Bitcoin Soars to $30,000 Reaching 2-Month Peak, Defies Crypto Volatility

In Brief

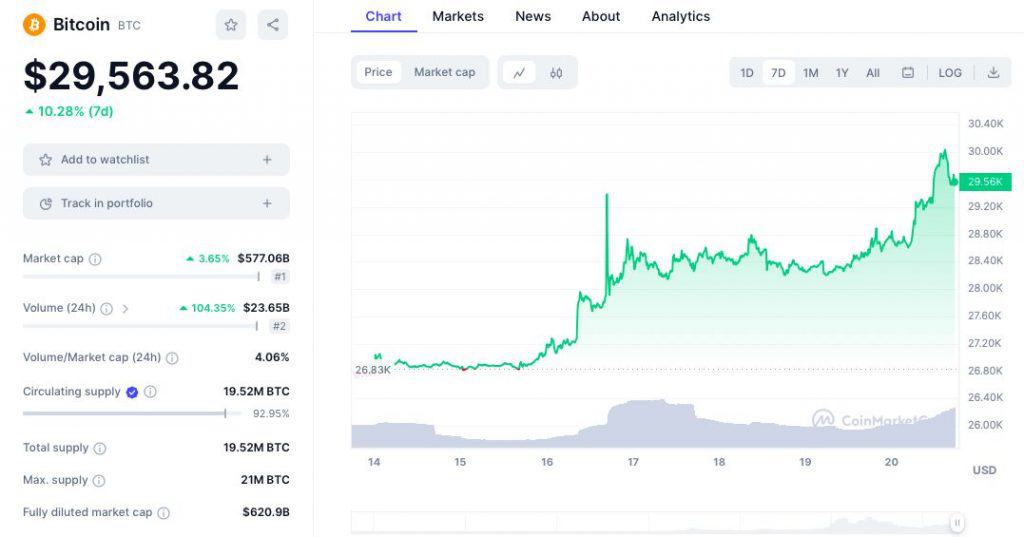

Bitcoin surged past $30,000, reaching its highest value since July, with a weekly gain exceeding 10%.

Bitcoin experienced heightened volatility as investors awaited updates on spot Bitcoin exchange-traded fund (ETF) applications with major firms like BlackRock involved.

Bitcoin surged past the $30,000 mark on Friday, marking its highest value since July. It recorded a weekly gain exceeding 10% amid ongoing disruption in the cryptocurrency market. The crypto reached a peak of $30,022, a level not seen since July 23.

According to Reuters, the overall sentiment in the broader financial markets has recently been tense due to various factors. Investors have been concerned about the Middle East conflict, the rise of benchmark U.S. 10-year yields nearing 5%, and the possibility of interest rates remaining high for an extended period.

This week, Bitcoin markets have displayed heightened volatility as investors eagerly await updates on applications submitted to the U.S. Securities and Exchange Commission (SEC) for a spot Bitcoin exchange-traded fund (ETF), with major financial firms involved, including BlackRock.

As per sources on X, BlackRock is now actively collaborating with the SEC to advance the ETF process, a notable development given the initial lack of response from the SEC. This activity is currently influencing the market price as investors are factoring in the possibility of a Bitcoin Spot ETF.

Moreover, another source said that a senior ETF analyst at Bloomberg expressed optimism about the approval of a spot Bitcoin ETF, predicting it will be authorized within the next three months. Cryptocurrency investors expect the approval of these applications to bring in significant capital to the cryptocurrency asset class.

On Monday, Bitcoin surged to almost $30,000 but then lost most of its gains after BlackRock denied reports of its high-profile ETF approval. A false rumor, initially spread by crypto media outlet Cointelegraph’s X account, caused a brief $2,000 surge in the price of Bitcoin. This surge led to sector-wide volatility and over $100 million in hourly liquidations.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Agne is a journalist who covers the latest trends and developments in the metaverse, AI, and Web3 industries for the Metaverse Post. Her passion for storytelling has led her to conduct numerous interviews with experts in these fields, always seeking to uncover exciting and engaging stories. Agne holds a Bachelor’s degree in literature and has an extensive background in writing about a wide range of topics including travel, art, and culture. She has also volunteered as an editor for the animal rights organization, where she helped raise awareness about animal welfare issues. Contact her on agnec@mpost.io.

More articles

Agne is a journalist who covers the latest trends and developments in the metaverse, AI, and Web3 industries for the Metaverse Post. Her passion for storytelling has led her to conduct numerous interviews with experts in these fields, always seeking to uncover exciting and engaging stories. Agne holds a Bachelor’s degree in literature and has an extensive background in writing about a wide range of topics including travel, art, and culture. She has also volunteered as an editor for the animal rights organization, where she helped raise awareness about animal welfare issues. Contact her on agnec@mpost.io.