Bitcoin ETF Anticipation Fuels Market Optimism, Analysts Predict BTC Reaching $200,000

In Brief

CryptoQuant predicts a potential $1 trillion addition to the crypto market cap if Bitcoin spot ETFs get approved.

Several major financial institutions are in line for Bitcoin ETF approvals, possibly by March 2024.

Analysts, including Tom Lee of Fundstrat, anticipate Bitcoin prices could soar above $150,000 upon ETF approval, depending on various factors.

The topic of Bitcoin ETF has become a hotbed of discussion and speculation. With everyone from seasoned analysts to casual investors throwing their hat into the ring with price predictions, the buzz is undeniable.

CryptoQuant, a leading blockchain analytics firm, presented an intriguing projection: Bitcoin could see an infusion of $155 billion in its market cap if the U.S. greenlights the much-anticipated spot exchange-traded funds (ETFs). Should this happen, Bitcoin might solidify its stance as a $900 billion asset, pushing the overall cryptocurrency market up by a staggering $1 trillion.

These predictions stem from recent institutional adoption patterns. Back in 2020-2021, a noticeable surge in institutional interest came as a result of them integrating Bitcoin into their balance sheets. However, the next wave could see these financial institutions offering Bitcoin access to clients via spot ETFs.

Hopes and Reality of BTC Price

Several premier financial entities have lodged their applications to introduce spot Bitcoin ETFs in the U.S., with potential approvals expected by March 2024. To put these numbers into perspective, the predicted influx from spot ETFs dwarfs the investments made in the Grayscale Bitcoin Trust (GBTC) during the last bull run. With GBTC already boasting assets worth $16.7 billion, these new additions would significantly augment the market.

Drawing from CryptoQuant’s estimates, if the aspiring issuers allocate just 1% of their Assets Under Management (AUM) to these ETFs, Bitcoin could welcome approximately $155 billion, which is nearly one-third of its current market cap. Such a shift could potentially catapult Bitcoin’s price somewhere between $50,000 and $73,000.

Historical Trends

This bullish sentiment saw a recent test when Bitcoin momentarily surged to $30,000. This spike occurred after a premature report by Cointelegraph claimed the fake approval of a spot Bitcoin ETF. Though later debunked, this brief surge signifies the market’s high anticipatory sentiment.

While CryptoQuant projects a buoyant trajectory for Bitcoin, AI platform Google Bard‘s range offers another perspective.

Many analysts within its purview foresee an uptick in Bitcoin demand leading to a potential price surge. Some even go as far as predicting Bitcoin prices reaching the $100,000 or even $200,000 mark upon a spot ETF’s approval.

Google Bard’s analysis

However, various factors, including market sentiment, institutional demand for Bitcoin, digital assets’ regulatory landscape and the general economic climate, would play pivotal roles in this price shift.

Tom Lee from Fundstrat, in a conversation with CNBC’s Squawk Box, ventured a guess that successful Bitcoin spot ETF approvals could fundamentally alter Bitcoin’s supply-demand dynamic, pushing prices even beyond the $150,000 mark. However, he emphasized this applies explicitly to a U.S.-approved spot Bitcoin ETF.

“If the Spot #Bitcoin ETF gets approved … the clearing price of $BTC is above $150,000.” – Tom Lee @fundstrat pic.twitter.com/ILQZqdjsZA

— Michael Saylor⚡️ (@saylor) August 16, 2023

Current Market Conditions

Despite the turbulent market reactions following the erroneous ETF approval reports, Bitcoin’s price displayed resilience, holding strong at $28,736 at the time of writing. But, as always, investors should proceed with caution and thorough research before making any financial commitments.

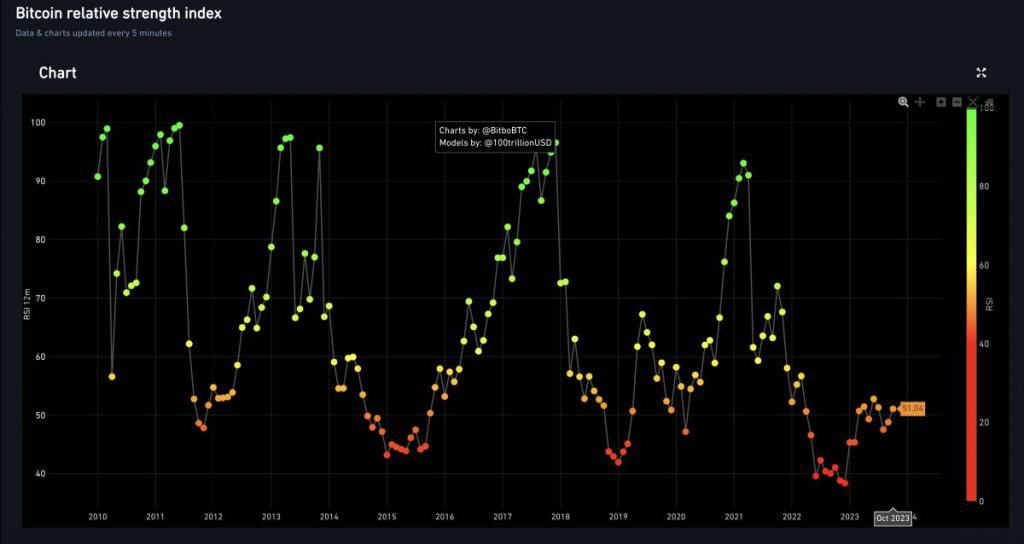

The current RSI (Relative Strength Index) of Bitcoin stands at 51, signaling potential overbought conditions. While an RSI over 50 typically indicates bullish momentum, traders should exercise caution given its proximity to the overbought boundary.

In conclusion, as the world keenly watches the unfolding narrative around spot Bitcoin ETFs, it becomes evident that their approval could be a pivotal moment in cryptocurrency history. While predictions abound, only time will unveil Bitcoin’s true trajectory in the aftermath of such a monumental decision.

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.

More articles

Nik is an accomplished analyst and writer at Metaverse Post, specializing in delivering cutting-edge insights into the fast-paced world of technology, with a particular emphasis on AI/ML, XR, VR, on-chain analytics, and blockchain development. His articles engage and inform a diverse audience, helping them stay ahead of the technological curve. Possessing a Master's degree in Economics and Management, Nik has a solid grasp of the nuances of the business world and its intersection with emergent technologies.