Bitcoin’s Price Surged Past $28,000 as Non-Zero Bitcoin Addresses Reached 5-Year High

In Brief

The global capitalization of Bitcoin has surged by roughly $27 billion in the past 24 hours as traders have capitalized on the recent global rally.

$27 billion has been added to the global capitalization of Bitcoin in less than 24 hours as Bitcoin (BTC) rallied above $28,000.

Since May 11, the largest cryptocurrency by market cap, BTC, has been consolidating between $26,700 and $27,100. However, since the recent global hike, the coin has increased 3% in the past 24 hours. The price of Bitcoin on May 29 is compared to that of a standard Bitcoin. On May 29, bitcoin was trading at around $28,025, with a 65% increase in 24 hours, pushing its market capitalization above $543 billion.

The global cryptocurrency market size has grown by 2.35% in the past 24 hours to $1.162 trillion, according to CoinMarketCap (CMC), which accounts for nearly 90% of Bitcoin’s price rise.

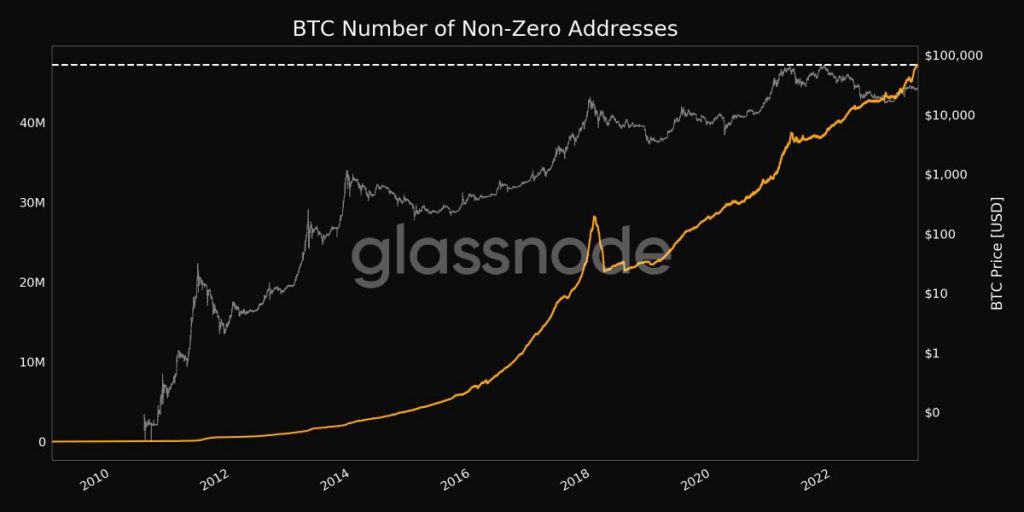

The price increase is due to a new all-time high in Bitcoin addresses (ATH) of 47,220,463, reported Glassnode data. Despite reduced prices, wallets are constantly growing despite the constant expansion of BTC.

7,725,079 bitcoins were assumed to be lost or inactive BTC addresses in Glassnode data, marking a fiveyear high.

- The Glassnode analysis indicates that more than 60% of Bitcoin currently in circulation is dormant. The analysis assumes that investors who do not regularly trade their holdings are holding these coins and awaiting a potential market breakout. High-volume traders typically store their coins short-term but trade actively on exchanges.

Read more related articles:

- For the past few weeks, Bitcoin (BTC) has been languishing in a tight price range of approximately $23,400

- Bitcoin Markets: BTC set to break past the $20,000 resistance level

- MPost Markets: Ether price reaches $1,481

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.

More articles

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.