Crypto Market Weekly – Bitcoin Holds Steady Course Amidst Ethereum’s Modest Dip

In Brief

An overview of the cryptocurrency market’s developments during the week of October 1.

In the ever-volatile world of cryptocurrencies, this week presented a surprisingly placid face. Here’s an in-depth analysis of the market’s dynamics, which reveals a poised market, possibly waiting for its next cue. We are currently experiencing a real lull in the world of cryptocurrencies. There is no significant rise or fall for most coins. However, this situation can also be considered as “the calm before the storm”.

Bitcoin (BTC)

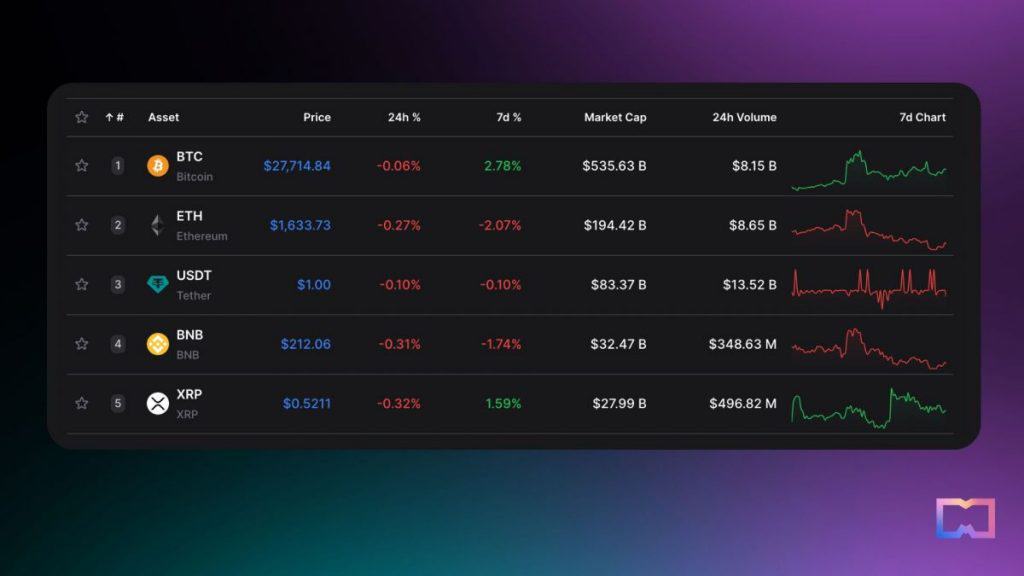

Sitting at a price of $27,692.92, Bitcoin, the market’s flagship currency, reflected only a minor weekly drop of -0.14%. With a market cap holding strong at $535.63 billion and a trading volume of $8.15 billion, the currency’s resilience in a neutral market suggests investor confidence remains intact. BTC’s dominance at 49.51% underscores its unwavering significance in the crypto ecosystem.

A nearly even split between long and short positions, with a minor lean towards shorts (52.51%), suggests traders are divided on BTC’s immediate future. This near 50-50 split, coupled with a neutral Fear and Greed Index at 50, indicates a market in waiting, possibly anticipating a major catalyst or news.

Ethereum (ETH)

Ethereum, Bitcoin’s closest competitor, exhibited a bit more vulnerability with a decline of -2.10%, landing its price at $1,633.32. Boasting a substantial market cap of $194.42 billion and an impressive trading volume of $8.65 billion, Ethereum’s dip is a testament to the broader market sentiment, reinforcing the calmness sweeping the market.

Altcoins: A Mixed Bag

The altcoin market mirrored a similar subdued demeanor:

BNB, priced at $212.16, dipped by -1.69%. Its trading volume, comparatively lower at $348.63 million, suggests reduced activity or possibly traders’ hesitation in making major moves.

XRP, however, bucked the trend, showing a slight uptick of 1.69%, signaling that it remains an altcoin of interest for investors.

With Tether (USDT) staying stable at $1.00 and exhibiting only a minor 0.10% fluctuation over the week, it’s clear that stablecoins remain a refuge for many traders during uncertain times.

Market Movers: Gaining and Losing Ground

Amidst the overarching tranquillity, some coins made noticeable moves:

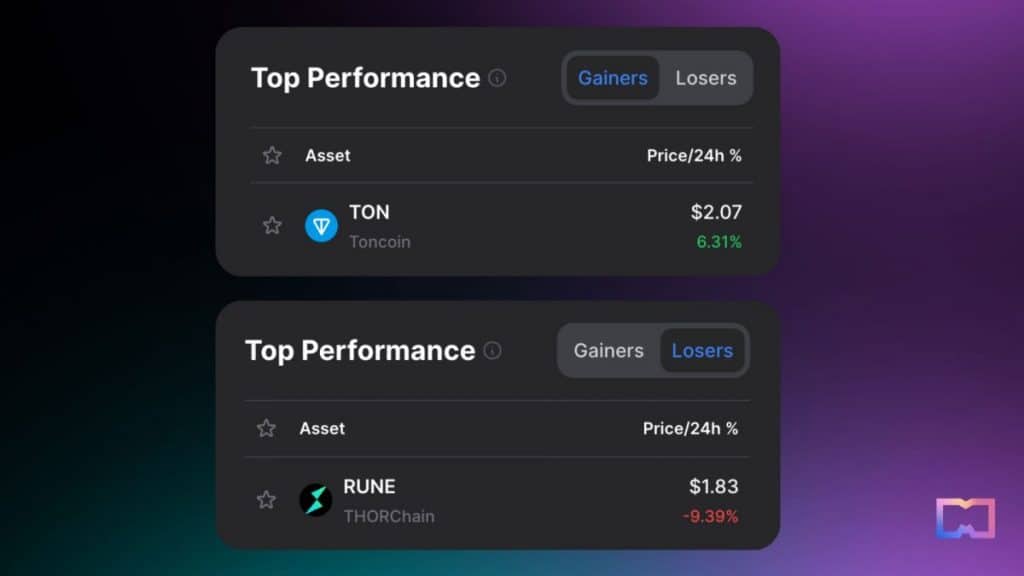

Toncoin’s impressive 6.31% growth makes it the standout performer, possibly due to specific news or project developments.

Conversely, THORChain’s (RUNE) substantial dip of -9.39% suggests negative sentiment or potential market reactions to recent news or updates related to the coin.

Futures Trading: A Hint of Caution

A deeper look into the futures market reveals some caution among traders. Binance Futures, leading the market, showed a decrease of -15.74% in its 7-day trading volume, with OKX Futures and Bybit (Futures) following suit with declines of -22.06% and -18.24%, respectively.

Such retrenchment in futures trading could indicate that traders are playing safe, potentially foreseeing market turbulence or simply awaiting clearer signals.

NFTs: The Silent Giants

In the realm of NFTs, CryptoPunks continues its dominance, but the overall NFT market seems to mirror the calmness of the broader crypto environment.

In a week characterized by hushed undertones, the cryptocurrency market appears to be in a reflective state. Both BTC and ETH, the twin pillars of the crypto world, are treading water, suggesting the market is on the cusp of a decisive move. Traders and investors alike would do well to stay vigilant, keeping an eye out for the subtle cues that might dictate the market’s next direction.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.

More articles

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.