level for over two years. Since then, in less than two weeks, the OI has surged by nearly 50%, indicating heightened demand for leveraged ETH positions.

As Ethereum demonstrates recovery signs and factors indicate positive changes, the cryptocurrency appears positioned for continued upward momentum.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.About The Author

Alisa is a reporter for the Metaverse Post. She focuses on investments, AI, metaverse, and everything related to Web3. Alisa has a degree in Business of Art and expertise in Art & Tech. She has developed her passion for journalism through writing for VCs, notable crypto projects, and scientific writing. You can contact her at alisa@mpost.io

More articles

Alisa is a reporter for the Metaverse Post. She focuses on investments, AI, metaverse, and everything related to Web3. Alisa has a degree in Business of Art and expertise in Art & Tech. She has developed her passion for journalism through writing for VCs, notable crypto projects, and scientific writing. You can contact her at alisa@mpost.io