Bald 30,000% and Сurve Exploit – What Happened in Crypto This Weekend

In Brief

New Base network-based meme coin BALD increased by 30,000% in 24 hours, as Base’s public launch is expected in August.

DeFi protocol Curve Finance was exploited. It lost over $47 million due to the reentrancy vulnerability in the Vyper.

Over the weekend, two significant events happened in the crypto industry.

BALD Increased by 30,000%

The new Base network-based meme coin BALD increased by 30,000% in 24 hours. Base is the Ethereum Layer 2 network launched by Coinbase on July 13. It was developed in collaboration with Optimism, which uses Optimistic Rollups to allow users to save on gas fees.

Base’s public launch is scheduled for August. So, the token’s price might have increased significantly due to the upcoming release. On July 31 alone, over $63 million of ETH had been bridged to the chain, according to Dune.

As of the moment of writing, the BALD token’s market value has reached $70 million. Approximately 25,000 ETH are currently deposited on the Base chain. BALD’s price at the time of writing is $0.05595.

In the past two days, X (former Twitter) has become full of BALD-themed memes. The reference to these “artworks” might be Coinbase CEO Brian Armstrong’s shaved hairstyle.

It’s important to note that such meme coins are highly volatile and are not a secure investment. Furthermore, individuals should do their research before purchasing any token.

Curve Finance Exploited

On July 30, the DeFi protocol, Curve Finance, was exploited. It lost over $47 million due to the reentrancy vulnerability in Vyper, a Pythonic programming language targeting the Ethereum Virtual Machine. According to the company, versions 0.2.15, 0.2.16, and 0.3.0 were vulnerable, and a number of Curve Finance’s stable pools used these versions.

Curve Finance CEO Michael Egorov later confirmed that over 32 million CRV (approximately $22 million) were drained from the protocol’s swap pool. Following that, he repaid 4.63 million USDT and deposited 16 million CRV on Aave.

As stated by Curve Finance in a blog post, neither crvUSD contracts nor pools were affected by the hack.

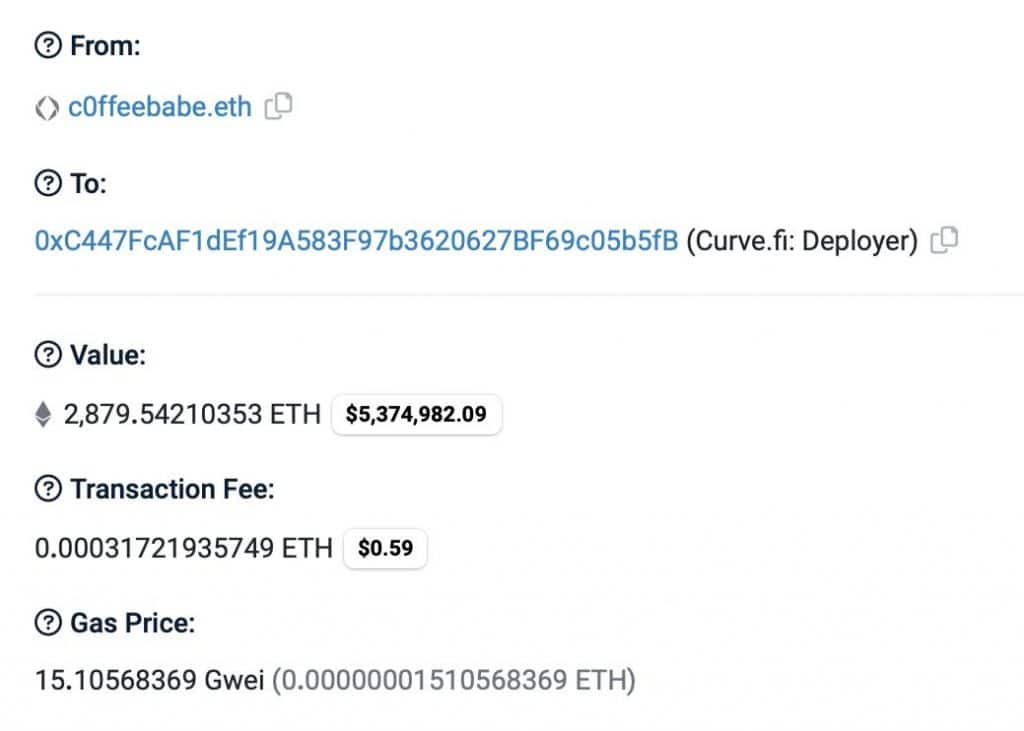

On a side note, many transactions were reportedly made by white hats and MEV bots. For example, on July 30, an anonymous user called c0ffeebabe.eth returned 2,879 ETH (approximately $5.4 million at the time of writing) to the Curve deployer.

Read more:

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Valeria is a reporter for Metaverse Post. She focuses on fundraises, AI, metaverse, digital fashion, NFTs, and everything web3-related. Valeria has a Master’s degree in Public Communications and is getting her second Major in International Business Management. She dedicates her free time to photography and fashion styling. At the age of 13, Valeria created her first fashion-focused blog, which developed her passion for journalism and style. She is based in northern Italy and often works remotely from different European cities. You can contact her at valerygoncharenko@mpost.io

More articles

Valeria is a reporter for Metaverse Post. She focuses on fundraises, AI, metaverse, digital fashion, NFTs, and everything web3-related. Valeria has a Master’s degree in Public Communications and is getting her second Major in International Business Management. She dedicates her free time to photography and fashion styling. At the age of 13, Valeria created her first fashion-focused blog, which developed her passion for journalism and style. She is based in northern Italy and often works remotely from different European cities. You can contact her at valerygoncharenko@mpost.io