A16z releases first-ever ‘State of Crypto Report’

Venture capital company A16z–formally known as Andreessen Horowitz–released their first-ever “State of Crypto” report this morning. The 50-slide PDF, available as a web preview or full free download, begins with a brief outline of the internet’s history before divulging the company’s intel on market cycles, blockchain developments, DeFi, stablecoins, NFTs, gaming, and DAOs–culled from tracking data and the countless entrepreneurs A16z encounters in their line of work. According to the firm, this recurring report will come out annually.

This inaugural edition of the “State of Crypto” arrives on the heels of a recent stock market downturn. Though crypto has been heralded for maintaining value independent of IRL market fluctuations, Investopedia notes that “Cryptocurrency and stock prices are somewhat correlated after accounting for cryptocurrency’s volatility,” adding, “Investors and traders treat cryptocurrency the same way they treat stocks, so prices tend to trend the same.”

A16z has packaged the report with accessible language, a quick pace, and eye-catching aesthetics that make the information feel fun–perhaps part of a greater strategy to assure the public of crypto’s stability, especially since their firm helps raise funding for so many watershed projects in the Web3 space at present.

That being said, the document definitely reads more informative than spin-doctoring. “State of Crypto” opens with a solid definition of what exactly Web3 is–an excellent place to start since CoinDesk aptly noted that Web3 “means something different to everyone you ask.” According to A16z’s definition, it means “the third era of the internet… which combines the decentralized, community-governed ethos of the first era with the advanced modern functionality of the second era.” Results “will unlock a new wave of creativity and entrepreneurship.”

“There’s about four or five companies that basically control the internet,” said Andreessen Horowitz general partner Chris Dixon at this week’s Permissionless conference in Palm Beach. “I think we’re at risk of having the internet turn into the 1970s broadcast landscape [with networks] controlling everything.”

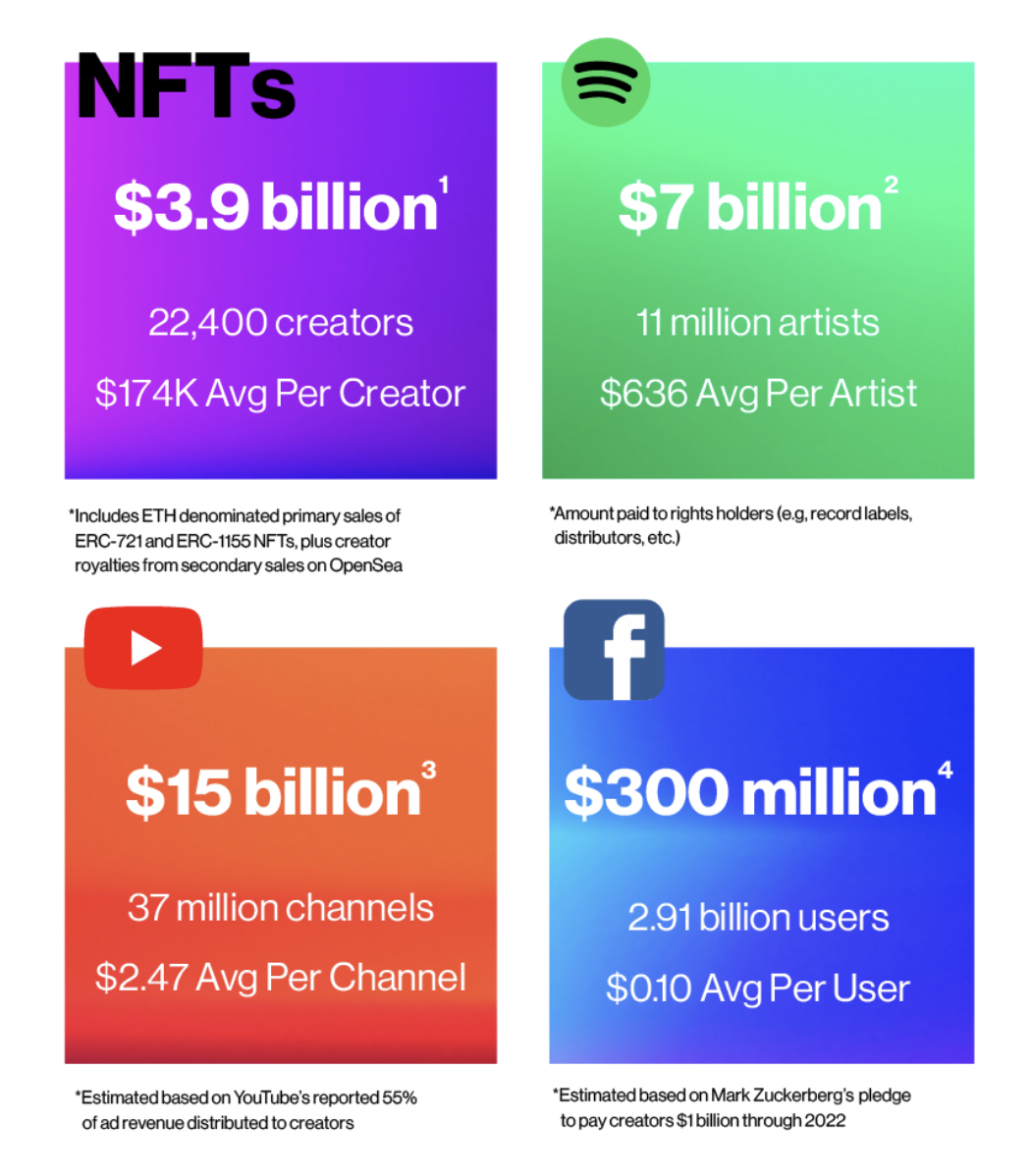

Ownership delineates Web3 from former iterations, and that ownership takes many shapes. NFTs are the most obvious, where blockchain technology enables creators to keep control over content on the web, monetizing creations directly with fans. A table on page 40 compares average creator revenues by source from 2021. Clocking $3.9 billion total, NFTs trailed Spotify ($7 billion) and YouTube ($15 billion) in terms of lump sums, but decimate the competition by matters of proportion, yielding $174K on average per creator, versus Spotify ($636) and ($2.47). Look at those figures again. They’re right.

Web3 also unlocks large-scale digital agency through Defi and DAOs, which bypass power structures like banks to provide consumers direct access to pooling and promoting their own resources. The report notes that “1.7 billion people do not have access to a bank account,” even though “Of the unbanked, 1 billion have access to a mobile phone and 480 million have internet.” In the past two years alone, “DeFi has grown from nearly zero to $100 billion.” A16z estimates that if DeFi was its own bank–which it cannot be, since that’s antithetical to the name–it would be the 31st largest in the world based on total assets under management.

The opening intel section titled “Market Cycles” offers the only apology for the uncertainty adopting this paradigm presently costs. “The crypto market develops in cycles,” A16z writes, oscillating between price, interest, new ideas, and startups/projects. “These cycles appear chaotic from the outside, but have an underlying order.” It’s an interesting point to articulate uncertainty alone ultimately harms valuations, not force majeure itself. “The result is consistent long-term growth, driven by a feedback loop between interest and innovation.”

Their closing takeaways keep consistent with this optimism, stating Web3 infrastructure will continue to improve–especially with their projected growth and merging of non-Ethereum L1s and L2s, which should also lighten the blockchain’s environmental load. Most of the other talking points parrot the same blanket excitement, but A16z interestingly notes that users who earn tokens through games and NFTs “will likely choose to save those tokens in DeFi protocols vs. tradfi [traditional finance] banks given the better rates and user experience.”

“Web3 empowers a collective owned future over a corporate or government owned future,” A16z says, leaving the reader to wonder for themselves whether a money-owned future is any different–no matter the kind of currency it comes in. However, money is more than the facts and figures we see here–it is a measurement of value, impossible to pin down like electricity. Power. Check the report out for yourself and sign up for their newsletter to decide what equity means for you as the world moves into an inevitable Web3 future.

Read related posts:

- Sky Mavis Raised $150М to Cover The Ronin Bridge Hack

- South China Morning Post Sells its First Historical NFT Collection in Two Hours

- Here’s how a New York crackdown on bitcoin mining could affect the industry

Disclaimer

In line with the Trust Project guidelines, please note that the information provided on this page is not intended to be and should not be interpreted as legal, tax, investment, financial, or any other form of advice. It is important to only invest what you can afford to lose and to seek independent financial advice if you have any doubts. For further information, we suggest referring to the terms and conditions as well as the help and support pages provided by the issuer or advertiser. MetaversePost is committed to accurate, unbiased reporting, but market conditions are subject to change without notice.

About The Author

Vittoria Benzine is a Brooklyn-based art writer and personal essayist covering contemporary art with a focus on human contexts, counterculture, and chaos magic. She contributes to Maxim, Hyperallergic, Brooklyn Magazine, and more.

More articles

Vittoria Benzine is a Brooklyn-based art writer and personal essayist covering contemporary art with a focus on human contexts, counterculture, and chaos magic. She contributes to Maxim, Hyperallergic, Brooklyn Magazine, and more.