Borrower Gets a $35,000 Loan Using an NFT-Backed Patek Phillipe Watch as Collateral

In Brief

An anonymous individual gave a stranger a $35,000 loan. The latter used an NFT-backed Patek Philip watch as collateral.

The individuals will receive the Patek Philip watch back once the corresponding non-fungible token is burned. In case the borrower defaults, the lender can claim the item.

This use case shows the possibilities enabled by the proof-of-ownership of Real World Assets (RWAs) backed by NFTs.

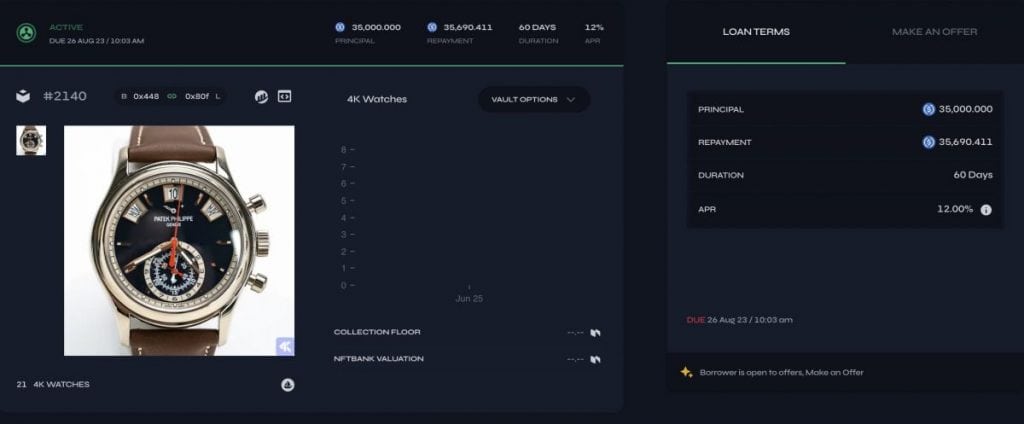

On June 25, an anonymous individual gave a stranger a $35,000 loan. The latter used a Patek Philip watch as collateral. The chronograph, reportedly a 5960/01G-001 model, costs between $54,000 and $79,000 in 2023.

Notably, the lender does not know the borrower’s name or address and has never met them. However, thanks to the proof-of-ownership enabled by NFT-backed Real World Assets, this was not a big deal.

To list a watch as collateral, the borrower sent it to an escrow company, which then sent the borrower a non-fungible token representing the ownership of the item. Following this, the borrower listed the token on Arcade, a p2p loan protocol for NFTs. The individual then accepted the best loan offer. After this, the non-fungible token was transferred to an escrow wallet, where it will stay until the borrower repays the sum or until the lending period ends.

The borrower took $35,000 for two months at an annual percentage rate of 12%. So, by August 26, they are obliged to repay $35,690,411. The individuals will receive the Patek Philip watch back once the corresponding non-fungible token is burned. In case the borrower defaults, the lender can claim the item.

This use case shows the possibilities enabled by the proof-of-ownership of Real World Assets (RWAs) backed by NFTs. Even though the market is very young, in 2023, RWA is becoming a hot topic. The tokenization of Real World Assets is an innovative way to bridge DeFi (Decentralized Finance) and TradFi (Traditional Finance). As of today, we have seen watches or real estate represented on-chain by non-fungible tokens – however, the market has the potential to grow in the nearest future.

There are several decentralized exchanges that support the trading of tokenized Real World Assets. Among these is Pearl, a Polygon-based exchange with deep liquidity for tokenized RWAs and premium digital assets.

Read more:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Valeria is a reporter for Metaverse Post. She focuses on fundraises, AI, metaverse, digital fashion, NFTs, and everything web3-related. Valeria has a Master’s degree in Public Communications and is getting her second Major in International Business Management. She dedicates her free time to photography and fashion styling. At the age of 13, Valeria created her first fashion-focused blog, which developed her passion for journalism and style. She is based in northern Italy and often works remotely from different European cities. You can contact her at valerygoncharenko@mpost.io

More articles

Valeria is a reporter for Metaverse Post. She focuses on fundraises, AI, metaverse, digital fashion, NFTs, and everything web3-related. Valeria has a Master’s degree in Public Communications and is getting her second Major in International Business Management. She dedicates her free time to photography and fashion styling. At the age of 13, Valeria created her first fashion-focused blog, which developed her passion for journalism and style. She is based in northern Italy and often works remotely from different European cities. You can contact her at valerygoncharenko@mpost.io